2K Sports 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

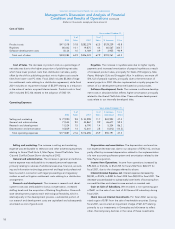

The following table summarizes our minimum contractual obligations and commercial commitments as of October 31, 2003:

Payments due by periods ended October 31,

2009 and

Contractual Obligations Total 2004 2005 to 2006 2007 to 2008 thereafter

Capital Lease Obligations $ 176 $ 103 $ 73 — —

Operating Lease Obligations 38,086 7,268 10,497 $8,289 $12,032

Letters of Credit 9,290 9,290 — — —

Publishing Arrangements 36,555 27,224 8,822 509 —

Distribution Arrangements 14,330 14,330 — — —

Total $98,437 $58,215 $19,392 $8,798 $12,032

21

Fluctuations in Operating Results and Seasonality

We have experienced fluctuations in quarterly operating results as

a result of the timing of the introduction of new titles; variations in

sales of titles developed for particular platforms; market acceptance

of our titles; development and promotional expenses relating to the

introduction of new titles, sequels or enhancements of existing titles;

projected and actual changes in platforms; the timing and success of

title introductions by our competitors; product returns; changes in

pricing policies by us and our competitors; the size and timing of

acquisitions; the timing of orders from major customers; and order

cancellations and delays in product shipment. Sales of our titles are

also seasonal, with peak shipments typically occurring in the fourth

calendar quarter (our fourth and first fiscal quarters) as a result of

increased demand for titles during the holiday season. Quarterly

comparisons of operating results are not necessarily indicative of

future operating results.

International Operations

Sales in international markets, principally in the United Kingdom

and other countries in Europe, have accounted for a significant por-

tion of our net sales. For fiscal 2003 and 2002, sales in international

markets accounted for approximately 27.9% and 20.0%, respectively,

of our net sales. We are subject to risks inherent in foreign trade,

including increased credit risks, tariffs and duties, fluctuations in for-

eign currency exchange rates, shipping delays and international politi-

cal, regulatory and economic developments, all of which can have a

significant impact on our operating results.

Cautionary Statement and Risk Factors

Safe Harbor Statement under the Securities Litigation Reform

Act of 1995: We make statements in this report that are considered

forward-looking statements under federal securities laws. Such

forward-looking statements are based on the beliefs of management

as well as assumptions made by and information currently available

to them. The words “expect,” “anticipate,” “believe,” “may,”

“estimate,” “intend” and similar expressions are intended to identi-

fy such forward-looking statements. Forward-looking statements

involve risks, uncertainties and assumptions including, but not

limited to, the following which could cause our actual results,

performance or achievements to be materially different from results,

performance or achievements, expressed or implied by such

forward-looking statements:

The market for interactive entertainment software titles is

characterized by short product life cycles. The interactive entertain-

ment software market is characterized by short product life cycles and

frequent introductions of new products. New products introduced

by us may not achieve significant market acceptance or achieve suffi-

cient sales to permit us to recover development, manufacturing and

marketing costs. Historically, few interactive entertainment software

products have achieved sustained market acceptance. Even the most

successful titles remain popular for only limited periods of time, often

less than nine months, although sales of certain products may extend

for significant periods of time, including through our election to

participate in Sony’s Greatest Hits and Microsoft’s Platinum Hits

programs.

The life cycle of a game generally involves a relatively high level

of sales during the first few months after introduction followed by a

decline in sales. Because net sales associated with the initial ship-

ments of a new product generally constitute a high percentage of the

total net sales associated with the life of a product, any delay in the

introduction of one or more new products could adversely affect our

operating results. Additionally, because we introduce a relatively limit-

ed number of new products in any period, the failure of one or more

of our products to achieve market acceptance could adversely affect

our operating results.

A significant portion of our net sales is derived from a limited

number of titles. For the year ended October 31, 2003, our ten best-

selling titles accounted for approximately 50.5% of our net sales, with

Grand Theft Auto: Vice City for PlayStation 2 accounting for 33.6% of

our net sales, Midnight Club 2 for PlayStation 2 accounting for 4.1%

of our net sales and Grand Theft Auto: Vice City for PC accounting for

2.6% of our net sales. Our ten best-selling titles accounted for approxi-

mately 59.5% of our net sales for the year ended October 31, 2002.

For this period, Grand Theft Auto 3 for PlayStation 2 accounted for

29.8% of our net sales, Grand Theft Auto: Vice City for the PlayStation

2 accounted for 7.5% of our net sales and Max Payne for PlayStation 2

accounted for 6.6% of our net sales. Our ten best-selling titles

accounted for approximately 30.8% of our net sales for the fiscal year

ended October 31, 2001. Our future titles may not be commercially

viable. If we fail to continue to develop and sell new, commercially

successful titles, our net sales and profits may decrease substantially

and we may incur losses.