2K Sports 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Acquisitions

During fiscal 2003, we acquired the assets of Frog City, Inc.

(“Frog City”), the developer of Tropico 2: Pirate Cove, and all of the

outstanding membership interests of Cat Daddy Games LLC (“Cat

Daddy”), another development studio. The total purchase price for

both studios consisted of $757 in cash and $319 of prepaid royalties

previously advanced to Frog City. We also agreed to make additional

payments of up to $2,500 to the former owners of Cat Daddy, based

on a percentage of Cat Daddy’s profits for the first three years after

acquisition, which will be recorded as compensation expense if the

targets are met. In connection with the acquisitions, we recorded

goodwill of $1,267 and net liabilities of $191.

In November 2002, we acquired all of the outstanding capital

stock of Angel Studios, Inc. (“Angel”), the developer of the Midnight

Club and Smuggler’s Run franchises. The purchase price consisted

of 235,679 shares of restricted common stock (valued at $6,557),

$28,512 in cash and $5,931 (net of $801 of royalties payable to

Angel) of prepaid royalties previously advanced to Angel. In connec-

tion with the acquisition, we recorded identifiable intangibles of

$4,720 (comprised of intellectual property of $2,810, technology

of $1,600 and non-competition agreements of $310), goodwill of

$37,425 and net liabilities of $1,145.

In August 2002, we acquired all of the outstanding capital stock

of Barking Dog Studios Ltd. (“Barking Dog”), a Canadian-based

development studio. The purchase price consisted of 242,450 shares

of restricted common stock (valued at $3,801), $3,000 in cash, $825

of prepaid royalties previously advanced to Barking Dog and

assumed net liabilities of $70. In connection with the acquisition,

we recorded identifiable intangibles of $2,200, comprised of non-

competition agreements of $2,000 and intellectual property of $200,

and goodwill of $6,372.

In November 2000, we acquired all of the capital stock of VLM

Entertainment Group Inc. (“VLM”), a third-party video game distribu-

tor, for $2,000 in cash and 875,000 shares of common stock (valued

at $8,039). VLM accounted for 14.5% of our distribution net sales in

fiscal 2001.

The acquisitions have been accounted for as purchase transactions

and, accordingly, the results of operations and financial position of

the acquired businesses are included in our consolidated financial

statements from the respective dates of acquisition.

In December 2003, we acquired all of the outstanding capital stock

and paid certain liabilities of TDK Mediactive, Inc. (“TDK”). The pur-

chase price of approximately $14,276 consisted of $17,116 in cash and

issuance of 163,641 restricted shares of our common stock (valued at

$5,160), reduced by approximately $8,000 due to TDK under a distri-

bution agreement. We are in the process of completing the purchase

price allocation. TDK’s results will be included in our operating results

beginning in the first quarter of fiscal 2004.

15

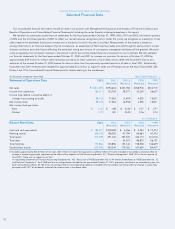

Fiscal Years Ended October 31, 2003 and 2002

Net Sales

Years ended October 31,

2003 % 2002 % $ Increase % Inc

Publishing $ 671,892 65.0 $568,492 71.5 $103,400 18.2

Distribution 361,801 35.0 226,184 28.5 135,617 60.0

Net sales $1,033,693 100.0 $794,676 100.0 $239,017 30.1

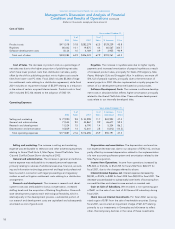

Net Sales. The increase in net sales was attributable to growth

in our publishing and distribution operations.

The increase in publishing revenues was primarily attributable to

sales of Grand Theft Auto: Vice City for PlayStation 2, which was

released in October 2002 in North America and in November 2002

internationally and reflected the growth of our publishing operations

in Europe. We expect continued growth in our publishing business in

fiscal 2004. Publishing revenues in fiscal 2003 and 2002 include

licensing revenues of $25,002 and $13,873, respectively.

Products designed for video game console platforms accounted

for 81.2% of fiscal 2003 publishing revenues as compared to 83.9%

for fiscal 2002. Products designed for PC platforms accounted for

17.2% of fiscal 2003 publishing revenues as compared to 14.3%

for fiscal 2002. We anticipate our product mix will remain relatively

constant for the foreseeable future but may fluctuate from period

to period.

Distribution revenues are derived from the sale of third-party soft-

ware titles, accessories and hardware. The increase in distribution

revenues was primarily attributable to our increasing market share for

budget titles in North American retail channels. We expect continued

growth in our distribution business in fiscal 2004, and that distribution

revenues may increase as a percentage of net sales during this period.

International operations accounted for approximately $288,753, or

27.9% of net sales for fiscal 2003 compared to $159,245, or 20.0% of

net sales for fiscal 2002. The increases were primarily attributable to

expanded publishing operations in Europe, which benefited from the

November 2002 release of Grand Theft Auto: Vice City for PlayStation

2, and significantly higher average foreign exchange rates. We expect

international sales to continue to account for a significant portion of

our revenues.