2K Sports 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

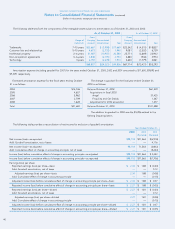

17. COMPREHENSIVE INCOME

The components of and changes in accumulated other comprehensive income (loss) are:

Foreign Currency Net Unrealized Accumulated Other

Translation Gain (Loss) on Comprehensive

Adjustments Investments Income (Loss)

Balance at November 1, 2000 $ (9,841) $(2,831) $(12,672)

Comprehensive income changes during the year, net of taxes of $1,832 (767) 2,987 2,220

Balance at October 31, 2001 (10,608) 156 (10,452)

Comprehensive income changes during the year, net of taxes of $87 5,553 (142) 5,411

Balance at October 31, 2002 (5,055) 14 (5,041)

Comprehensive income changes during the year, net of taxes of $9 4,119 (14) 4,105

Balance at October 31, 2003 $ (936) $ — $ (936)

The taxes in the above table relate to the changes in the net unrealized gain (loss) on investments. The foreign currency adjustments are not

adjusted for income taxes as they relate to indefinite investments in non-U.S. subsidiaries.

selling net appreciated assets of the Company to the extent required

to generate sufficient taxable income prior to the expiration of these

benefits. At October 31, 2003, based on management’s future plans,

this strategy was no longer viable, and accordingly a valuation

allowance has been recorded for this asset as it is more likely than not

that the deferred tax asset related to these carryforwards will not be

realized. At October 31, 2003, the Company had foreign net operat-

ing losses of $9,800 expiring between 2005 and 2010 and state net

operating losses of $41,700 expiring between 2021 and 2023. Limita-

tions on the utilization of these losses may apply, and accordingly val-

uation allowances have been recorded for these assets.

The total amount of undistributed earnings of foreign subsidiaries

was approximately $60,700 and $41,900 for the years ended October

31, 2003 and 2002, respectively. It is the Company’s intention to rein-

vest undistributed earnings of its foreign subsidiaries and thereby

indefinitely postpone their remittance. Accordingly, no provision has

been made for foreign withholding taxes or United States income tax-

es which may become payable if undistributed earnings of foreign

subsidiaries were paid as dividends to the Company.

16. STOCKHOLDERS’ EQUITY

In July 2001, the Company issued 1,300,000 shares of common

stock in a private placement to institutional investors and received

proceeds of $20,892, net of $1,400 of selling commissions and offer-

ing expenses.

In February 2001, certain stockholders of the Company exchanged

and surrendered for cancellation 564,212 shares of the Company’s

common stock (valued at $7,310) for shares of Gameplay having an

equal value.

In February 2002, the Company issued 20,000 shares of restricted

common stock to a former employee in connection with a separation

agreement.

In January 2003, the Board of Directors authorized a stock repur-

chase program under which the Company may repurchase up to

$25,000 of its common stock from time to time in the open market or

in privately negotiated transactions. The Company has not repur-

chased any shares under this program.

In November 2003, at a special meeting, the Company’s stock-

holders voted to amend the certificate of incorporation to increase

the Company’s authorized shares of common stock from 50,000,000

to 100,000,000.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements (continued)

(Dollars in thousands, except per share amounts)

44

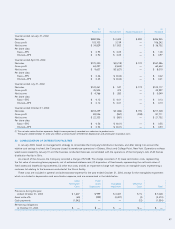

18. INCENTIVE PLANS

Incentive Stock Plan

The Incentive Stock Plan (“Incentive Plan”), adopted by the Board

of Directors on June 12, 2003, allows the granting of restricted stock,

deferred stock and other stock-based awards of the Company’s com-

mon stock to directors, officers and other employees of the Company.

A maximum of 500,000 shares are available for distribution under the

Incentive Plan. As of October 31, 2003, 285,000 shares of restricted

common stock have been granted under the Incentive Plan. The cost

of the restricted shares granted is expensed over the vesting period.

The Incentive Plan is administered by the Compensation Committee

of the Board of Directors.

Stock Option Plans

In June 2002, the stockholders of the Company approved the

Company’s 2002 Stock Option Plan, as previously adopted by the

Company’s Board of Directors (the “2002 Plan”), pursuant to which

officers, directors, employees and consultants of the Company may

receive stock options to purchase up to an aggregate of 3,000,000

shares of common stock. In April 2003, the stockholders approved an

increase in the aggregate amount of shares to 4,000,000 shares.

In January 1997, the stockholders of the Company approved the

Company’s 1997 Stock Option Plan, as amended, as previously

adopted by the Company’s Board of Directors (the “1997 Plan”), pur-

suant to which officers, directors, employees and consultants of the

Company may receive options to purchase up to an aggregate of

6,500,000 shares of the Company’s common stock.