2K Sports 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Certain amounts in the financial statements of the prior years

have been reclassified to conform to the current year presentation

for comparative purposes.

Estimates

The preparation of financial statements in conformity with general-

ly accepted accounting principles requires management to make

estimates and assumptions that affect the reported amounts of assets

and liabilities and the disclosure of contingent assets and liabilities

at the dates of the financial statements and the reported amounts

of net sales and expenses during the reporting periods. The most

significant estimates and assumptions relate to the recoverability of

prepaid royalties, capitalized software development costs and other

intangibles, valuation of inventories, realization of deferred income

taxes and the adequacy of allowances for returns, price concessions

and doubtful accounts. Actual amounts could differ significantly from

these estimates.

Concentration of Credit Risk

A significant portion of the Company’s cash balance is maintained

with several major financial institutions. While the Company attempts

to limit credit exposure with any single institution, there are times that

balances will exceed insurable amounts.

If the financial condition and operations of the Company’s customers

deteriorate, the risk of collection could increase substantially. As of

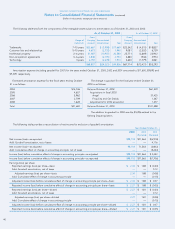

October 31, 2003 and 2002, the receivable balances from the Compa-

ny’s five largest customers amounted to approximately 54.6% and 43.6%

of the Company’s net receivable balance, respectively, with two cus-

tomers accounting for 16.6% and 11.7% at October 31, 2003 and with

two customers representing 14.1% and 10.3% at October 31, 2002. For

each of the three years in the period ended October 31, 2003, the

Company’s five largest customers accounted for 38.6%, 31.4%, and

20.8% of net sales, respectively. For the year ended October 31, 2003,

one customer accounted for $117,636, or 11.4%, of net sales. Except for

the largest customers noted above, all receivable balances from the

remaining individual customers were less than 10% of the Company’s

net receivable balance. The Company maintained insurance, to the

extent available, on the receivable balances, with certain limits, in the

event of a customer’s bankruptcy or insolvency. In November 2003, the

Company terminated this insurance on domestic receivables.

Revenue Recognition

Publishing revenue is derived from the sale of internally developed

interactive software titles or from the sale of titles licensed from third-

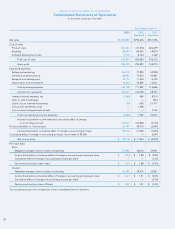

party developers. Publishing revenue amounted to $671,892, $568,492,

and $244,071 in 2003, 2002 and 2001, respectively.

Distribution revenue is derived from the sale of third-party interac-

tive software titles, hardware and accessories. Distribution revenue

amounted to $361,801, $226,184 and $207,325 in 2003, 2002 and

2001, respectively.

The Company recognizes revenue upon the transfer of title and

risk of loss to its customers. The Company applies the provisions of

Statement of Position 97-2, “Software Revenue Recognition” in con-

junction with the applicable provisions of Staff Accounting Bulletin

No. 101, “Revenue Recognition.” Accordingly, the Company recog-

nizes revenue for software when (1) there is persuasive evidence that

an arrangement with our customer exists, which is generally a cus-

tomer purchase order, (2) the software is delivered, (3) the selling

price is fixed or determinable and (4) collection of the customer

receivable is deemed probable. The Company’s payment arrange-

ments with customers typically provide net 30 and 60-day terms.

Revenue is recognized after deducting estimated reserves for

returns and price concessions. In specific circumstances when the

Company does not have a reliable basis to estimate returns and price

concessions or is unable to determine that collection of receivables is

probable, it defers the sale until such time as it can reliably estimate

any related returns and allowances and determine that collection of

the receivables is probable.

The Company accepts returns and grants price concessions in con-

nection with its publishing arrangements. Following reductions in the

price of the Company’s products, it grants price concessions to permit

customers to take credits against amounts they owe the Company with

respect to merchandise unsold by them. The Company’s customers must

satisfy certain conditions to entitle them to return products or receive

price concessions, including compliance with applicable payment terms

and confirmation of field inventory levels.

The Company’s distribution arrangements with customers do not

give them the right to return titles or to cancel firm orders. However,

the Company sometimes accepts returns from its distribution cus-

tomers for stock balancing and makes accommodations to customers,

which includes credit and returns, when demand for specific titles falls

below expectations.

The Company makes estimates of future product returns and price

concessions related to current period product revenue. The Company

estimates the amount of future returns and price concessions for pub-

lished titles based upon, among other factors, historical experience,

customer inventory levels, analysis of sell-through rates and changes

in demand and acceptance of its products by consumers.

Significant management judgments and estimates must be made

and used in connection with establishing the allowance for returns

and price concessions in any accounting period. The Company

believes it can make reliable estimates of returns and price conces-

sions. However, actual results may differ from initial estimates as a

result of changes in circumstances, market conditions and assump-

tions. Adjustments to estimates are recorded in the period in which

they become known.

Effective November 1, 2000, the Company adopted Staff Account-

ing Bulletin (“SAB”) No. 101, “Revenue Recognition in Financial State-

ments.” Consistent with the guidelines provided in SAB No. 101, the

Company changed its revenue recognition policy to recognize revenue

as noted above. Prior to the adoption of SAB 101, the Company recog-

nized revenue upon shipment. As a result of adopting SAB 101, net

sales and cost of sales of approximately $23.8 million and $15.1 million,

respectively, which were originally recognized in the year ended

October 31, 2000 were also recognized in the year ended October 31,

2001. The cumulative effect of the application of the revenue recogni-

tion policies set forth in SAB 101 for the year ended October 31, 2001,

as restated, was approximately $5.2 million, net of tax benefit of

approximately $3.5 million, or $0.15 per share.

33