2K Sports 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advertising

The Company expenses advertising costs as incurred. Advertising

expense for the years ended October 31, 2003, 2002 and 2001

amounted to $55,795, $39,909 and $22,983, respectively.

Cash and Cash Equivalents

The Company considers all highly liquid instruments purchased with

original maturities of three months or less to be cash equivalents.

Inventory

Inventories are stated at the lower of average cost or market. The

Company periodically evaluates the carrying value of its inventories

and makes adjustments as necessary. Estimated product returns are

included in the inventory balance at their cost. Estimated product

returns at October 31, 2003 and 2002 were $8,706 and $5,015,

respectively.

Prepaid Royalties

The Company’s agreements with licensors and developers gener-

ally provide it with exclusive publishing rights and require it to make

advance royalty payments that are recouped against royalties due

to the developer based on product sales. Prepaid royalties are amor-

tized as cost of sales on a title-by-title basis, based on the greater of

the proportion of current year sales to total of current and estimated

future sales for that title or the contractual royalty rate based on

actual net product sales. The Company continually evaluates the

recoverability of prepaid royalties and charges to cost of sales the

amount that management determines is probable that will not be

recouped at the contractual royalty rate in the period in which such

determination is made or if the Company determines that it will can-

cel a development project. Included in prepaid royalties at October

31, 2003 and 2002, respectively, are $14,241 and $22,561 related to

titles that have not been released yet. Prepaid royalties are classified

as current and non-current assets based upon estimated net product

sales within the next year.

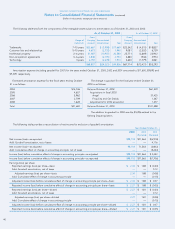

The following table provides the details of total prepaid royalties:

Years Ended October 31,

2003 2002 2001

(Restated) (Restated)

Beginning balance $ 26,418 $ 33,149 $ 24,718

Additions 30,034 28,555 25,423

Amortization (19,065) (21,238) (15,798)

Reclassification (7,251) 1,419 —

Write-down (9,525) (15,126) (1,196)

Foreign exchange 24 (341) 2

Ending balance 20,635 26,418 33,149

Less current balance 12,196 14,215 22,052

Non-current balance $ 8,439 $ 12,203 $ 11,097

The reclassification for the year ended October 31, 2003 principal-

ly reflects the transfer of prepaid royalties paid to Angel Studios, Inc.

and Frog City, Inc. prior to their acquisition by the Company as a

component of the purchase price of the acquisitions.

Capitalized Software Development Costs

The Company capitalizes internal software development costs, as

well as film production and other content costs, subsequent to estab-

lishing technological feasibility of a title. Capitalized software develop-

ment costs represent the costs associated with the internal develop-

ment of the Company’s publishing products. Amortization of such costs

as a component of cost of sales is recorded on a title-by-title basis,

based on the greater of the proportion of current year sales to total of

current and estimated future sales for the title or the straight-line

method over the remaining estimated useful life of the title. The Com-

pany continually evaluates the recoverability of capitalized software

costs and will charge to cost of sales any amounts that are deemed

unrecoverable or for projects that it will abandon.

The following table provides the details of capitalized software

development costs:

Years Ended October 31,

2003 2002 2001

Beginning balance $ 10,385 $ 9,739 $ 7,668

Additions 15,923 9,645 6,293

Amortization (10,940) (7,633) (3,780)

Reclassification —(1,419) —

Write-down (63) (490) (389)

Foreign exchange 1,031 543 (53)

Balance, October 31 $ 16,336 $10,385 $ 9,739

For the year ended October 31, 2001, capitalized software

development costs of $389 were written off as cost of sales—software

development costs, as part of the impairment charge as described in

Note 4.

Property and Equipment

Office equipment, furniture and fixtures and automobiles are

depreciated using the straight-line method over their estimated lives

ranging from five to seven years. Computer equipment and software

are depreciated using the straight-line method over three years. Lease-

hold improvements are amortized over the lesser of the term of the

related lease or estimated useful lives. Accumulated amortization

includes the amortization of assets recorded under capital leases,

which amounted to approximately $88 and $92 at October 31, 2003

and 2002, respectively. The cost of additions and betterments is capi-

talized, and repairs and maintenance costs are charged to operations

in the periods incurred. When depreciable assets are retired or sold,

the cost and related allowances for depreciation are removed from the

accounts and the gain or loss is recognized. The carrying amounts of

these assets are recorded at historical cost.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements (continued)

(Dollars in thousands, except per share amounts)

34