Abercrombie & Fitch 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of contents

-

Page 1

ABERCROMBIE & FITCH CO /DE/ (ANF) 10-K Annual report pursuant to section 13 and 15(d) Filed on 03/29/2011 Filed Period 01/29/2011 -

Page 2

... file number 1-12107 ABERCROMBIE & FITCH CO. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 31-1469076 (I.R.S. Employer Identification No.) 6301 Fitch Path, New Albany, Ohio (Address of principal executive offices... -

Page 3

... MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS FINANCIAL SUMMARY CURRENT TRENDS AND OUTLOOK QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME... -

Page 4

... accessories for men, women and kids under the Abercrombie & Fitch, abercrombie kids, and Hollister brands. The Company also operates stores and direct-to-consumer operations offering bras, underwear, personal care products, sleepwear and at-home products for women under the Gilly Hicks brand. As of... -

Page 5

... and personality of each brand. The store design, furniture, fixtures and music are all carefully planned and coordinated to create a shopping experience that reflects the Abercrombie & Fitch, abercrombie kids, Hollister or Gilly Hicks lifestyle. The Company's sales associates and managers are... -

Page 6

... Gilly Hicks stores domestically. The Company also operated six Abercrombie & Fitch stores, four abercrombie kids stores and 18 Hollister stores internationally. Direct-to-Consumer Business. During Fiscal 2010, the Company operated, and continues to operate, four websites, including: www.abercrombie... -

Page 7

...office and field employees to help monitor compliance with the Company's product quality standards. Distribution and Merchandise Inventory. In Fiscal 2010, a majority of the Company's merchandise and related materials were shipped to the Company's two distribution centers ("DCs") in New Albany, Ohio... -

Page 8

... expanding internationally, it also faces competition in local markets from established chains, as well as local specialty stores. Brand recognition, fashion, price, service, store location, selection and quality are the principal competitive factors in retail store and direct-to-consumer sales. The... -

Page 9

... operations. The Company completed the closure of the RUEHL branded stores and related direct-to-consumer operations during the fourth quarter of Fiscal 2009. Accordingly, the results of operations of RUEHL are reflected in Loss from Discontinued Operations, Net of Tax on the Consolidated Statements... -

Page 10

... impact current store performance; • our international expansion plan is dependent on a number of factors, any of which could delay or prevent successful penetration into new markets or could adversely affect the profitability of our international operations; • our direct-to-consumer sales... -

Page 11

... our reliance on third parties to deliver merchandise from our distribution centers to our stores and direct-to-consumer customers could result in disruptions to our business; • we may be exposed to risks and costs associated with credit card fraud and identity theft that would cause us to incur... -

Page 12

... income is adversely affected. Our performance is subject to factors that affect worldwide economic conditions including unemployment, consumer credit availability, consumer debt levels, reductions in net worth based on declines in the financial, residential real estate and mortgage markets, sales... -

Page 13

...supply quality products in a timely manner, we may experience inventory shortages, which may negatively impact customer relationships, diminish brand loyalty and result in lost sales. Any of these events could significantly harm our operating results and financial condition. Fluctuations in the Cost... -

Page 14

..., obtaining prime locations for stores, setting up foreign offices and distribution centers, as well as hiring experienced management. We may be unable to open and operate new stores successfully, or we may face operational issues that delay our intended pace of international store openings, and, in... -

Page 15

... of new systems and platforms; • diversions of sales from our stores; • liability for online content; • violations of state, federal or international laws, including those relating to online privacy; • credit card fraud; • the failure of the computer systems that operate our websites and... -

Page 16

...Our Financial Condition or Results of Operations. Historically, we have internally developed and launched new brands that have contributed to our sales growth. Our most recently added brand is Gilly Hicks, which offers bras, underwear, personal care products, sleepwear and at-home products for girls... -

Page 17

... future. Our Market Share May be Negatively Impacted by Increasing Competition and Pricing Pressures from Companies with Brands or Merchandise Competitive with Ours. The sale of apparel and personal care products through brick-and-mortar stores and direct-to-consumer channels is a highly competitive... -

Page 18

... vicinity of our stores and the continuing popularity of malls in the United States and, increasingly, in many international locations as shopping destinations. We cannot control the development of new shopping malls in the United States or around the world; the availability or cost of appropriate... -

Page 19

... and the operation of our stores. Our senior executive officers have substantial experience and expertise in the retail business and have made significant contributions to the growth and success of our brands. If we were to lose the benefit of their involvement - in particular the services of any... -

Page 20

...: • the imposition of additional trade law provisions or regulations; • reliance on a limited number of shipping and air carriers who may experience capacity issues that adversely affect our ability to ship inventory in a timely manner or for an acceptable cost; • the imposition of additional... -

