2K Sports 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

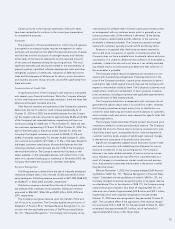

Certain of Neo’s Internet-related technology assets were deter-

mined to be impaired in April 2001. Accordingly, the Company

recorded as cost of sales an impairment charge of $3,786, consisting

of $2,350 relating to server maintenance technologies and $1,047

relating to multiplayer technologies developed by Neo’s development

studio in connection with Online Pirates and $389 of capitalized soft-

ware relating to other products to be developed by Neo. In addition,

the Company recorded as selling and marketing expenses an impair-

ment charge of $401 related to online sales promotions.

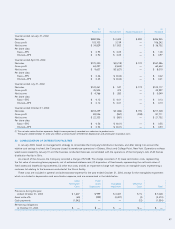

Pro forma financial information for fiscal 2003 and 2002 acquisi-

tions is not presented since the impact is not material. The unaudited

pro forma data below for the year ended October 31, 2001 is pre-

sented as if purchase acquisitions for fiscal 2001 had been made as of

November 1, 2000. The unaudited pro forma financial information is

based on management’s estimates and assumptions and does not

purport to represent the results that actually would have occurred if

the acquisitions had, in fact, been completed on the date assumed,

or which may result in the future.

Unaudited

Pro Forma

October 31, 2001

(Restated)

Net sales $459,006

Loss before cumulative effect of change in

accounting principle $ (4,458)

Net loss $ (9,702)

Net loss per share—Basic $ (0.28)

Net loss per share—Diluted $ (0.28)

Included in the unaudited pro forma information is amortization of

goodwill of approximately $7,320, net of taxes of $2,799, for the year

ended October 31, 2001.

5. DISPOSITION OF ASSETS

In July 2001, the Company sold all of the outstanding capital

stock of Jack of All Games UK, a video game distributor, to Jay Two

Limited, an unaffiliated third party controlled by Freightmasters Ltd.,

for approximately $215. In connection with the sale, the purchaser

assumed net liabilities of $436. The Company recorded a non-operat-

ing gain of $651. There were no income taxes payable on this gain.

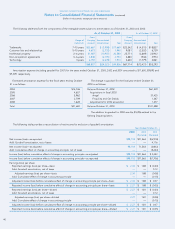

6. INTANGIBLE ASSETS AND GOODWILL

As a result of the adoption of SFAS 142, the Company discontin-

ued the amortization of goodwill effective November 1, 2001. Identifi-

able intangible assets are amortized under the straight-line method

over the period of expected benefit ranging from three to ten years,

except for intellectual property, which is amortized based on the

shorter of the useful life or expected revenue stream. The Company

re-characterized acquired workforce of $925, which is not defined as

an acquired intangible asset under SFAS 141, as goodwill. Additional-

ly, the estimated useful lives of certain identifiable intangible assets

were adjusted in conjunction with the adoption of SFAS 142. The

adjustment to the useful lives did not have a material effect on the

results of operations.

Intangible assets consist of trademarks, intellectual property, cus-

tomer lists and acquired technology. The excess purchase price paid

over identified intangible and tangible net assets of acquired compa-

nies is reported separately as goodwill.

During the year ended October 31, 2003, the Company acquired

all the intellectual property rights associated with Army Men and

School Tycoon for an aggregate cost of $1,075.

In May 2002, the Company acquired all rights, title and interest to

the Max Payne product franchise, including all of the intellectual

property rights associated with the brand, and a perpetual, royalty-

free license to use the Max Payne game engine and related technolo-

gy. The purchase price consisted of $10,000 in cash and 969,932

shares of restricted common stock (valued at $18,543). In October

2003, the Company recorded an additional intangible of $8,000, of

which $1,000 related to the delivery of the final version of Max Payne

2for the PC and $7,000 based on the determination that the sales

targets for the PC and console versions of Max Payne would be

achieved. The Max Payne assets acquired have been recorded as

intellectual property and included in intangible assets.

In December 2000, the Company acquired the exclusive world-

wide publishing rights to the franchise of Duke Nukem PC and video

games. In connection with the transaction, the Company paid $2,300

in cash and issued 557,103 shares of its common stock (valued at

approximately $5,400). In addition, the Company is required to make

a further payment of $6,000 contingent upon delivery of the final ver-

sion of Duke Nukem Forever for the PC. The Company recorded an

intangible asset of $7,700 related to the intellectual property pur-

chased in this transaction. The additional $6,000 will be recorded as

an additional intangible asset upon resolution of the contingency.

In 2003, the Company recorded a charge of $4,407 related to the

impairment of a customer list, which was included in depreciation and

amortization (see Note 20). In addition, cost of sales—product costs

include $7,892 of intellectual property and technology written off in

2003, of which $5,499 related to Duke Nukem Forever and its sequel,

reflecting the continued development delays for these products.

39