Abercrombie & Fitch 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

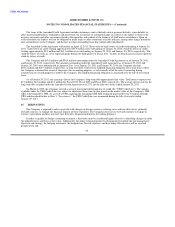

Agreement and, as a result, revised the ratio requirements, as further discussed below, and also reduced the amount available from

$450 million to $350 million (as amended, the "Amended Credit Agreement"). As stated in the Amended Credit Agreement, the

primary purposes of the agreement are for trade and stand-by letters of credit in the ordinary course of business, as well as to fund

working capital, capital expenditures, acquisitions and investments, and other general corporate purposes.

The Amended Credit Agreement has several borrowing options, including interest rates that are based on: (i) a defined Base

Rate, plus a margin based on the defined Leverage Ratio, payable quarterly; (ii) an Adjusted Eurodollar Rate (as defined in the

Amended Credit Agreement) plus a margin based on the Leverage Ratio, payable at the end of the applicable interest period for the

borrowing and, for interest periods in excess of three months, on the date that is three months after the commencement of the interest

period; or (iii) an Adjusted Foreign Currency Rate (as defined in the Amended Credit Agreement) plus a margin based on the

Leverage Ratio, payable at the end of the applicable interest period for the borrowing and, for interest periods in excess of three

months, on the date that is three months after the commencement of the interest period. The Base Rate represents a rate per annum

equal to the higher of (a) PNC Bank's then publicly announced prime rate or (b) the Federal Funds Effective Rate (as defined in the

Amended Credit Agreement) as then in effect plus 1/2 of 1.0%. The facility fees payable under the Amended Credit Agreement are

based on the Company's Leverage Ratio (i.e., the ratio, on a consolidated basis, of (a) the sum of total debt (excluding trade letters of

credit) plus 600% of forward minimum rent commitments to (b) consolidated earnings before interest, taxes, depreciation,

amortization and rent with the further adjustments to be discussed in the following paragraphs ("Consolidated EBITDAR") for the

trailing four-consecutive-fiscal-quarter periods. The facility fees accrue at a rate of 0.25% to 0.625% per annum based on the Leverage

Ratio for the most recent determination date. The Amended Credit Agreement did not have a utilization fee as of January 29, 2011.

The Amended Credit Agreement requires that the Leverage Ratio not be greater than 3.75 to 1.00 at the end of each testing period.

The Company's Leverage Ratio was 2.43 as of January 29, 2011. The Amended Credit Agreement also required that the Coverage

Ratio for A&F and its subsidiaries on a consolidated basis of (i) Consolidated EBITDAR for the trailing four-consecutive-fiscal-

quarter period to (ii) the sum of, without duplication, (x) net interest expense for such period, (y) scheduled payments of long-term

debt due within twelve months of the date of determination and (z) the sum of minimum rent and contingent store rent, not be less

than 1.75 to 1.00 at January 29, 2011. The minimum Coverage Ratio varies over time based on the terms set forth in the Amended

Credit Agreement. The Amended Credit Agreement amended the definition of Consolidated EBITDAR to add back the following

items, among others: (a) recognized losses arising from investments in certain ARS to the extent such losses do not exceed a defined

level of impairments for those investments; (b) non-cash charges in an amount not to exceed $50 million related to the closure of

RUEHL branded stores and related direct-to-consumer operations; (c) non-recurring cash charges in an aggregate amount not to

exceed $61 million related to the closure of RUEHL branded stores and related direct-to-consumer operations; (d) additional non-

recurring non-cash charges in an amount not to exceed $20 million in the aggregate over the trailing four-consecutive-fiscal-quarter

period; and (e) other non-recurring cash charges in an amount not to exceed $10 million in the aggregate over the trailing four-

consecutive-fiscal-quarter period. The Company's Coverage Ratio was 2.51 as of January 29, 2011. The Amended Credit Agreement

also limited the Company's consolidated capital expenditures to $325 million in Fiscal 2010, plus $99.5 million representing the

unused portion of the allowable capital expenditures from Fiscal 2009. The Company was in compliance with the applicable ratio

requirements and other covenants at January 29, 2011.

84