Abercrombie & Fitch 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

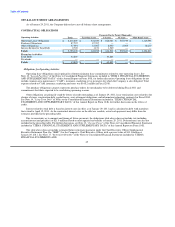

Stores and distribution expense included store-related asset impairment charges associated with 99 stores of $33.2 million, or

1.1% of net sales, for the fifty-two weeks ended January 30, 2010 and store-related asset impairment charges associated with 20 stores

of $8.3 million, or 0.2% of net sales for the fifty-two weeks ended January 31, 2009. Excluding the effect of impairment charges, the

increase in the stores and distribution expense rate was primarily attributable to higher store occupancy costs, including rent,

depreciation and other occupancy costs.

Variable direct-to-consumer expenses included in stores and distribution expense were $50.1 million for Fiscal 2009, compared

to $60.0 million in Fiscal 2008.

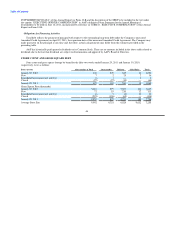

Marketing, General and Administrative Expense

Marketing, general and administrative expense for Fiscal 2009 decreased 12.8% to $353.3 million compared to $405.2 million in

Fiscal 2008.

The decrease in expense was related to reductions in employee compensation and benefits, travel, and outside services. The

marketing, general and administrative expense rate was 12.1% for Fiscal 2009, an increase of 50 basis points compared to 11.6% for

Fiscal 2008.

Other Operating Income, Net

Other operating income for Fiscal 2009 was $13.5 million compared to $8.8 million for Fiscal 2008.

The increase was primarily driven by gains on foreign currency transactions for Fiscal 2009 compared to losses on foreign

currency transactions for Fiscal 2008, as well as an increase in income related to gift cards for which the Company has determined the

likelihood of redemption to be remote. In Fiscal 2009, other operating income also benefited from a reduction of other-than-temporary

impairments of $9.2 million related to the Company's trading auction rate securities, partially offset by a reduction of a related put

option of $7.7 million as compared to an other-than-temporary impairment charge of $14.0 million related to the Company's trading

auction rate securities, partially offset by a gain on a related put option of $12.3 million in Fiscal 2008.

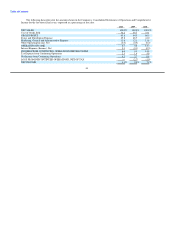

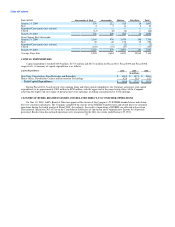

Interest Income, Net and Income Tax Expense

Fiscal 2009 interest income was $8.2 million and interest expense was $6.6 million compared to interest income of $14.8 million

and interest expense was $3.4 million for Fiscal 2008. The decrease in interest income was due primarily to a lower average rate of

return on investments. The increase in interest expense was due primarily to imputed interest expense related to certain store lease

transactions.

The income tax expense rate for continuing operations for Fiscal 2009 was 33.9% compared to 39.5% for Fiscal 2008. The Fiscal

2009 rate benefited from foreign operations. Additionally, Fiscal 2008 included a $9.9 million charge related to the execution of the

Chairman and Chief Executive Officer's new employment agreement, which resulted in certain non-deductible amounts pursuant to

Section 162(m) of the Internal Revenue Code.

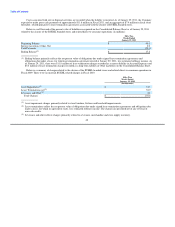

Loss from Discontinued Operations, Net of Tax

The Company completed the closure of its RUEHL branded stores and related direct-to-consumer operations in the fourth

quarter of Fiscal 2009. Accordingly, the after-tax operating results appear in Loss from Discontinued Operations, Net of Tax on the

Consolidated Statements of Operations and Comprehensive

41