Page 21

... in our stores and process direct-to-consumer orders could be interrupted and sales could be negatively impacted. We are in the process of consolidating our two distribution centers in New Albany into one, with an expected completion date in mid-2012. This consolidation requires management's focus... -

Page 22

... stores require the collection of certain customer data, such as credit card information. In order for our sales channels to function and develop successfully, we and other parties involved in processing customer transactions must be able to transmit confidential information, including credit card... -

Page 23

... Have a Negative Impact on Our Brand Image and Limit Our Ability to Penetrate New Markets. We believe our trademarks, Abercrombie & Fitch®, abercrombie®, Hollister Co.®, Gilly Hicks®, Gilly Hicks Sydney® and the "Moose," "Seagull" and "Koala" logos, are an essential element of our strategy. We... -

Page 24

... supplies from, or manufacture in, less costly markets or penetrate new markets should our business plan include selling our merchandise in those non-U.S. jurisdictions. We have an anti-counterfeiting program, under the auspices of the Abercrombie & Fitch Brand Protection Team, whose goal is to... -

Page 25

...online privacy, unsolicited commercial communication and zoning and occupancy laws and ordinances that regulate retailers generally and/or govern the importation, promotion and sale of merchandise and the operation of retail stores and distribution centers. As our business becomes more international... -

Page 26

...of operations. Failure to protect personally identifiable information of our customers or associates could subject us to considerable reputational harm as well as significant fines, penalties and sanctions both domestically and abroad. In addition, changes in federal, state and international minimum... -

Page 27

... setting in New Albany, Ohio and an additional small distribution and shipping facility located in the Columbus, Ohio area, all of which are owned by the Company. Additionally, the Company leases small facilities to house its design and sourcing support centers in Hong Kong, New York City and Los... -

Page 28

... on the Company's financial condition, results of operations or cash flows. The Company's identified contingencies include the following matters: On June 23, 2006, Lisa Hashimoto, et al. v. Abercrombie & Fitch Co. and Abercrombie & Fitch Stores, Inc., was filed in the Superior Court of the State of... -

Page 29

... action. On December 9, 2010, after briefing and argument, the trial court granted in part, and denied in part, plaintiffs' motion, certifying sub-classes to pursue meal break claims, meal premium pay claims, work related travel claims, travel expense claims, termination pay claims, reporting time... -

Page 30

... for The Honorable Milton Pollack of the United States District Court for the Southern District of New York from 1989 to 1990. Before joining Vorys, Mr. Robins practiced for several years as an associate at Davis Polk & Wardwell in New York City. The executive officers serve at the pleasure of the... -

Page 31

...2009 and Fiscal 2010. A&F expects to continue to pay a quarterly dividend, subject to the Board of Directors' review of the Company's cash position and results of operations. As of March 18, 2011, there were approximately 4,350 stockholders of record. However, when including investors holding shares... -

Page 32

... of A&F's Common Stock in the open market during Fiscal 2009. During Fiscal 2008, A&F repurchased approximately 0.7 million shares of A&F's Common Stock in the open market with a cost of approximately $50.0 million. Both the Fiscal 2010 and the Fiscal 2008 repurchases were pursuant to authorizations... -

Page 33

... shows the changes, over the five-year period ended January 29, 2011 (the last day of A&F's Fiscal 2010), in the value of $100 invested in (i) shares of A&F's ...closing price on the last trading day of the fiscal year indicated. COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN* Among Abercrombie & Fitch... -

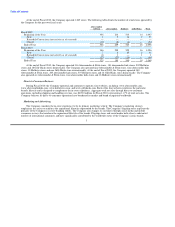

Page 34

...ABERCROMBIE & FITCH CO. FINANCIAL SUMMARY Summary of Operations (Information below excludes amounts related to discontinued operations, except where otherwise noted) 2010 2009 2008 2007 2006(1) (Thousands, except per share and per square foot amounts, ratios and store and associate data) Net Sales... -

Page 35

... 2011. Excluding the net loss from discontinued operations and store-related asset impairment charges, the Company reported non-GAAP net income per diluted share of $1.12 for the fifty-two weeks ended January 30, 2010. The Company believes that the non-GAAP financial measures are useful to investors... -

Page 36

... & Fitch, six abercrombie kids and three Hollister stores. (3) For the fifty-two week period ended January 29, 2011, store closure charges were associated with the closure of 64 stores, primarily related to lease obligations. Net cash provided by operating activities, the Company's primary source of... -

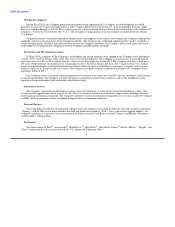

Page 37

... Statements of Operations and Comprehensive Income for the last three fiscal years, expressed as a percentage of net sales: 2010 2009 2008 NET SALES Cost of Goods Sold GROSS PROFIT Stores and Distribution Expense Marketing, General and Administrative Expense Other Operating Income, Net OPERATING... -

