Abercrombie & Fitch 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Policy Effect if Actual Results Differ from Assumptions

Income Taxes

The provision for income taxes is determined using the asset and

liability approach. Tax laws often require items to be included in

tax filings at different times than the items are being reflected in

the financial statements. A current liability is recognized for the

estimated taxes payable for the current year. Deferred taxes

represent the future tax consequences expected to occur when the

reported amounts of assets and liabilities are recovered or paid.

Deferred taxes are adjusted for enacted changes in tax rates and tax

laws. Valuation allowances are recorded to reduce deferred tax

assets when it is more likely than not that a tax benefit will not be

realized.

A provision for U.S. income tax has not been recorded on

undistributed profits of non-U.S. subsidiaries that the Company has

determined to be indefinitely reinvested outside the U.S.

Determination of the amount of unrecognized deferred U.S.

income tax liability on these unremitted earnings is not practicable

because of the complexities associated with this hypothetical

calculation.

The Company does not expect material changes in the

judgments, assumptions or interpretations used to calculate the

tax provision for Fiscal 2010. However, changes in these

assumptions may occur and should those changes be significant,

they could have a material impact on the Company's income tax

provision.

If the Company's intention or U.S. tax law changes in the future,

there may be a significant negative impact on the provision for

income taxes to record an incremental tax liability in the period

the change occurs.

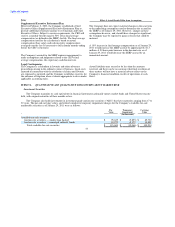

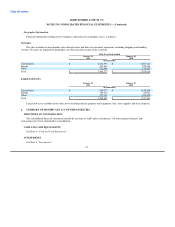

Equity Compensation Expense

The Company's equity compensation expense related to stock

options and stock appreciation rights is estimated using the Black-

Scholes option-pricing model to determine the fair value of the

stock option and stock appreciation right grants, which requires the

Company to estimate the expected term of the stock option and

stock appreciation right grants and expected future stock price

volatility over the expected term.

The Company does not expect material changes in the near term

to the underlying assumptions used to calculate equity

compensation expense for Fiscal 2010. However, changes in

these assumptions do occur, and, should those changes be

significant, they could have a material impact on the Company's

equity compensation expense.

During Fiscal 2010, the Company issued stock-appreciation

rights and no stock options. A 10% increase in term would yield

a 3% increase in the Black-Scholes valuation for stock

appreciation rights issued during the year, while a 10% increase

in volatility would yield a 9% increase in the Black-Scholes

valuation for stock appreciation rights issued during the year.

52