2K Sports 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2003, we acquired all of the outstanding capital

stock and paid certain liabilities of TDK. The purchase price of

approximately $14,276 consisted of $17,116 in cash and issuance of

163,641 restricted shares of our common stock (valued at $5,160),

reduced by approximately $8,000 due to TDK under a distribution

agreement.

Our accounts receivable, less allowances, which includes doubtful

accounts, returns, price concessions, rebates and other sales

allowances at October 31, 2003 was $166,536 as compared to

$105,576 at October 31, 2002.

The increase of $92,971 in gross accounts receivable at October

31, 2003 principally reflects increased product releases at year end as

well as cash received in advance of products shipped at the end of

fiscal 2002. Two retail customers each accounted for more than 10%

of the domestic receivable balance (28.3% in aggregate) at October

31, 2003. As of October 31, 2003, most of our receivables had been

covered by insurance, with certain limits and deductibles, in the event

of a customer’s bankruptcy or insolvency. In November 2003, we ter-

minated our domestic receivables insurance. Generally, we have been

able to collect our receivables in the ordinary course of business. We

do not hold any collateral to secure payment from customers. As a

result, we are subject to credit risks, particularly in the event that any

of the receivables represent a limited number of retailers or are con-

centrated in foreign markets. If we are unable to collect our accounts

receivable as they become due, we could be required to increase our

allowance for doubtful accounts, which could adversely affect our

liquidity and working capital position.

Our allowances increased from $30,806 at October 31, 2002 to

$62,817 at October 31, 2003 and increased as a percentage of gross

receivables from 22.6% at October 31, 2002 to 27.4% at October 31,

2003. The increase was due to additional price concessions and

returns for our published products and additional bad debts, net of

deductibles and insurance proceeds, related to the bankruptcy of two

customers, the losses from which were not entirely covered by insur-

ance. We had accounts receivable days outstanding of 54 days for the

three months ended October 31, 2003, as compared to 45 days for the

three months ended October 31, 2002. Receivable days outstanding

increased primarily as a result of increased product releases at year

end. Our receivable days outstanding fluctuate from period to period

depending on the timing of product releases.

Inventories of $101,748 at October 31, 2003 increased $27,357

from October 31, 2002, reflecting higher levels of distribution

products to support the growth of this business. Accounts payable

of $106,172 at October 31, 2003 increased $26,512 primarily due

to the increase in inventory levels.

In September 2002, we relocated our principal executive offices

to 622 Broadway, New York, New York. We have recently leased

additional space at 622 Broadway to accommodate our expanded

operations. We estimate that as of October 31, 2003 we will incur

an additional $1,200 in capital expenditures for continuing renova-

tions and leasehold improvements for this space. In connection with

signing a ten year lease, we provided a standby letter of credit of

$1,560, expiring December 31, 2003. As a result of the relocation,

we recorded expenses of $363 and $514 in fiscal 2003 and 2002,

respectively, related to lease costs with regard to our former execu-

tive offices. In addition, we expect to spend an additional $4,000 in

connection with the implementation of accounting software systems

for our international operations and the upgrade for our domestic

operations. We are considering expanding our distribution facilities

in Cincinnati, Ohio, which would require additional capital expendi-

tures for leasehold improvements and equipment. As of the date

of this report, we have no other material commitments for capital

expenditures.

Our Board of Directors authorized a stock repurchase program

under which we may repurchase up to $25,000 of our common stock

from time to time in the open market or in privately negotiated transac-

tions. We have not repurchased any shares under this program.

We have incurred and may continue to incur significant legal,

accounting and other professional fees and expenses in connection

with pending regulatory matters.

Based on our currently proposed operating plans and assump-

tions, we believe that projected cash flow from operations and avail-

able cash resources will be sufficient to satisfy our cash requirements

for the reasonably foreseeable future.

Contractual Obligations and Contingent Liabilities

and Commitments

Our offices and warehouse facilities are occupied under non-

cancelable operating leases expiring at various times from December

2003 to October 2013. We also lease certain furniture, equipment

and automobiles under non-cancelable leases expiring through

October 2007. Our future minimum rental payments for the year

ending October 31, 2004 are $7,268 and aggregate minimum rental

payments through applicable lease expirations are $37,865.

We have entered into distribution agreements under which we

purchase various software games. These agreements, which expire

between June 2004 and March 2005, require remaining aggregate

minimum guaranteed payments of $14,330 at October 31, 2003,

including $3,491 of payments due pursuant to an agreement with

TDK. These agreements are collateralized by a standby letter of credit

of $3,600 at October 31, 2003. Additionally, assuming performance

by third-party developers, we have outstanding commitments under

various software development agreements to pay developers an

aggregate of $27,224 over the fiscal year ending October 31, 2004.

In connection with our acquisition of the publishing rights to the

Duke Nukem franchise for PC and video games in December 2000,

we are obligated to pay $6,000 contingent upon delivery of the final

version of Duke Nukem Forever for the PC. In May 2003, we agreed

to pay up to $6,000 upon the achievement of certain sales targets for

Max Payne 2. We also agreed to make additional payments of up to

$2,500 to the former owners of Cat Daddy based on a percentage

Cat Daddy’s profits for the first three years after acquisition. The

payables will be recorded when the conditions requiring their

payment are met.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

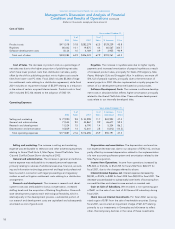

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (continued)

(Dollars in thousands, except per share amounts)

20