Page 38

... financial and statistical data compares Fiscal 2010 to Fiscal 2009 and Fiscal 2009 to Fiscal 2008: 2010 Net sales by brand (thousands) Abercrombie & Fitch abercrombie Hollister Gilly Hicks** Increase (decrease) in net sales from prior year Abercrombie & Fitch abercrombie Hollister Gilly Hicks... -

Page 39

... and Hong Kong. We also plan to open five Abercrombie & Fitch flagship stores in Paris, Madrid, Dusseldorf, Brussels and Singapore. The Company's flagship store in Dublin is now expected to open in 2012. Fourth, sustaining strong growth rates in our direct-to-consumer business, which should benefit... -

Page 40

... direct-to-consumer business, including shipping and handling revenue, and new stores, primarily international. The impact of foreign currency on sales for Fiscal 2010 and Fiscal 2009 was less than 1% of net sales. Comparable store sales by brand for Fiscal 2010 were as follows: Abercrombie & Fitch... -

Page 41

..., while Canada and Japan were the weakest. Within the U.S., flagship and tourist stores outperformed non-tourist stores, though all store categories experienced positive comparable store sales. For Fiscal 2010, total Company international net sales, including direct-to-consumer net sales, increased... -

Page 42

... 2010 was 34.3% compared to 33.9% for Fiscal 2009, in each year benefiting from foreign operations. Loss from Discontinued Operations, Net of Tax The Company completed the closure of its RUEHL branded stores and related direct-to-consumer operations in the fourth quarter of Fiscal 2009. Accordingly... -

Page 43

...decrease in net direct-to-consumer sales, including shipping and handling revenue. Comparable store sales by brand for Fiscal 2009 were as follows: Abercrombie & Fitch decreased 19% with men's decreasing by a low double-digit percent and women's decreasing by a mid twenty; abercrombie kids decreased... -

Page 44

...to Section 162(m) of the Internal Revenue Code. Loss from Discontinued Operations, Net of Tax The Company completed the closure of its RUEHL branded stores and related direct-to-consumer operations in the fourth quarter of Fiscal 2009. Accordingly, the after-tax operating results appear in Loss from... -

Page 45

... share associated with the impairment of store-related assets for Fiscal 2008. Refer to GAAP reconciliation table in "ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS" of this Annual Report on Form 10-K for a reconciliation of net income per diluted share... -

Page 46

...net income for Fiscal 2009 compared to Fiscal 2008, adjusted for non-cash impairment charges. Operating cash flows for Fiscal 2009 included payments of approximately $22.6 million related primarily to lease termination agreements associated with the closure of RUEHL branded stores and related direct... -

Page 47

...to Fiscal 2008 related primarily to a reduction in new domestic mall-based store openings in Fiscal 2009. The Company also had cash outflows for the purchase of trust-owned life insurance policies and cash inflows from the sale of marketable securities. Financing Activities In Fiscal 2010, financing... -

Page 48

..., and information technology contracts for Fiscal 2010. See Note 14, "Long-Term Debt" of Notes to the Consolidated Financial Statements included in "ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA" of this Annual Report on Form 10-K, for further discussion on the letters of credit. Interest... -

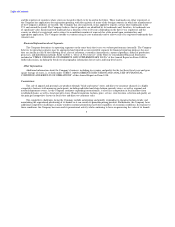

Page 49

... square footage by brand for the fifty-two weeks ended January 29, 2011 and January 30, 2010, respectively, were as follows: Store Activity Abercrombie & Fitch abercrombie Hollister Gilly Hicks Total January 30, 2010 New Remodels/Conversions (net activity) Closed January 29, 2011 Gross Square Feet... -

Page 50

... 2010 2009 (In millions) 2008 New Store Construction, Store Refreshes and Remodels Home Office, Distribution Centers and Information Technology Total Capital Expenditures $ $ 118.0 $ 42.9 160.9 $ 137.0 $ 38.5 175.5 $ 286.4 81.2 367.6 During Fiscal 2011, based on new store opening plans... -

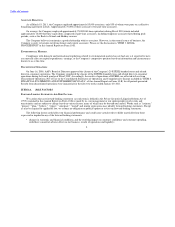

Page 51

...charges related to the closure of the RUEHL branded stores and related direct-to-consumer operations in Fiscal 2009. There were no material RUEHL related charges in Fiscal 2010. Fifty-Two Weeks Ended January 30, 2010 (In thousands) Asset Impairments(1) Lease Terminations, net(2) Severance and Other... -

Page 52

... years ended January 30, 2010 and January 31, 2009. 2009 2008 NET SALES Cost of Goods Sold GROSS PROFIT Stores and Distribution Expense Marketing, General and Administrative Expense Other Operating Income, Net NET LOSS BEFORE INCOME TAXES(1) Income Tax Benefit LOSS FROM DISCONTINUED OPERATIONS, NET... -

