Abercrombie & Fitch 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

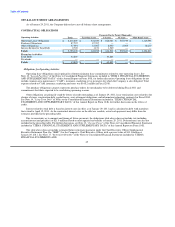

Income for all fiscal years presented. Loss from discontinued operations, net of tax, was $78.7 million and $35.9 million for Fiscal

2009 and Fiscal 2008, respectively. Loss from discontinued operations, net of tax included after-tax charges of $34.2 million

associated with the closure of the RUEHL business for Fiscal 2009, and after-tax charges of $31.4 million and $13.6 million

associated with the impairment of RUEHL-related store assets for Fiscal 2009 and Fiscal 2008, respectively.

Refer to Note 16, "Discontinued Operations" of the Notes to Consolidated Financial Statements included in "ITEM 8.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA" of this Annual Report on Form 10-K for further discussion.

Net Income and Net Income per Diluted Share

Net income for Fiscal 2009 was $0.3 million compared to $272.3 million for Fiscal 2008. Net income per diluted share was

$0.00 in Fiscal 2009 versus $3.05 in Fiscal 2008. Net income per diluted share included $0.89 of net loss per diluted share from

discontinued operations and an after-tax charge of approximately $0.23 per diluted share associated with the impairment of store-

related assets for Fiscal 2009 and $0.40 of net loss per diluted share from discontinued operations and an after-tax charge of

approximately $0.06 per diluted share associated with the impairment of store-related assets for Fiscal 2008. Refer to GAAP

reconciliation table in "ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS" of this Annual Report on Form 10-K for a reconciliation of net income per diluted share on a GAAP

basis to net income per diluted share on a non-GAAP basis, excluding store-related asset impairment charges, store closure charges

and loss from discontinued operations, net of tax.

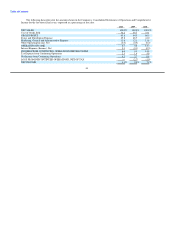

FINANCIAL CONDITION

Liquidity and Capital Resources

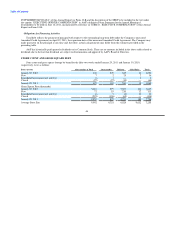

Historical Sources and Uses of Cash

Seasonality of Cash Flows

The retail business has two principal selling seasons: the Spring season which includes the first and second fiscal quarters

("Spring") and the Fall season which includes the third and fourth fiscal quarters ("Fall"). As is typical in the apparel industry, the

Company experiences its greatest sales activity during the Fall season due to Back-to-School and Holiday sales periods, particularly in

the United States. The Company relies on excess operating cash flows, which are largely generated in the Fall season, to fund

operating expenses and to reinvest in the business to support future growth throughout the year. The Company also has available a

credit facility as a source for additional funding.

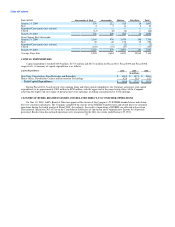

Credit Agreement

As of March 18, 2011, the Company had $305.6 million available (less outstanding letters of credit of $2.9 million) under its

unsecured Amended Credit Agreement (as amended in June 2009). The Company had $43.8 million and $50.9 million outstanding

under its unsecured Amended Credit Agreement on January 29, 2011 and January 30, 2010, respectively, denominated in Japanese

Yen. The average interest rate for Fiscal 2010 was 2.7%. The average interest rate for Fiscal 2009 was 2.0%.

The Amended Credit Agreement requires that the Leverage Ratio not be greater than 3.75 to 1.00 at the end of each testing

period. The Company's Leverage Ratio was 2.43 as of January 29, 2011. The Amended Credit Agreement also requires that the

Coverage Ratio for A&F and its subsidiaries on a consolidated basis

42