Abercrombie & Fitch 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

operations. Additionally, Fiscal 2009 operating cash flows benefited from a reduction in inventory in reaction to the declining sales

trend, partially offset by an increase in lease related assets, including lease deposits and prepaid rent associated with new flagship

stores.

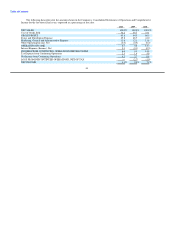

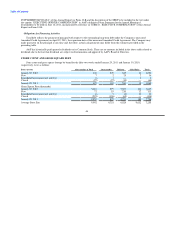

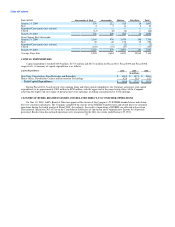

Investing Activities

Cash outflows from investing activities in Fiscal 2010, Fiscal 2009 and Fiscal 2008 were used primarily for capital expenditures

related to new store construction and information technology investments. Fiscal 2010 cash outflows for capital expenditures were

comparable to Fiscal 2009. The decrease in Fiscal 2009 capital expenditures compared to Fiscal 2008 related primarily to a reduction

in new domestic mall-based store openings in Fiscal 2009. The Company also had cash outflows for the purchase of trust-owned life

insurance policies and cash inflows from the sale of marketable securities.

Financing Activities

In Fiscal 2010, financing activities consisted primarily of the repurchase of A&F's Common Stock, the payments of dividends,

proceeds associated with the exercise of share-based compensation awards and repayment of borrowings denominated in Japanese

Yen under the Company's unsecured credit agreement. In Fiscal 2009, financing activities consisted of repayment of $100.0 million

borrowed under the Company's unsecured credit agreement, denominated in U.S. Dollars, and separate borrowings of $48.0 million

denominated in Japanese Yen under the Company's unsecured Amended Credit Agreement, and payment of dividends. In Fiscal 2008,

financing activities consisted primarily of the repurchase of the A&F's Common Stock, the payment of dividends, proceeds from

share-based compensation, and proceeds from borrowing under the Company's unsecured credit agreement. A&F's Board of Directors'

will review the Company's cash position and results of operations and address the appropriateness of future dividend amounts.

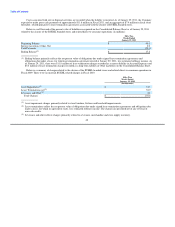

During Fiscal 2010, A&F repurchased approximately 1.6 million shares of A&F's Common Stock in the open market with a

market value of approximately $76.2 million. A&F did not repurchase any shares of A&F's Common Stock in the open market during

Fiscal 2009. During Fiscal 2008, A&F repurchased approximately 0.7 million shares of A&F's Common Stock in the open market

with a value of approximately $50.0 million. Both the Fiscal 2010 and Fiscal 2008 repurchases were pursuant to A&F Board of

Directors' authorizations.

As of January 29, 2011, A&F had approximately 9.8 million remaining shares available for repurchase as part of the

November 20, 2007 A&F Board of Directors' authorization to repurchase 10.0 million shares of A&F's Common Stock.

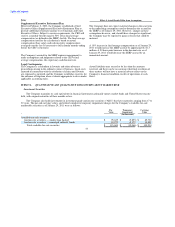

FUTURE CASH REQUIREMENTS AND SOURCES OF CASH

Over the next twelve months, the Company's primary cash requirements will be funding operating activities, including inventory,

compensation, rent, taxes and other operating expenses, as well as capital expenditures and quarterly dividend payments to

stockholders subject to A&F Board of Directors approval. Subject to the availability of cash and suitable market conditions, A&F

expects to continue to repurchase shares of its Common Stock. The Company anticipates funding these cash requirements with cash

generated from operations. The Company also has availability under the Amended Credit Facility as a source of additional funding.

44