Page 53

... in a reduction of the price paid by the customer are recorded as a reduction of sales. The Company sells gift cards in its stores and through direct-to-consumer operations. The Company accounts for gift cards sold to customers by recognizing a liability at the time of sale. The liability remains on... -

Page 54

... for impairment or whenever events or changes in circumstances indicate that full recoverability of net asset balances through future cash flows is in question. The Company's impairment calculation requires management to make assumptions and judgments related to factors used in the evaluation... -

Page 55

... for Fiscal 2010. However, changes in these assumptions may occur and should those changes be significant, they could have a material impact on the Company's income tax provision. If the Company's intention or U.S. tax law changes in the future, there may be a significant negative impact on the... -

Page 56

...cash equivalents in financial instruments, primarily money market funds and United States treasury bills, with original maturities of three months or less. The Company also holds investments in investment grade auction rate securities ("ARS") that have maturities ranging from 17 to 32 years. The par... -

Page 57

... varies by security. The credit ratings may change over time and would be an indicator of the default risk associated with the ARS and could have a material effect on the value of the ARS. If the Company expects that it will not recover the entire cost basis of the available-for-sale ARS, intends to... -

Page 58

Table of Contents the Company had $306.2 million available, less outstanding letters of credit, under its unsecured Amended Credit Agreement. Assuming no changes in the Company's financial structure as it stood at January 29, 2011, if market interest rates average an increase of 100 basis points ... -

Page 59

Table of Contents ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA ABERCROMBIE & FITCH CO. CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME 2010 2009 2008 (Thousands, except share and per share amounts) $ 3,468,777 $ 2,928,626 $ 3,484,058 1,256,596 1,045,028 1,152,963 2,212,181 ... -

Page 60

...of Contents ABERCROMBIE & FITCH CO. CONSOLIDATED BALANCE SHEETS January 29, January 30, 2011 2010 (Thousands, except par value amounts) ASSETS CURRENT ASSETS: Cash and Equivalents Marketable Securities Receivables Inventories Deferred Income Taxes Other Current Assets TOTAL CURRENT ASSETS PROPERTY... -

Page 61

... Tax Benefit from Share-based Compensation Issuances and Exercises Share-based Compensation Expense Unrealized Losses on Marketable Securities Net Change in Unrealized Gains or Losses on Derivative Financial Instruments Foreign Currency Translation Adjustments Balance, January 31, 2009 Net Income... -

Page 62

Table of Contents ABERCROMBIE & FITCH CO. CONSOLIDATED STATEMENTS OF CASH FLOWS 2010 2009 (Thousands) 2008 OPERATING ACTIVITIES: Net Income Impact of Other Operating Activities on Cash Flows: Depreciation and Amortization Non-Cash Charge for Asset Impairment Share-Based Compensation Lessor ... -

Page 63

... financial statements of, and transactions applicable to, the Company and reflect its assets, liabilities, results of operations and cash flows. On June 16, 2009, A&F's Board of Directors approved the closure of the Company's 29 RUEHL branded stores and related direct-to-consumer operations... -

Page 64

... includes net merchandise sales through stores and direct-to-consumer operations, including shipping and handling revenue. Net sales are reported by geographic area based on the location of the customer. Fifty-Two Weeks Ended January 29, 2011 (In thousands): January 30, 2010 United States Europe... -

Page 65

...on purchases of goods and services that will be recovered as sales are made to customers. INVENTORIES Inventories are principally valued at the lower of average cost or market utilizing the retail method. The Company determines market value as the anticipated future selling price of merchandise less... -

Page 66

... to, management's plans for future operations, recent operating results and projected cash flows. The Company expenses all internal-use software costs incurred in the preliminary project stage and capitalizes certain direct costs associated with the development and purchase of internal-use software... -

Page 67

... in the estimating process. However, the ultimate outcome of various legal issues could be different than management estimates, and adjustments may be required. STOCKHOLDERS' EQUITY At January 29, 2011 and January 30, 2010, there were 150.0 million shares of A&F's $.01 par value Class A Common Stock... -

Page 68

..., 2011, January 30, 2010 and January 31, 2009, respectively. The Company sells gift cards in its stores and through direct-to-consumer operations. The Company accounts for gift cards sold to customers by recognizing a liability at the time of sale. Gift cards sold to customers do not expire or lose... -

Page 69

...ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) technology; outside services such as legal and consulting; relocation, as well as recruiting; samples and travel expenses. OTHER OPERATING INCOME, NET Other operating income consists primarily of: income related to gift... -

Page 70

... ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) DESIGN AND DEVELOPMENT COSTS Costs to design and develop the Company's merchandise are expensed as incurred and are reflected as a component of "Marketing, General and Administrative Expense." NET INCOME PER SHARE Net... -

