2K Sports 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

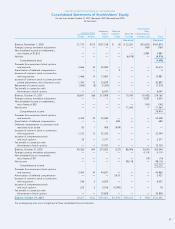

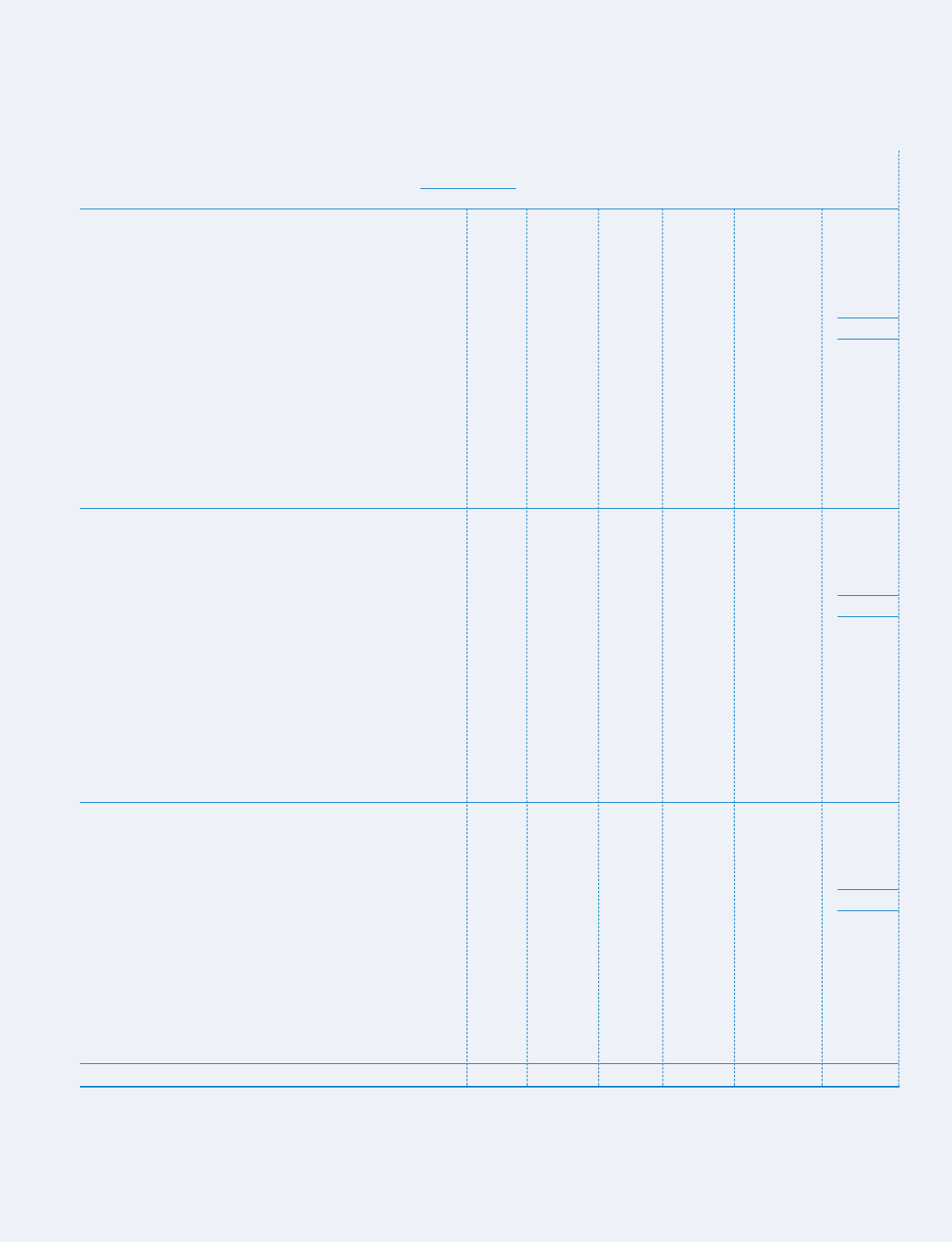

Accumulated

Additional Deferred Other

Common Stock Paid-in Compen- Retained Comprehensive

Shares Amount Capital sation Earnings Income (Loss) Total

(Restated) (Restated)

Balance, November 1, 2000 31,173 $312 $157,738 $ (5) $ 22,261 $(12,672) $167,634

Foreign currency translation adjustment — — — — — (767) (767)

Net unrealized income on investments,

net of taxes of $1,832 — — — — — 2,987 2,987

Net loss — — — — (6,918) — (6,918)

Comprehensive (loss) (4,698)

Proceeds from exercise of stock options

and warrants 3,266 32 22,582 — — — 22,614

Amortization of deferred compensation — — — 5 — — 5

Issuance of common stock in connection

with acquisitions 1,466 14 13,967 — — — 13,981

Issuance of common stock in connection with

private placements, net of issuance costs 1,300 13 20,879 — — — 20,892

Retirement of common stock (564) (5) (7,305) — — — (7,310)

Tax benefit in connection with

the exercise of stock options — — 6,047 — — — 6,047

Balance, October 31, 2001 36,641 366 213,908 — 15,343 (10,452) 219,165

Foreign currency translation adjustment — — — — — 5,553 5,553

Net unrealized income on investments,

net of taxes of $87 — — — — — (142) (142)

Net income — — — — 71,563 — 71,563

Comprehensive income 76,974

Proceeds from exercise of stock options

and warrants 2,434 25 23,283 — — — 23,308

Amortization of deferred compensation — — — 682 — — 682

Deferred compensation in connection with

restricted stock issued 50 1 908 (909) — — —

Issuance of common stock in connection

with acquisitions 1,212 12 22,332 — — — 22,344

Issuance of compensatory stock

and stock options 25 — 2,371 — — — 2,371

Tax benefit in connection with

the exercise of stock options — — 10,700 — — — 10,700

Balance, October 31, 2002 40,362 404 273,502 (227) 86,906 (5,041) 355,544

Foreign currency translation adjustment — — — — — 4,119 4,119

Net unrealized loss on investment,

net of taxes of $9 — — — — — (14) (14)

Net income — — — — 98,118 — 98,118

Comprehensive income 102,223

Proceeds from exercise of stock options

and warrants 3,404 34 44,831 — — — 44,865

Amortization of deferred compensation — — — 3,427 — — 3,427

Issuance of common stock in connection

with acquisition 236 2 6,555 — — — 6,557

Issuance of compensatory stock

and stock options 225 2 5,106 (5,090) — — 18

Tax benefit in connection with

the exercise of stock options — — 20,858 — — — 20,858

Balance, October 31, 2003 44,227 $442 $350,852 $(1,890) $185,024 $ (936) $533,492

The accompanying notes are an integral part of these consolidated financial statements.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Consolidated Statements of Stockholders’ Equity

For the Years Ended October 31, 2001 (Restated), 2002 (Restated) and 2003

(In thousands)

31