Abercrombie & Fitch 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

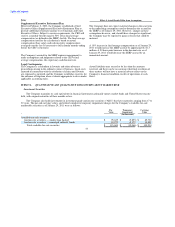

Policy Effect if Actual Results Differ from Assumptions

Supplemental Executive Retirement Plan

Effective February 2, 2003, the Company established a Chief

Executive Officer Supplemental Executive Retirement Plan to

provide additional retirement income to its Chairman and Chief

Executive Officer. Subject to service requirements, the CEO will

receive a monthly benefit equal to 50% of his final average

compensation (as defined in the SERP) for life. The final average

compensation used for the calculation is based on actual

compensation (base salary and cash incentive compensation)

averaged over the last 36 consecutive full calendar months ending

before the CEO's retirement.

The Company's accrual for the SERP requires management to

make assumptions and judgments related to the CEO's final

average compensation, life expectancy and discount rate.

The Company does not expect material changes in the near term

to the underlying assumptions used to determine the accrual for

the SERP as of January 29, 2011. However, changes in these

assumptions do occur, and, should those changes be significant,

the Company may be exposed to gains or losses that could be

material.

A 10% increase in final average compensation as of January 29,

2011 would increase the SERP accrual by approximately $1.3

million. A 50 basis point increase in the discount rate as of

January 29, 2011 would decrease the SERP accrual by an

immaterial amount.

Legal Contingencies

The Company is a defendant in lawsuits and other adversary

proceedings arising in the ordinary course of business. Legal costs

incurred in connection with the resolution of claims and lawsuits

are expensed as incurred, and the Company establishes reserves for

the outcome of litigation where it deems appropriate to do so under

applicable accounting rules.

Actual liabilities may exceed or be less than the amounts

reserved, and there can be no assurance that final resolution of

these matters will not have a material adverse effect on the

Company's financial condition, results of operations or cash

flows.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

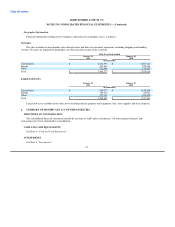

Investment Securities

The Company maintains its cash equivalents in financial instruments, primarily money market funds and United States treasury

bills, with original maturities of three months or less.

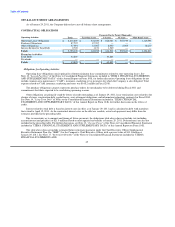

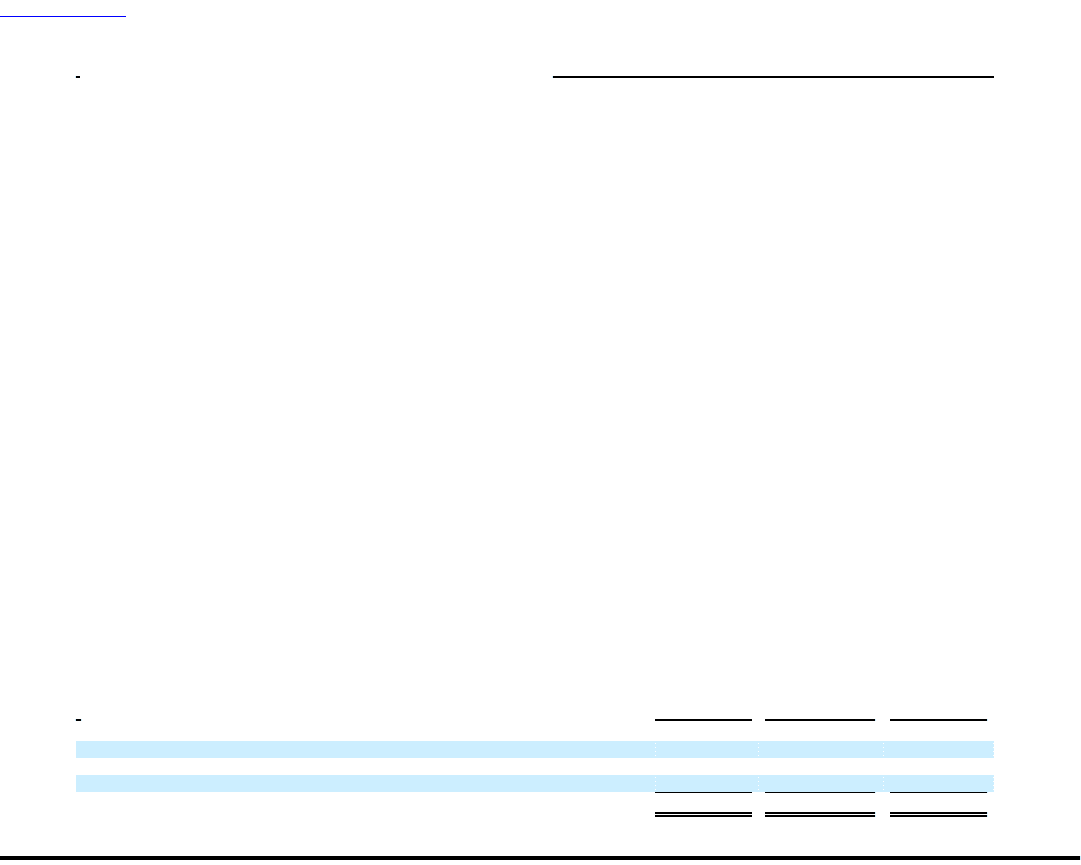

The Company also holds investments in investment grade auction rate securities ("ARS") that have maturities ranging from 17 to

32 years. The par and carrying values, and related cumulative temporary impairment charges for the Company's available-for-sale

marketable securities as of January 29, 2011 were as follows:

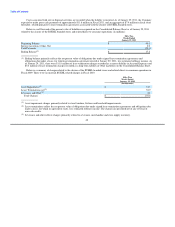

Par Temporary Carrying

Value Impairment Value

(In thousands)

Available-for-sale securities:

Auction rate securities — student loan backed $ 95,625 $ (9,893) $ 85,732

Auction rate securities — municipal authority bonds 19,975 (5,173) 14,802

Total available-for-sale securities $ 115,600 $ (15,066) $ 100,534

53