Page 71

Table of Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) related to share-based compensation for the fifty-two week periods ended January 29, 2011, January 30, 2010 and January 31, 2009, respectively. A deferred tax asset is recorded for the compensation ... -

Page 72

... FINANCIAL STATEMENTS - (Continued) Plans As of January 29, 2011, A&F had two primary share-based compensation plans: the 2005 Long-Term Incentive Plan (the "2005 LTIP"), under which A&F grants stock options, stock appreciation rights and restricted stock units to associates of the Company... -

Page 73

... TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 2010 and the fifty-two weeks ended January 31, 2009, and the weighted-average assumptions used in calculating such fair value, on the date of grant, were as follows: Fiscal Year Fiscal 2009 Fiscal 2008 Grant date market price Exercise price Fair... -

Page 74

... of grant, were as follows: Fiscal Year Chairman and Chief Executive Officer 2010 2009 2008 Other Executive Officers 2010 2009 All Other Associates 2010 2009 Grant date market price Exercise price Fair value Assumptions: Price volatility Expected term (Years) Risk-free interest rate Dividend yield... -

Page 75

...-average period of 1.5 years. Restricted Stock Units Below is a summary of restricted stock unit activity for the fifty-two weeks ended January 29, 2011: Weighted-Average Grant Date Fair Value Restricted Stock Units Number of Shares Non-vested at January 30, 2010 Granted Vested Forfeited Non... -

Page 76

Table of Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Cash and equivalents include amounts on deposit with financial institutions, United States treasury bills, and other investments, primarily held in money market accounts, with original maturities of ... -

Page 77

Table of Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The par and carrying values, and related cumulative temporary impairment charges for the Company's available-for-sale marketable securities as of January 29, 2011 were as follows: Par Value Temporary ... -

Page 78

Table of Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 6. FAIR VALUE Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The inputs... -

Page 79

Table of Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) As a result of a lack of liquidity in the current ARS market, the Company measures the fair value of its ARS primarily using a discounted cash flow model as well as a comparison to similar securities ... -

Page 80

..., the Company incurred a non-cash, pre-tax impairment charge of $33.2 million, reported in Stores and Distribution Expense on the Consolidated Statement of Operations and Comprehensive Income for the fifty-two weeks ended January 30, 2010. The charge was associated with 34 Abercrombie & Fitch stores... -

Page 81

...factors that include future sales, gross margin performance and operating expenses. In instances where the discounted cash flow analysis indicated a negative value at the store level, the market exit price based on historical experience was used to determine the fair value by asset type. The Company... -

Page 82

... Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 10. LEASED FACILITIES Annual store rent is comprised of a fixed minimum amount and/or contingent rent based on a percentage of sales. For scheduled rent escalation clauses during the lease terms, the Company... -

Page 83

..., benefits, withholdings and other payroll related costs. Other accrued expenses include expenses incurred but not yet paid related to outside services associated with store, direct-to-consumer and home office operations. 12. OTHER LIABILITIES Other liabilities consisted of (in thousands): 2010 2009... -

Page 84

Table of Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The provision for income taxes from continuing operations consisted of (in thousands): 2010 2009 2008 Current: Federal State Foreign Deferred: Federal State Foreign Total provision $ $ $ $ $ 94,922... -

Page 85

... ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The effect of temporary differences which give rise to deferred income tax assets (liabilities) were as follows (thousands): 2010 2009 Deferred tax assets: Deferred compensation Rent Accrued expenses Foreign net... -

Page 86

Table of Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 2010 2009 (In thousands) 2008 Unrecognized tax benefits, beginning of the year Gross addition for tax positions of the current year Gross addition for tax positions of prior years Reductions of tax ... -

Page 87

... ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Agreement and, as a result, revised the ratio requirements, as further discussed below, and also reduced the amount available from $450 million to $350 million (as amended, the "Amended Credit Agreement"). As stated... -

Page 88

... ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The terms of the Amended Credit Agreement include customary events of default such as payment defaults, cross-defaults to other material indebtedness, bankruptcy and insolvency, the occurrence of a defined change... -

Page 89

... ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) retrospectively. The extent to which a hedging instrument has been and is expected to continue to be effective at achieving offsetting changes in fair value or cash flows is assessed and documented at least quarterly... -

Page 90

... OCI on Derivative Contracts (Effective Portion) (a) January 29, 2011 Derivatives in Cash Flow Hedging Relationships Other Operating Foreign Exchange Forward Contracts $ 1,614 $(3,790) Cost of Goods Sold $ 2,122 $ (3,074) Income, Net $ (304) $ (74) Location of (Loss) Recognized in Earnings Amount of... -

