2K Sports 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

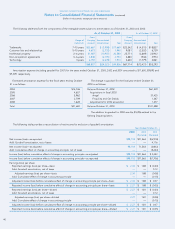

22. NET INCOME (LOSS) BEFORE CUMULATIVE EFFECT OF CHANGE IN ACCOUNTING PRINCIPLE PER SHARE

The following table provides a reconciliation of basic earnings (loss) per share to diluted earnings per share for the years ended October 31,

2003, 2002, and 2001.

Income (loss) before

cumulative effect

of change in Shares Per Share

accounting principle (in thousands) Amount

Year Ended October 31, 2003

Basic $98,118 41,965 $2.34

Effect of dilutive securities—Stock options, restricted stock and warrants — 1,332

Diluted $98,118 43,297 $2.27

Year Ended October 31, 2002 (Restated)

Basic $71,563 38,030 $1.88

Effect of dilutive securities—Stock options and warrants — 1,540

Diluted $71,563 39,570 $1.81

Year Ended October 31, 2001 (Restated)

Basic and Diluted $(1,674) 33,961 $(0.05)

The computation for the diluted number of shares excludes those unexercised stock options and warrants which are antidilutive. The number

of such shares was 1,000,000, 143,000 and 222,000 for the years ended October 31, 2003, 2002 and 2001, respectively.

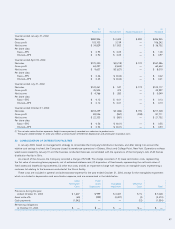

23. SUBSEQUENT EVENT

In December 2003, the Company acquired all of the outstanding capital stock and paid certain liabilities of TDK Mediactive (TDK). The pur-

chase price of approximately $14,276 consisted of $17,116 in cash and issuance of 163,641 restricted shares of the Company’s common stock

(valued at $5,160), reduced by approximately $8,000 due to TDK under a distribution agreement. The Company is in the process of completing

the purchase price allocation. TDK’s results will be included in the Company’s operating results beginning in the first quarter of fiscal 2004.

In September 2003, the Company and TDK entered into an agreement providing the Company with the exclusive North American distribu-

tion rights for certain TDK titles, including The Haunted Mansion, Star Trek: Shattered Universe and Corvette. During the three months ended

October 31, 2003, the Company recorded $9,225 of net sales related to this agreement. At October 31, 2003, the Company owed $5,945 to

TDK for purchases made under the agreement, which was included in accounts payable, and remaining guarantee payments of $3,491 under

the contract.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements (concluded)

(Dollars in thousands, except per share amounts)