Abercrombie & Fitch 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

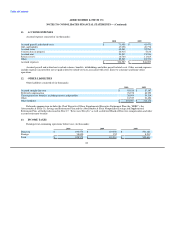

7. PROPERTY AND EQUIPMENT, NET

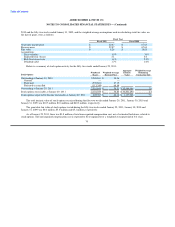

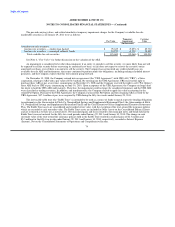

Property and equipment, net, consisted of (in thousands):

January 29, January 30,

2011 2010

Land $ 36,885 $ 32,877

Building 223,520 223,532

Furniture, fixtures and equipment 602,885 593,984

Information technology 233,867 211,461

Leasehold improvements 1,247,493 1,205,276

Construction in progress 64,401 48,352

Other 47,006 47,010

Total $ 2,456,057 $ 2,362,492

Less: Accumulated depreciation and amortization (1,306,474) (1,118,473)

Property and equipment, net $ 1,149,583 $ 1,244,019

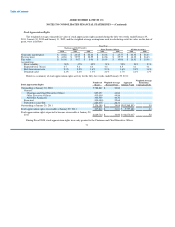

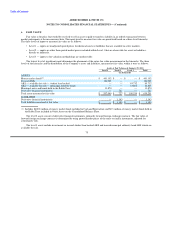

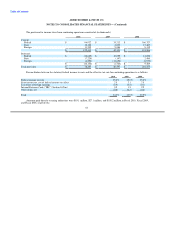

Long-lived assets, primarily comprised of property and equipment, are reviewed periodically for impairment or whenever events

or changes in circumstances indicate that full recoverability of net asset balances through future cash flows is in question. Factors used

in the evaluation include, but are not limited to, management's plans for future operations, recent operating results, and projected cash

flows.

In the second quarter of Fiscal 2010, as a result of a strategic review of under-performing stores, the Company determined that a

number of stores were likely to be closed prior to lease expiration, which caused a triggering event requiring the Company to evaluate

the related long-lived assets for impairment. Associated with these expected closures, the Company incurred a non-cash, pre-tax asset

impairment charge of $2.2 million, included in Stores and Distribution Expense on the Consolidated Statement of Operations and

Comprehensive Income for the fifty-two weeks ended January 29, 2011. The charge was associated with one Abercrombie & Fitch,

one abercrombie kids and three Hollister stores.

In the fourth quarter of Fiscal 2010, as a result of the fiscal year-end review of long-lived store-related assets, the Company

incurred store-related asset impairment charges of $48.4 million, included in Stores and Distribution Expense on the Consolidated

Statement of Operations and Comprehensive Income for the fifty-two weeks ended January 29, 2011. The asset impairment charge

was primarily related to 13 Gilly Hicks stores constructed using the original large format store of approximately 10,000 gross square

feet which has been revised to a smaller format of 5,000 gross square feet for new stores. The charge also included one

Abercrombie & Fitch, one Abercrombie kids and six Hollister stores.

In the fourth quarter of Fiscal 2009, as a part of the Company's year-end review for impairment of long-lived store-related assets,

the Company incurred a non-cash, pre-tax impairment charge of $33.2 million, reported in Stores and Distribution Expense on the

Consolidated Statement of Operations and Comprehensive Income for the fifty-two weeks ended January 30, 2010. The charge was

associated with 34 Abercrombie & Fitch stores, 46 abercrombie kids stores and 19 Hollister stores.

77