2K Sports 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

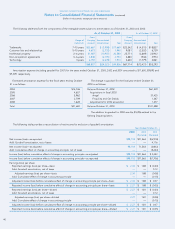

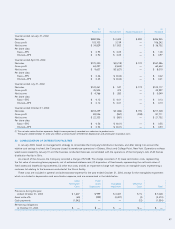

The following table provides a reconciliation of net income for exclusion of goodwill amortization:

Years Ended October 31,

2003 2002 2001

(Restated) (Restated)

Net income (loss)—as reported $98,118 $71,563 $(6,918)

Add: Goodwill amortization, net of taxes —— 4,116

Net income (loss)—as adjusted 98,118 71,563 (2,802)

Add: Cumulative effect of change in accounting principle, net of taxes —— (5,244)

Income (loss) before cumulative effect of change in accounting principle—as adjusted $98,118 $71,563 $ 2,442

Income (loss) before cumulative effect of change in accounting principle—as reported $98,118 $71,563 $(1,706)

Earnings (loss) per share:

Reported earnings (loss) per share—basic $ 2.34 $ 1.88 $ (0.20)

Add: Goodwill amortization, net of taxes —— 0.12

Adjusted earnings (loss) per share—basic 2.34 1.88 (0.08)

Add: Cumulative effect of change in accounting principle —— (0.15)

Adjusted income (loss) before cumulative effect of change in accounting principle per share—basic $ 2.34 $ 1.88 $ 0.07

Reported income (loss) before cumulative effect of change in accounting principle per share—basic $ 2.27 $ 1.88 $ (0.05)

Reported earnings (loss) per share—diluted $ 2.27 $ 1.81 $ (0.20)

Add: Goodwill amortization, net of taxes —— 0.12

Adjusted earnings (loss) per share—diluted 2.27 1.81 (0.08)

Add: Cumulative effect of change in accounting principle —— (0.15)

Adjusted income (loss) before cumulative effect of change in accounting principle per share—diluted $ 2.27 $ 1.81 $ 0.07

Reported income (loss) before cumulative effect of change in accounting principle per share—diluted $ 2.27 $ 1.81 $ (0.05)

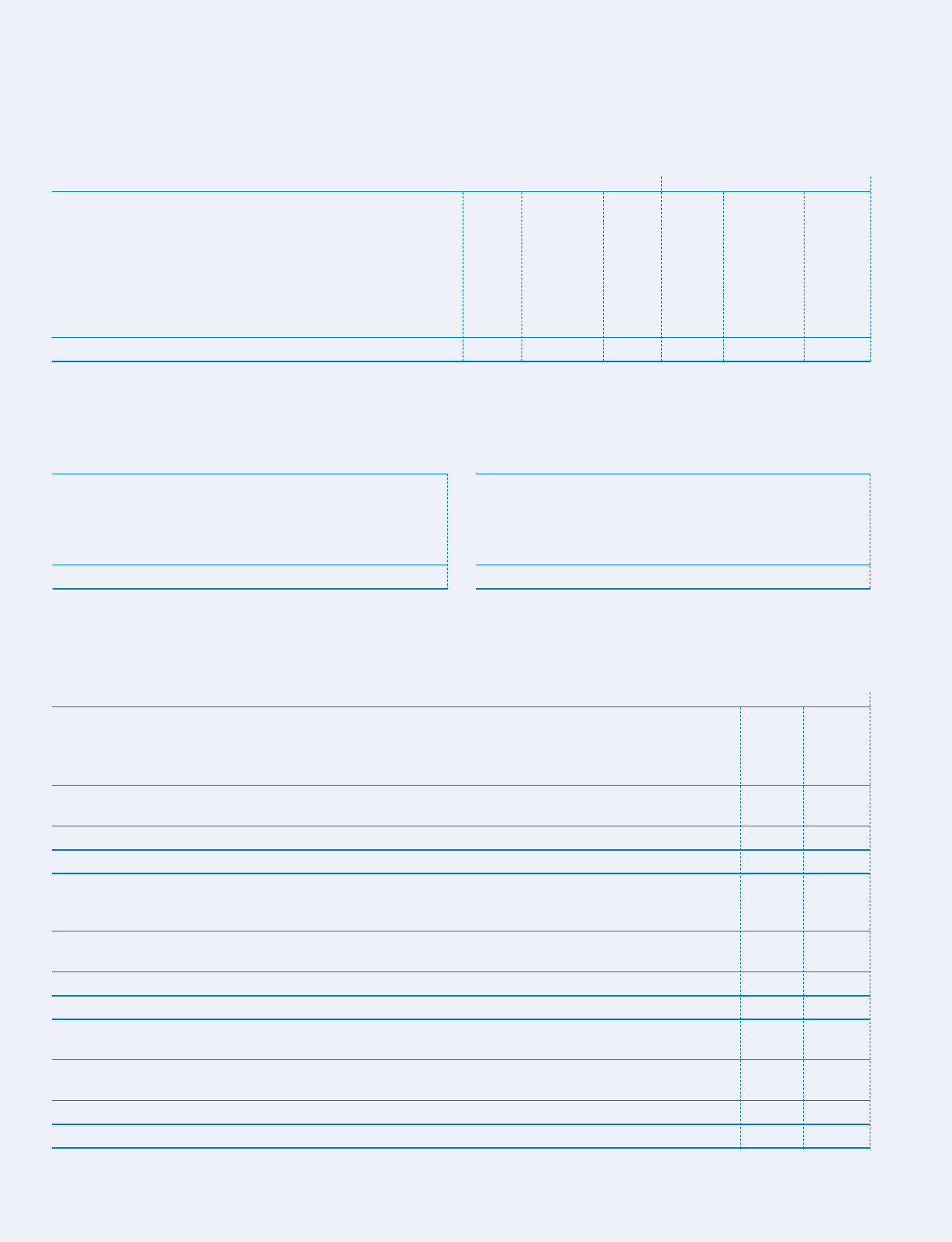

The following table sets forth the components of the intangible assets subject to amortization as of October 31, 2003 and 2002:

As of October 31, 2003 As of October 31, 2002

Gross Gross

Range of Carrying Accumulated Carrying Accumulated

Useful Life Amount Amortization Net Amount Amortization Net

Trademarks 7–10 years $23,667 $ (5,998) $17,669 $23,342 $ (4,515) $18,827

Customer lists and relationships 5–10 years 4,673 (2,733) 1,940 9,081 (2,352) 6,729

Intellectual property 2– 6 years 31,487 (10,907) 20,580 25,771 (2,869) 22,902

Non-competition agreements 3– 6 years 4,838 (2,105) 2,733 4,880 (906) 3,974

Technology 3 years 4,192 (2,278) 1,914 4,640 (1,779) 2,861

$68,857 $(24,021) $44,836 $67,714 $(12,421) $55,293

Amortization expense (including goodwill for 2001) for the years ended October 31, 2003, 2002 and 2001 amounted to $11,600, $9,893 and

$9,309, respectively.

Estimated amortization expense for the fiscal years ending October

31 is as follows:

2004 $16,726

2005 4,657

2006 5,962

2007 2,709

2008 1,628

Total $31,682

The change in goodwill for the fiscal year ended October 31,

2003 is as follows:

Balance October 31, 2002 $61,529

Acquisitions in fiscal 2003

Angel 37,425

Frog City and Cat Daddy 1,267

Adjustments for 2002 acquisition 1,277

Balance October 31, 2003 $101,498

The addition to goodwill in 2002 was the $5,496 related to the

Barking Dog acquisition.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements (continued)

(Dollars in thousands, except per share amounts)

40