Abercrombie & Fitch 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

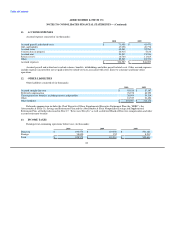

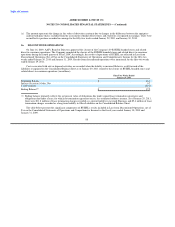

10. LEASED FACILITIES

Annual store rent is comprised of a fixed minimum amount and/or contingent rent based on a percentage of sales. For scheduled

rent escalation clauses during the lease terms, the Company records minimum rental expenses on a straight-line basis over the terms of

the leases on the Consolidated Statements of Operations and Comprehensive Income. The term of the lease over which the Company

amortizes construction allowances and minimum rental expenses on a straight-line basis begins on the date of initial possession.

Certain leases provide for contingent rents, which are primarily determined as a percentage of sales in excess of a predetermined

level. The Company records a contingent rent liability in accrued expenses on the Consolidated Balance Sheets and the corresponding

rent expense on the Consolidated Statements of Operations and Comprehensive Income when the Company determines that it is

probable that the expense has been incurred and the amount can be reasonably estimated.

Store lease terms may also require additional payments covering taxes, common area costs and certain other expenses.

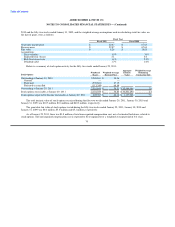

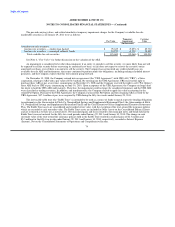

A summary of rent expense follows (in thousands):

2010 2009 2008

Store rent:

Fixed minimum $ 333,419 $ 301,138 $ 267,108

Contingent 9,306 6,136 14,289

Total store rent 342,725 307,274 281,397

Buildings, equipment and other 4,988 5,071 5,905

Total rent expense $ 347,713 $ 312,345 $ 287,302

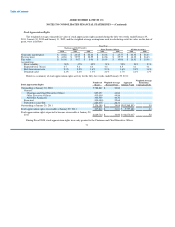

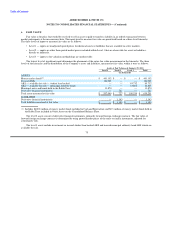

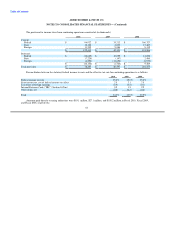

At January 29, 2011, the Company was committed to non-cancelable leases with remaining terms of one to 17 years. A summary

of operating lease commitments under non-cancelable leases follows (thousands):

Fiscal 2011 $ 331,151

Fiscal 2012 $ 319,982

Fiscal 2013 $ 303,531

Fiscal 2014 $ 285,337

Fiscal 2015 $ 262,586

Thereafter $ 1,110,598

79