Abercrombie & Fitch 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

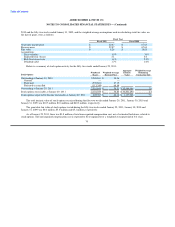

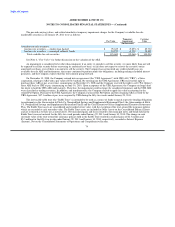

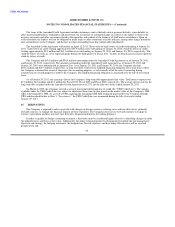

During Fiscal 2009, as a result of a strategic review of the RUEHL business, the Company determined that a triggering event

occurred. As a result of that assessment, the Company incurred non-cash, pre-tax impairment charges of $51.5 million, reported in

Loss from Discontinued Operations, Net of Tax on the Consolidated Statement of Operations and Comprehensive Income for the

fifty-two weeks ended January 30, 2010. There was no remaining fair value of RUEHL long-lived assets as of January 30, 2010.

Store-related assets are considered level 3 assets in the fair value hierarchy and the fair values were determined at the store level,

primarily using a discounted cash flow model. The estimation of future cash flows from operating activities requires significant

estimates of factors that include future sales, gross margin performance and operating expenses. In instances where the discounted

cash flow analysis indicated a negative value at the store level, the market exit price based on historical experience was used to

determine the fair value by asset type. The Company had store-related assets measured at fair value of $14.6 million and $19.3 million

on the Consolidated Balance Sheets at January 29, 2011 and January 30, 2010, respectively.

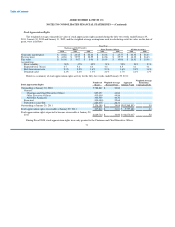

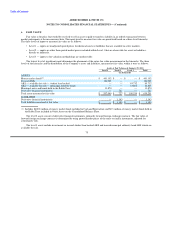

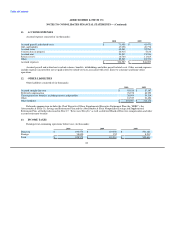

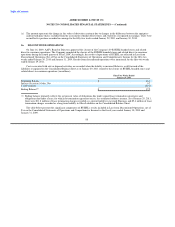

8. OTHER ASSETS

Other assets consisted of (in thousands):

2010 2009

Rabbi Trust $ 82,501 $ 71,245

Lease deposits 61,658 54,051

Store supplies 32,275 32,441

Restricted cash 26,322 10,163

Non-current deferred tax asset 16,764 1,516

Prepaid income tax on intercompany items 13,709 12,694

Other 31,288 28,260

Other assets $ 264,517 $ 210,370

Restricted cash includes various cash deposits with international banks that are used as collateralization for customary non-debt

banking commitments and deposits into trust accounts to conform with standard insurance security requirements. Store supplies

include, but are not limited to, hangers, frames, sign holders, security tags and back-room supplies. Other includes intangible

intellectual property, prepaid leases, and various other assets.

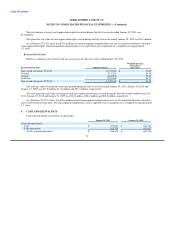

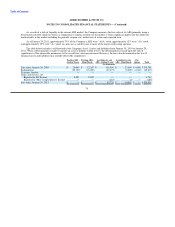

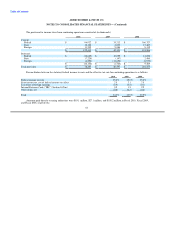

9. DEFERRED LEASE CREDITS

Deferred lease credits are derived from payments received from landlords to wholly or partially offset store construction costs

and are classified between current and long-term liabilities. The amounts, which are amortized over the respective lives of the related

leases, consisted of the following (in thousands):

January 29, January 30,

2011 2010

Deferred lease credits $ 544,223 $ 546,191

Amortized deferred lease credits (310,066) (290,542)

Total deferred lease credits, net $ 234,157 $ 255,649

78