Abercrombie & Fitch 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

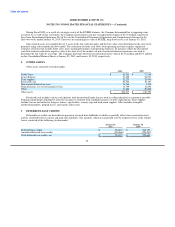

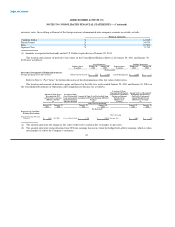

(c) The amount represents the change in fair value of derivative contracts due to changes in the difference between the spot price

and forward price that is excluded from the assessment of hedge effectiveness and, therefore, recognized in earnings. There were

no ineffective portions recorded in earnings for the fifty-two weeks ended January 29, 2011 and January 30, 2010.

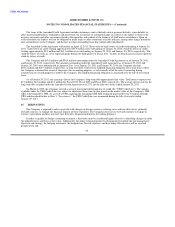

16. DISCONTINUED OPERATIONS

On June 16, 2009, A&F's Board of Directors approved the closure of the Company's 29 RUEHL branded stores and related

direct-to-consumer operations. The Company completed the closure of the RUEHL branded stores and related direct-to-consumer

operations during the fourth quarter of Fiscal 2009. Accordingly, the results of operations of RUEHL are reflected in Loss from

Discontinued Operations, Net of Tax on the Consolidated Statements of Operations and Comprehensive Income for the fifty-two

weeks ended January 30, 2010 and January 31, 2009. Results from discontinued operations were immaterial for the fifty-two weeks

ended January 29, 2011.

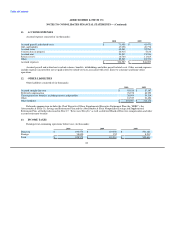

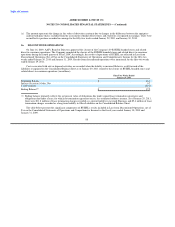

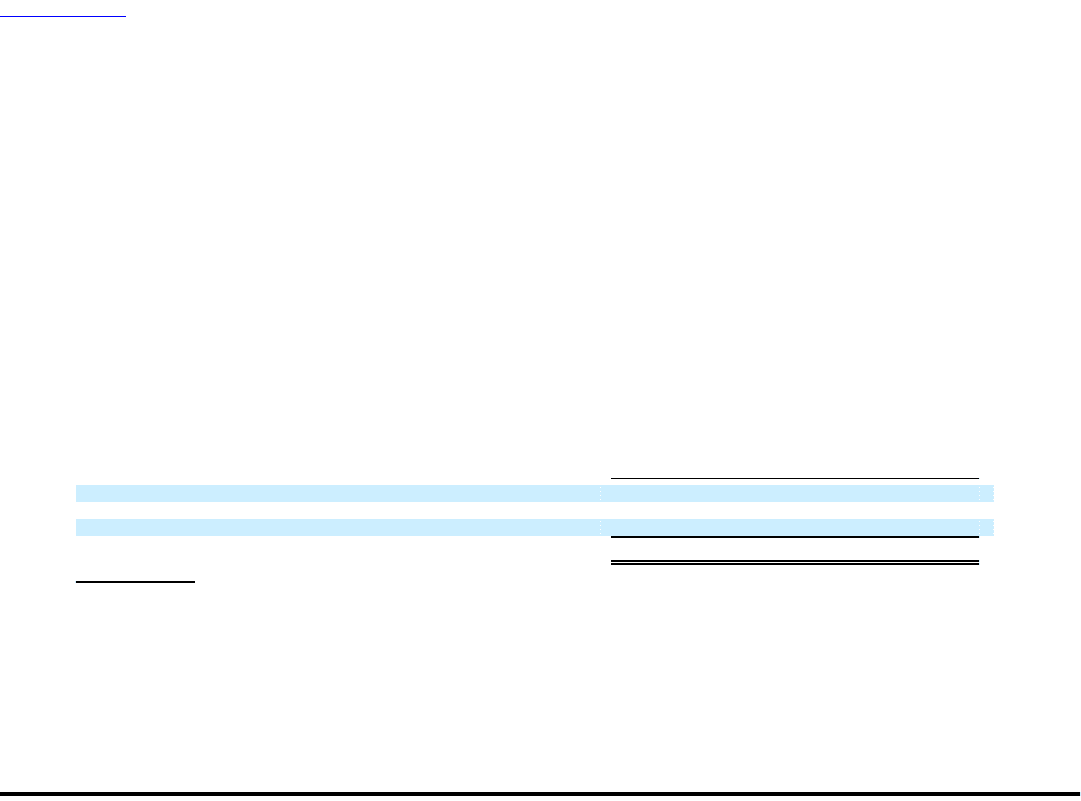

Costs associated with exit or disposal activities are recorded when the liability is incurred. Below is a roll forward of the

liabilities recognized on the Consolidated Balance Sheet as of January 29, 2011 related to the closure of RUEHL branded stores and

related direct-to-consumer operations (in millions):

Fifty-Two Weeks Ended

January 29, 2011

Beginning Balance $ 46.1

Interest Accretion / Other, Net 0.2

Cash Payments (29.1)

Ending Balance(1) $ 17.2

(1) Ending balance primarily reflects the net present value of obligations due under signed lease termination agreements and

obligations due under a lease, for which no termination agreement exists, less estimated sublease income. As of January 29, 2011,

there were $11.8 million of lease termination charges recorded as a current liability in Accrued Expenses and $5.4 million of lease

termination charges recorded as a long-term liability in Other Liabilities on the Consolidated Balance Sheet.

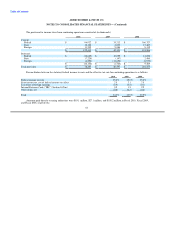

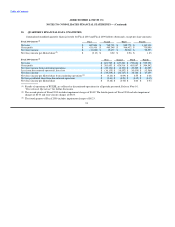

The table below presents the significant components of RUEHL's results included in Loss from Discontinued Operations, net of

Tax on the Consolidated Statements of Operations and Comprehensive Income for the fiscal years ended January 30, 2010 and

January 31, 2009.

88