Abercrombie & Fitch 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

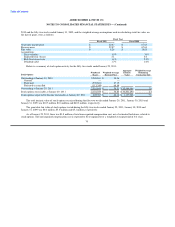

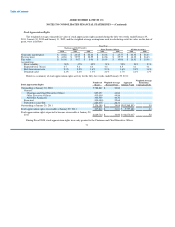

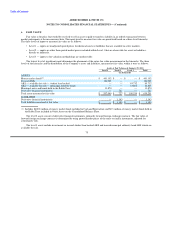

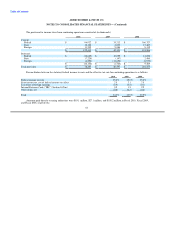

The par and carrying values, and related cumulative temporary impairment charges for the Company's available-for-sale

marketable securities as of January 29, 2011 were as follows:

Temporary Carrying

Par Value Impairment Value

(In thousands)

Available-for-sale securities:

Auction rate securities — student loan backed $ 95,625 $ (9,893) $ 85,732

Auction rate securities — municipal authority bonds 19,975 (5,173) 14,802

Total available-for-sale securities $ 115,600 $ (15,066) $ 100,534

See Note 6, "Fair Value" for further discussion on the valuation of the ARS.

An impairment is considered to be other-than-temporary if an entity (i) intends to sell the security, (ii) more likely than not will

be required to sell the security before recovering its amortized cost basis, or (iii) does not expect to recover the security's entire

amortized cost basis, even if there is no intent to sell the security. The Company has not incurred any credit-related losses on

available-for-sale ARS and furthermore, the issuers continued to perform under the obligations, including making scheduled interest

payments, and the Company expects that this will continue going forward.

On November 13, 2008, the Company entered into an agreement (the "UBS Agreement") with UBS AG ("UBS"), a Swiss

corporation, relating to ARS with a par value of $76.5 million. By entering into the UBS Agreement, UBS received the right to

purchase these ARS at par, at any time, commencing on November 13, 2008 and the Company reserved the right to sell ("Put Option")

these ARS back to UBS at par, commencing on June 30, 2010. Upon acceptance of the UBS Agreement, the Company no longer had

the intent to hold the UBS ARS until maturity. Therefore, the impairment could no longer be considered temporary and the UBS ARS

were classified as trading securities. In addition, and simultaneously, the Company elected to apply fair value accounting for the

related Put Option. Pursuant to the UBS Agreement, the Company exercised the Put Option and the remaining ARS covered by the

UBS Agreement, $37.1 million at par, were acquired by UBS during the fifty-two weeks ended January 29, 2011.

The irrevocable rabbi trust (the "Rabbi Trust") is intended to be used as a source of funds to match respective funding obligations

to participants in the Abercrombie & Fitch Co. Nonqualified Savings and Supplemental Retirement Plan I, the Abercrombie & Fitch

Co. Nonqualified Savings and Supplemental Retirement Plan II and the Chief Executive Officer Supplemental Executive Retirement

Plan. The Rabbi Trust assets are consolidated and recorded at fair value, with the exception of the trust-owned life insurance policies

which are recorded at cash surrender value. The Rabbi Trust assets are included in Other Assets on the Consolidated Balance Sheets

and are restricted as to their use as noted above. Net unrealized gains and losses related to the municipal notes and bonds held in the

Rabbi Trust were not material for the fifty-two week periods ended January 29, 2011 and January 30, 2010. The change in cash

surrender value of the trust-owned life insurance policies held in the Rabbi Trust resulted in realized gains of $2.3 million and

$5.3 million for the fifty-two weeks ended January 29, 2011 and January 30, 2010, respectively, recorded as Interest Expense

(Income), Net on the Consolidated Statements of Operations and Comprehensive Income.

74