Page 91

... operations. The Company completed the closure of the RUEHL branded stores and related direct-to-consumer operations during the fourth quarter of Fiscal 2009. Accordingly, the results of operations of RUEHL are reflected in Loss from Discontinued Operations, Net of Tax on the Consolidated Statements... -

Page 92

...Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 2009 2008 NET SALES Cost of Goods Sold GROSS PROFIT Stores and Distribution Expense Marketing, General and Administrative Expense Other Operating Income, Net NET LOSS BEFORE INCOME TAXES(1) Income Tax Benefit... -

Page 93

Table of Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) expense of $2.7 million and net income of $1.0 million and $2.5 million for Fiscal 2010, Fiscal 2009 and Fiscal 2008, respectively, associated with the SERP. The net expense for fifty-two weeks ended ... -

Page 94

... further proceedings in the state-court derivative action until resolution of the consolidated federal derivative cases. On December 21, 2007 Spencer de la Cruz, a former employee, filed an action against Abercrombie & Fitch Co. and Abercrombie & Fitch Stores, Inc. (collectively, the "Defendants... -

Page 95

... Date occurs. The "Distribution Date" generally means the earlier of (i) the close of business on the 10th day after the date (the "Share Acquisition Date") of the first public announcement that a person or group (other than A&F or any of A&F's subsidiaries or any employee benefit plan of A&F or of... -

Page 96

... of Contents ABERCROMBIE & FITCH CO. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 20. QUARTERLY FINANCIAL DATA (UNAUDITED) Summarized unaudited quarterly financial results for Fiscal 2010 and Fiscal 2009 follows (thousands, except per share amounts): Fiscal 2010 Quarter(1) First Second... -

Page 97

... internal control over financial reporting as of January 29, 2011, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company's management is responsible for these financial statements... -

Page 98

... Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the... -

Page 99

..., processed, summarized and reported within the time periods specified in the SEC's rules and forms, and that such information is accumulated and communicated to A&F's management, including the Chairman and Chief Executive Officer of A&F and the Executive Vice President and Chief Financial Officer... -

Page 100

... OWNERS AND MANAGEMENT - Section 16(a) Beneficial Ownership Reporting Compliance" in A&F's definitive Proxy Statement for the Annual Meeting of Stockholders to be held on June 16, 2011. Code of Business Conduct and Ethics Information concerning the Abercrombie & Fitch Code of Business Conduct and... -

Page 101

... Proxy Statement for the Annual Meeting of Stockholders to be held on June 16, 2011. ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. Information concerning certain relationships and transactions involving the Company and certain related persons within the meaning... -

Page 102

...(a) The following documents are filed as a part of this Annual Report on Form 10-K: (1) Consolidated Financial Statements: Consolidated Statements of Operations and Comprehensive Income for the fiscal years ended January 29, 2011, January 30, 2010 and January 31, 2009. Consolidated Balance Sheets as... -

Page 103

...(Amendment No. 2), dated and filed June 12, 2008 (File No. 001-12107). Appointment and Acceptance of Successor Rights Agent, effective as of the opening of business on November 2, 2009, between A&F and American Stock Transfer & Trust Company, LLC (as successor to National City Bank), as Rights Agent... -

Page 104

... the quarterly period ended May 2, 2009 (File No. 001-12107). Amendment No. 2 to Credit Agreement, made as of June 16, 2009, by and among Abercrombie & Fitch Management Co., as a borrower; Abercrombie & Fitch Europe SA, Abercrombie & Fitch (UK) Limited, AFH Canada Stores Co. and AFH Japan, G.K., as... -

Page 105

... Abercrombie & Fitch Management Co.; and PNC Bank, National Association (as successor by merger to National City Bank), as Global Agent, incorporated herein by reference to Exhibit 4.1 to A&F's Quarterly Report on Form 10-Q for the quarterly period ended May 1, 2010 (File No. 001-12107). Abercrombie... -

Page 106

...(File No. 001-12107). Aircraft Time Sharing Agreement, made and entered into to be effective as of November 12, 2010, by and between Abercrombie & Fitch Management Co., as Lessor, and Michael S. Jeffries, as Lessee, and consented to by NetJets Sales, Inc., NetJets Aviation, Inc. and NetJets Services... -

Page 107

...August 2, 2008 (File No. 001-12107). Abercrombie & Fitch Co. 2003 Stock Plan for Non-Associate Directors, incorporated herein by reference to Exhibit 10.9 to A&F's Quarterly Report on Form 10-Q for the quarterly period ended May 3, 2003 (File No. 001-12107). Form of Restricted Shares Award Agreement... -

Page 108

... herein by reference to Exhibit 10.22 to A&F's Quarterly Report on Form 10-Q for the quarterly period ended October 30, 2004 (File No. 001-12107). Form of Stock Unit Agreement under the Abercrombie & Fitch Co. 2003 Stock Plan for Non-Associate Directors entered into by A&F in order to evidence... -

