2K Sports 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In November 2002, the FASB issued Interpretation No. 45,

“Guarantor’s Accounting and Disclosure Requirements for Guarantees,

Including Indirect Guarantees of Indebtedness of Others” (“FIN 45”).

FIN 45 expands previously issued accounting guidance and disclosure

requirements for certain guarantees and requires recognition of an

initial liability for the fair value of an obligation assumed by issuing a

guarantee. The provision for initial recognition and measurement of

liability will be applied on a prospective basis to guarantees issued

or modified after December 31, 2002. The adoption of FIN 45 in the

first quarter of fiscal 2003 did not have any impact on our financial

condition or results of operations.

In January 2003, the FASB issued Interpretation No. 46, “Consoli-

dation of Variable Interest Entities” (“FIN 46”). FIN 46 requires a vari-

able interest entity to be consolidated by a company if that company

is subject to a majority of the risk of loss from the variable interest enti-

ty’s activities or is entitled to receive a majority of the entity’s residual

return or both. FIN 46 also provides criteria for determining whether

an entity is a variable interest entity subject to consolidation. FIN 46

requires immediate consolidation of variable interest entities created

after January 31, 2003. For variable interest entities created prior to

February 1, 2003, consolidation is required on July 1, 2003. The adop-

tion of FIN 46 in the third quarter of fiscal 2003 did not have a materi-

al impact on our financial condition or results of operations (see Note

4 to Consolidated Financial Statements).

In April 2003, the FASB issued SFAS No. 149, “Amendment of

Statement 133 on Derivative Instruments and Hedging Activities”

(“SFAS 149”). SFAS 149 amends and clarifies financial accounting and

reporting for derivative instruments, including certain derivative instru-

ments embedded in other contracts and for hedging activities under

SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities.” In general, SFAS 149 is effective for contracts entered into

or modified after June 30, 2003 and for hedging relationships designat-

ed after June 30, 2003. The adoption of SFAS 149 did not have any

impact on our financial condition or results of operations.

In May 2003, the FASB issued SFAS No. 150, “Accounting for

Certain Financial Instruments with Characteristics of both Liabilities

and Equity” (“SFAS 150”). SFAS 150 establishes standards for how

an issuer classifies and measures in its statement of financial position

certain financial instruments with characteristics of both liabilities

and equity. In accordance with SFAS 150, financial instruments that

embody obligations for the issuer are required to be classified as

liabilities. SFAS 150 is effective for financial instruments entered into

or modified after May 31, 2003, and otherwise shall be effective at

the beginning of the first interim period beginning after June 15,

2003, except for the provisions relating to mandatorily redeemable

financial instruments which have been deferred indefinitely. The adop-

tion of SFAS 150 did not have any impact on our financial condition.

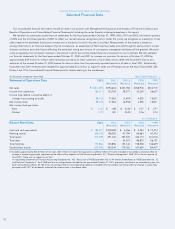

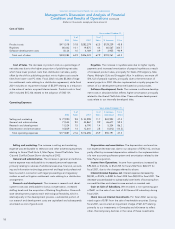

Results of Operations

The following table sets forth for the periods indicated the per-

centage of net sales represented by certain items reflected in our

statement of operations, and sets forth net sales by territory, sales

mix, platform and principal products:

Years Ended October 31,

Operating data: 2003 2002 2001

(Restated) (Restated)

Net sales 100.0% 100.0% 100.0%

Cost of sales

Product costs 52.0 51.8 62.5

Royalties 8.6 10.1 4.4

Software development costs 1.1 1.0 0.9

Total cost of sales 61.7 62.9 67.9

Selling and marketing 10.0 9.8 11.7

General and administrative 8.5 9.0 9.9

Research and development 2.4 1.5 1.4

Depreciation and amortization 1.6 1.4 2.8

Interest (income) expense, net (0.2) 0.1 1.9

Loss on Internet securities —— 4.8

Provision (benefit) for income taxes 6.5 6.2 (0.5)

Net income (loss) 9.5 9.0 (1.5)

Net Sales by Territory:

North America 72.1% 80.0% 76.4%

International 27.9 20.0 23.6

Net Sales Mix:

Publishing 65.0% 71.5% 54.1%

Distribution 35.0 28.5 45.9

Platform Mix (publishing):

Console 81.2% 83.9% 57.6%

PC 17.2 14.3 35.6

Accessories and handheld 1.6 1.8 6.8

Principal Products:

Grand Theft Auto: Vice City, PS2

(released October–

November 2002) 33.6% 7.5% — %

Grand Theft Auto: Vice City, PC

(released May 2003) 2.6 ——

Grand Theft Auto 3, PS2

(released October 2001) 2.4 29.8 7.3

Grand Theft Auto 3, PC

(released May 2002) 0.4 3.1 —

Max Payne, PS2

(released December 2001) 0.9 6.6 —

Max Payne, Xbox

(released December 2001) 0.2 3.0 —

Max Payne, PC

(released July 2001) —0.4 5.1

State of Emergency, PS2

(released February 2002) —4.4 —

Midnight Club 2, PS2

(released April 2003) 4.1 ——

Midnight Club, PS2

(released October 2000) 0.7 1.1 4.1

Smuggler’s Run, PS2

(released October 2000) —0.3 3.0

Ten largest titles 50.5% 59.5% 30.8%

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (continued)

(Dollars in thousands, except per share amounts)

14