Abercrombie & Fitch 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

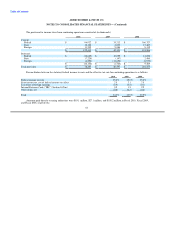

expense of $2.7 million and net income of $1.0 million and $2.5 million for Fiscal 2010, Fiscal 2009 and Fiscal 2008, respectively,

associated with the SERP.

The net expense for fifty-two weeks ended January 29, 2011 included $2.1 million to correct a cumulative under-accrual of the

SERP relating to prior periods, primarily Fiscal 2008. The Company does not believe this correction was material to the periods

affected.

18. CONTINGENCIES

A&F is a defendant in lawsuits and other adversary proceedings arising in the ordinary course of business. Legal costs incurred

in connection with the resolution of claims and lawsuits are generally expensed as incurred, and the Company establishes reserves for

the outcome of litigation where it deems appropriate to do so under applicable accounting rules. Actual liabilities may exceed the

amounts reserved, and there can be no assurance that final resolution of these matters will not have a material adverse effect on the

Company's financial condition, results of operations or cash flows. The Company's identified contingencies include the following

matters:

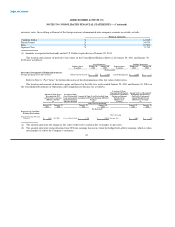

On June 23, 2006, Lisa Hashimoto, et al. v. Abercrombie & Fitch Co. and Abercrombie & Fitch Stores, Inc., was filed in the

Superior Court of the State of California for the County of Los Angeles. In that action, plaintiffs alleged, on behalf of a putative class

of California store managers employed in Hollister and abercrombie kids stores, that they were entitled to receive overtime pay as

"non-exempt" employees under California wage and hour laws. The complaint sought injunctive relief, equitable relief, unpaid

overtime compensation, unpaid benefits, penalties, interest and attorneys' fees and costs. The defendants answered the complaint on

August 21, 2006, denying liability. On June 23, 2008, the defendants settled all claims of Hollister and abercrombie kids store

managers who served in stores from June 23, 2002 through April 30, 2004, but continued to oppose the plaintiffs' remaining claims.

On January 29, 2009, the Court certified a class consisting of all store managers who served at Hollister and abercrombie kids stores in

California from May 1, 2004 through the future date upon which the action concludes. The parties then continued to litigate the claims

of that putative class. On May 24, 2010, plaintiffs filed a notice that they did not intend to continue to pursue their claim that members

of the class did not exercise independent managerial judgment and discretion. They also asked the Court to vacate the August 9, 2010

trial date previously set by the Court. On July 20, 2010, the trial court vacated the trial date and the defendants then moved to decertify

the putative class.

On September 16, 2005, a derivative action, styled The Booth Family Trust v. Michael S. Jeffries, et al., was filed in the United

States District Court for the Southern District of Ohio, naming A&F as a nominal defendant and seeking to assert claims for

unspecified damages against nine of A&F's present and former directors, alleging various breaches of the directors' fiduciary duty and

seeking equitable and monetary relief. In the following three months, four similar derivative actions were filed (three in the United

States District Court for the Southern District of Ohio and one in the Court of Common Pleas for Franklin County, Ohio) against

present and former directors of A&F alleging various breaches of the directors' fiduciary duty allegedly arising out of antecedent

employment law and securities class actions brought against the Company. A consolidated amended derivative complaint was filed in

the federal proceeding on July 10, 2006. On February 16, 2007, A&F announced that its Board of Directors had received a report of

the Special Litigation

90