Page 109

... rights to associates (employees) of A&F and its subsidiaries under the Abercrombie & Fitch Co. 2007 Long-Term Incentive Plan on and after February 12, 2009, incorporated herein by reference to Exhibit 10.1 to A&F's Current Report on Form 8-K dated and filed February 17, 2009 (File No. 001... -

Page 110

... 17, 2009 (File No. 001-12107). Credit Line Agreement - Borrower Agreement, effective March 6, 2009, signed on behalf of Abercrombie & Fitch Management Co., incorporated herein by reference to Exhibit 10.48 to A&F's Quarterly Report on Form 10-Q for the quarterly period ended July 31, 2010 (File No... -

Page 111

... from Abercrombie & Fitch Co.'s Annual Report on Form 10-K for the fiscal year ended January 29, 2011, formatted in XBRL (eXtensible Business Reporting Language): (i) Consolidated Statements of Operations and Comprehensive Income for the fiscal years ended January 29, 2011, January 30, 2010 and... -

Page 112

...duly authorized. ABERCROMBIE & FITCH CO. Date: March 29, 2011 By /s/ JONATHAN E. RAMSDEN Jonathan E. Ramsden, Executive Vice President and Chief Financial Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 113

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED JANUARY 29, 2011 ABERCROMBIE & FITCH CO. (Exact name of registrant as specified in its... -

Page 114

... from Abercrombie & Fitch Co.'s Annual Report on Form 10-K for the fiscal year ended January 29, 2011, formatted in XBRL (eXtensible Business Reporting Language): (i) Consolidated Statements of Operations and Comprehensive Income for the fiscal years ended January 29, 2011, January 30, 2010 and... -

Page 115

... THIS AIRCRAFT TIME SHARING AGREEMENT (this "Agreement") is made and entered into to be effective as of the 12th day of November, 2010 (the "Effective Date"), by and between Abercrombie & Fitch Management Co., a Delaware corporation having a mailing address of 6301 Fitch Path, New Albany, Ohio 43054... -

Page 116

... in such fiscal year. Section 4. Location and Use of the Aircraft. 4.1. Location of Aircraft. The Aircraft shall be principally hangared at Port Columbus International Airport, Columbus, Ohio during the Term. The Aircraft shall at all times be registered in the United States. 4.2. Use of Aircraft... -

Page 117

... FAA - Truth in Leasing. The LESSEE or his agent shall file a signed copy of this Agreement with the FAA, Aircraft Registration Branch, Attn: Technical Section, P.O. Box 25724, Oklahoma City, Oklahoma 73125, within twenty-four (24) hours after the execution of this Agreement. The LESSOR shall keep... -

Page 118

...'s rights under this Agreement with respect to any event of default shall operate to affect or impair the LESSOR's unenforced rights with respect to that event of default or any right with respect to another event of default by the LESSEE, past or future. Section 10. Risk of Loss. 10.1. Risk of... -

Page 119

... courier utilizing written proof of delivery to the attention of: LESSOR: Abercrombie & Fitch Management Co. 6301 Fitch Path New Albany, OH 43054 Attention: Chief Financial Officer Facsimile: 614.283.8961 With a copy to: Abercrombie & Fitch Co. 6301 Fitch Path New Albany, OH 43054 Attention: General... -

Page 120

... DISTRICT OFFICE. THE PARTIES HERETO CERTIFY THAT A TRUE COPY OF THIS AGREEMENT SHALL BE CARRIED ON THE AIRCRAFT AT ALL TIMES, AND THAT LESSEE SHALL HAVE A COPY OF THIS AGREEMENT ON HIS PERSON AT ALL TIMES THAT HE IS TRAVELING PURSUANT TO THIS AGREEMENT, AND SUCH COPY SHALL BE MADE AVAILABLE FOR... -

Page 121

IN WITNESS WHEREOF, the Parties have signed, or have caused their duly authorized officers or representatives to sign, this Agreement to be effective as of the Effective Date. LESSEE: /s/ MICHAEL S. JEFFRIES Michael S. Jeffries LESSOR: ABERCROMBIE & FITCH MANAGEMENT CO. By: Name: Title: /s/ DAVID S.... -

Page 122

EXHIBIT A Description of Aircraft Make and Model: Cessna 560XL (Citation Excel) Airframe Manufacturer's Serial Number: 560-5305 U.S. Registration Number: N628QS -

Page 123

....11 November 12, 2010 Michael S. Jeffries c/o The Jeffries Family Office 2 Easton Oval Columbus, OH 43219-6036 Re: Aircraft Time Sharing Agreements Dear Mike: Abercrombie & Fitch Management Co. ("LESSOR") and Michael S. Jeffries ("LESSEE"), are parties to an Aircraft Time Sharing Agreement, dated as... -

