2K Sports 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

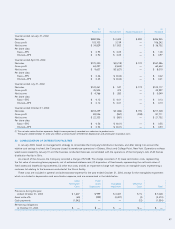

12. LOSS ON EARLY EXTINGUISHMENT OF DEBT

In July 2000, the Company entered into a subordinated loan

agreement with Finova Mezzanine Capital Inc. in the principal amount

of $15 million. The loan was payable in full in July 2005, and bore

interest at the rate of 12.5% per annum. In July 2001, the Company

prepaid the outstanding subordinated loan and recorded a loss of

$3,165 related to the deferred financing costs and the unamortized

discount associated with the loan.

13. COMMITMENTS AND CONTINGENCIES

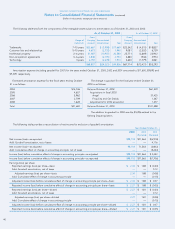

Capital Leases

The Company leases equipment under capital lease agreements,

which extend through fiscal year 2006. Future minimum lease pay-

ments under these capital leases, and the present value of such

payments as of October 31, 2003 are as follows:

Year ending October 31:

2004 $117

2005 74

2006 1

Total minimum lease payments 192

Less: amounts representing interest (16)

Present value of minimum obligations under capital leases $176

Lease Commitments

The Company leases 33 office and warehouse facilities. The

former corporate headquarters are leased under a non-cancelable

operating lease with a company controlled by the father of the

chairman of the board and expires in March 2004. Rent expense and

certain utility expenses under this lease amounted to $444, $403 and

$474, for the years ended October 31, 2003, 2002, and 2001, respec-

tively. The other offices are under non-cancelable operating leases

expiring at various times from December 2003 to October 2013. In

addition, the Company has leased certain equipment, furniture and

auto lease under non-cancelable operating leases which expire

through October 2007.

In September 2002, the Company relocated its principal executive

offices to 622 Broadway, New York, New York. The Company has

recently leased additional space at 622 Broadway to accommodate its

expanded operations. The Company estimates that as of October 31,

2003 it will incur an additional $1,200 in capital expenditures for con-

tinuing renovations and leasehold improvements for this space. In

connection with signing a ten year lease, the Company provided a

standby letter of credit of $1,560, expiring December 31, 2003. As a

result of the relocation, the Company recorded expenses of $363 and

$514 in fiscal 2003 and 2002, respectively, related to lease costs with

regard to the Company’s former executive offices.

Future minimum rentals required as of October 31, 2003 are as

follows:

Year ending October 31:

2004 $ 7,268

2005 5,657

2006 4,840

2007 4,221

2008 4,068

Thereafter 12,032

Total minimum lease payments 38,086

Less minimum rentals to be received under subleases (221)

$37,865

Rent expense amounted to $7,445, $5,090 and $3,353, for the

years ended October 31, 2003, 2002, and 2001, respectively.

Legal and Other Proceedings

The Company received a Wells Notice from the Staff of the

Securities and Exchange Commission stating the Staff’s intention to

recommend that the SEC bring a civil action seeking an injunction

and monetary damages against the Company alleging that it violated

certain provisions of the federal securities laws. The proposed

allegations stem from the previously disclosed SEC investigation into

certain accounting matters related to the Company’s financial state-

ments, periodic reporting and internal accounting controls. The

Company’s Chairman, an employee and two former officers also

received Wells Notices. The Company has entered into discussions

with the Staff to address the issues raised in the Wells Notice. The

SEC’s Staff also raised issues with respect to the Company’s revenue

recognition policies and its impact on its current and historical finan-

cial statements. The Company is unable to predict the outcome of

these matters.

The Company is involved in routine litigation in the ordinary

course of its business, which in management’s opinion will not have

a material adverse effect on the Company’s financial condition, cash

flows or results of operations.

Other

The Company periodically enters into distribution agreements to

purchase various software games that require the Company to make

minimum guaranteed payments. These agreements, which expire

between June 2, 2004 and March 22, 2005, require remaining aggre-

gate minimum guaranteed payments of $14,330 at October 31, 2003,

including $3,491 of payments due pursuant to an agreement with

TDK Mediactive, Inc. (“TDK”). These agreements are collateralized by

a standby letter of credit of $3,600 at October 31, 2003. Additionally,

assuming performance by third-party developers, the Company has

outstanding commitments under various software development

agreements to pay developers an aggregate of $27,224 during fiscal

2004. The Company also expects to spend an additional $4,000 in

connection with the implementation of accounting software systems

for its international operations and the upgrade for its domestic

operations.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements (continued)

(Dollars in thousands, except per share amounts)

42