Abercrombie & Fitch 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

technology; outside services such as legal and consulting; relocation, as well as recruiting; samples and travel expenses.

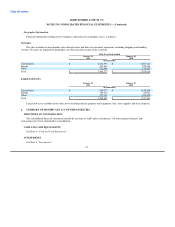

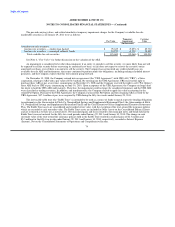

OTHER OPERATING INCOME, NET

Other operating income consists primarily of: income related to gift card balances whose likelihood of redemption has been

determined to be remote; gains and losses on foreign currency transactions; and the net impact of the change in valuation associated

with the other-than-temporary gains and losses on auction rate securities. See Note 5, "Investments."

WEBSITE AND ADVERTISING COSTS

Website and advertising costs are expensed as incurred as a component of Stores and Distribution Expense on the Consolidated

Statements of Operations and Comprehensive Income.

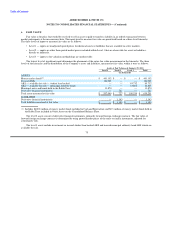

LEASES

The Company leases property for its stores under operating leases. Lease agreements may contain construction allowances, rent

escalation clauses and/or contingent rent provisions.

For construction allowances, the Company records a deferred lease credit on the Consolidated Balance Sheets and amortizes the

deferred lease credit as a reduction of rent expense on the Consolidated Statements of Operations and Comprehensive Income over the

terms of the leases. For scheduled rent escalation clauses during the lease terms, the Company records minimum rental expenses on a

straight-line basis over the terms of the leases on the Consolidated Statements of Operations and Comprehensive Income. The term of

the lease over which the Company amortizes construction allowances and minimum rental expenses on a straight-line basis begins on

the date of initial possession.

Certain leases provide for contingent rents, which are determined as a percentage of gross sales. The Company records a

contingent rent liability in accrued expenses on the Consolidated Balance Sheets and the corresponding rent expense on the

Consolidated Statements of Operations and Comprehensive Income when management determines that achieving the specified levels

during the fiscal year is probable.

Under GAAP, the Company is considered to be the owner of certain store locations, primarily related to flagships, in which the

Company is deemed to be involved in structural construction and has substantially all of the risks of ownership during construction of

the leased property. Accordingly, the Company records a construction-in-progress asset which is included in Property and Equipment,

Net and a related lease financing obligation which is included in Long-Term Debt on the Consolidated Balance Sheets. Once

construction is complete, the Company determines if the asset qualifies for sale-leaseback accounting treatment. If the arrangement

does not qualify for sale-leaseback treatment, the Company continues to amortize the obligation over the lease term and depreciates

the asset over its useful life.

STORE PRE-OPENING EXPENSES

Pre-opening expenses related to new store openings are charged to operations as incurred.

66