Abercrombie & Fitch 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

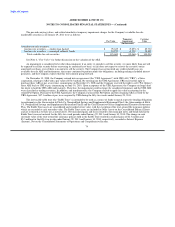

Cash and equivalents include amounts on deposit with financial institutions, United States treasury bills, and other investments,

primarily held in money market accounts, with original maturities of less than 3 months.

Any cash that is legally restricted from use is recorded in Other Assets in the Consolidated Balance Sheet. Restricted cash of

$10.2 million was reclassified from Cash and Equivalents to Other Assets for Fiscal 2009.

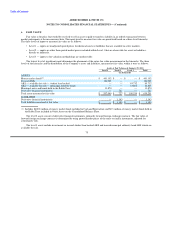

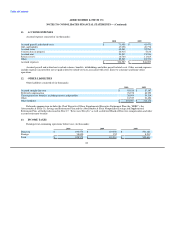

5. INVESTMENTS

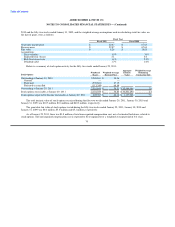

Investments consisted of (in thousands):

January 29, 2011 January 30, 2010

Marketable securities — Current:

Trading securities:

Auction rate securities — UBS — student loan backed $ — $ 20,049

Auction rate securities — UBS — municipal authority bonds — 12,307

Total trading securities — 32,356

Marketable securities — Non-Current:

Available-for-sale securities:

Auction rate securities — student loan backed 85,732 118,390

Auction rate securities — municipal authority bonds 14,802 23,404

Total available-for-sale securities 100,534 141,794

Rabbi Trust assets:(1)

Money market funds 343 1,317

Municipal notes and bonds 11,870 18,537

Trust-owned life insurance policies (at cash surrender value) 70,288 51,391

Total Rabbi Trust assets 82,501 71,245

Total investments $ 183,035 $ 245,395

(1) Rabbi Trust assets are included in Other Assets on the Consolidated Balance Sheets and are restricted as to their use.

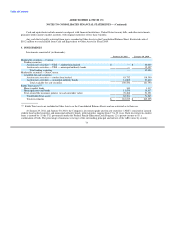

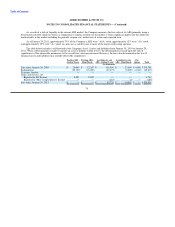

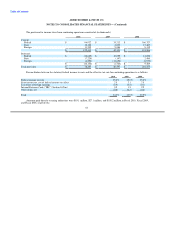

At January 29, 2011 and January 30, 2010, the Company's investment grade auction rate securities ("ARS") consisted of insured

student loan backed securities and municipal authority bonds, with maturities ranging from 17 to 32 years. Each investment in student

loans is insured by (1) the U.S. government under the Federal Family Education Loan Program, (2) a private insurer or (3) a

combination of both. The percentage of insurance coverage of the outstanding principal and interest of the ARS varies by security.

73