2K Sports 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

this individual for our strategic and operating decisions. The loss of

the services of this individual could have a material adverse effect on

our business and prospects. Additionally, pursuant to the terms of his

amended employment contract, our Chief Executive Officer has the

right to elect to voluntarily terminate his agreement and resign at any

time after March 30, 2004 and receive his full salary and bonus during

the eighteen-month period following such resignation. Furthermore,

we are dependent upon the expertise and skills of certain of our

Rockstar employees responsible for content creation and product

development and marketing. Although we have employment agree-

ments with each of these creative, development and marketing per-

sonnel, and we have granted them incentives in the form of an inter-

nal royalty program based on sales of Rockstar published products,

there can be no assurance that we will be able to continue to retain

these personnel at current compensation levels, or at all. Failure to

continue to attract and retain qualified management, creative, devel-

opment, financial, marketing, sales and technical personnel could

materially adversely affect our business and prospects.

Quantitative and Qualitative Disclosures About Market Risk

We are subject to market risks in the ordinary course of our busi-

ness, primarily risks associated with interest rate and foreign currency

fluctuations.

Historically, fluctuations in interest rates have not had a significant

impact on our operating results. At October 31, 2003, we had no

outstanding variable rate indebtedness.

We transact business in foreign currencies and are exposed to

risks resulting from fluctuations in foreign currency exchange rates.

Accounts relating to foreign operations are translated into United

States dollars using prevailing exchange rates at the relevant fiscal

quarter or year-end. Translation adjustments are included as a sepa-

rate component of stockholders’ equity. For the year ended October

31, 2003, our foreign currency translation adjustment gain was

$4,119. Foreign exchange transaction gain for the year ended Octo-

ber 31, 2003 was $2,015. A hypothetical 10% change in applicable

currency exchange rates at October 31, 2003 would result in a materi-

al translation adjustment.

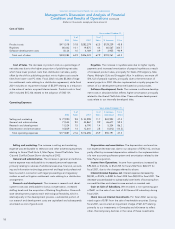

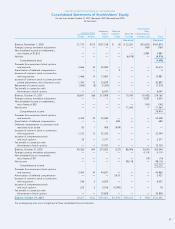

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (concluded)

(Dollars in thousands, except per share amounts)

26