Page 124

ABERCROMBIE & FITCH MANAGEMENT CO. By: Title: /s/ DAVID S. CUPPS SVP ACKNOWLEDGEMENT AND AGREEMENT I, Michael S. Jeffries, agree to the terms of the foregoing letter of understanding. /s/ MICHAEL JEFFRIES Michael S. Jeffries -

Page 125

...Contingent Rent Coverage Ratio 2,053,302 844,359 2.43 844,359 336,384 2.51 (1) (2) Adjusted Total Debt means the sum of long-term debt, outstanding standby letters of credit and 600% of forward minimum rent commitments. Consolidated EBITDAR means, for any period, Consolidated Net Income for such... -

Page 126

... (e) 16. Gilly Hicks LLC (e) 17. Abercrombie & Fitch Europe SA (f) 18. AFH Japan GK (f) 19. Abercrombie & Fitch Hong Kong Limited (f) 20. A&F Canada Holding Co (f) 21. Abercrombie & Fitch Trading Co. (g) 22. AFH Canada Stores Co. (h) 23. Abercrombie & Fitch Italia SRL (i) 24. Abercrombie & Fitch (UK... -

Page 127

...107646, 333-107648, 333-128000 and 333-145166) of Abercrombie & Fitch Co. of our report dated March 29, 2011 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in this Form 10-K. /s/PricewaterhouseCoopers LLP Columbus, Ohio March 29... -

Page 128

EXHIBIT 24.1 POWER OF ATTORNEY The undersigned officer and director of Abercrombie & Fitch Co., a Delaware corporation, which anticipates filing an Annual Report on Form 10-K for the fiscal year ended January 29, 2011 under the provisions of the Securities Exchange Act of 1934, as amended, with the ... -

Page 129

POWER OF ATTORNEY The undersigned officer of Abercrombie & Fitch Co., a Delaware corporation, which anticipates filing an Annual Report on Form 10-K for the fiscal year ended January 29, 2011 under the provisions of the Securities Exchange Act of 1934, as amended, with the Securities and Exchange ... -

Page 130

POWER OF ATTORNEY The undersigned director of Abercrombie & Fitch Co., a Delaware corporation, which anticipates filing an Annual Report on Form 10-K for the fiscal year ended January 29, 2011 under the provisions of the Securities Exchange Act of 1934, as amended, with the Securities and Exchange ... -

Page 131

POWER OF ATTORNEY The undersigned director of Abercrombie & Fitch Co., a Delaware corporation, which anticipates filing an Annual Report on Form 10-K for the fiscal year ended January 29, 2011 under the provisions of the Securities Exchange Act of 1934, as amended, with the Securities and Exchange ... -

Page 132

POWER OF ATTORNEY The undersigned director of Abercrombie & Fitch Co., a Delaware corporation, which anticipates filing an Annual Report on Form 10-K for the fiscal year ended January 29, 2011 under the provisions of the Securities Exchange Act of 1934, as amended, with the Securities and Exchange ... -

Page 133

POWER OF ATTORNEY The undersigned director of Abercrombie & Fitch Co., a Delaware corporation, which anticipates filing an Annual Report on Form 10-K for the fiscal year ended January 29, 2011 under the provisions of the Securities Exchange Act of 1934, as amended, with the Securities and Exchange ... -

Page 134

POWER OF ATTORNEY The undersigned director of Abercrombie & Fitch Co., a Delaware corporation, which anticipates filing an Annual Report on Form 10-K for the fiscal year ended January 29, 2011 under the provisions of the Securities Exchange Act of 1934, as amended, with the Securities and Exchange ... -

Page 135

POWER OF ATTORNEY The undersigned director of Abercrombie & Fitch Co., a Delaware corporation, which anticipates filing an Annual Report on Form 10-K for the fiscal year ended January 29, 2011 under the provisions of the Securities Exchange Act of 1934, as amended, with the Securities and Exchange ... -

Page 136

POWER OF ATTORNEY The undersigned director of Abercrombie & Fitch Co., a Delaware corporation, which anticipates filing an Annual Report on Form 10-K for the fiscal year ended January 29, 2011 under the provisions of the Securities Exchange Act of 1934, as amended, with the Securities and Exchange ... -

Page 137

POWER OF ATTORNEY The undersigned director of Abercrombie & Fitch Co., a Delaware corporation, which anticipates filing an Annual Report on Form 10-K for the fiscal year ended January 29, 2011 under the provisions of the Securities Exchange Act of 1934, as amended, with the Securities and Exchange ... -

Page 138

...in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who... -

Page 139

...in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who... -

Page 140

... with the Annual Report of Abercrombie & Fitch Co. (the "Corporation") on Form 10-K for the fiscal year ended January 29, 2011, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), the undersigned Michael S. Jeffries, Chairman and Chief Executive Officer of the...