2K Sports 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Intangible Assets

Intangible assets consist of identifiable intangibles and the remain-

ing excess purchase price paid over identified intangible and tangible

net assets of acquired companies (goodwill). Effective November 1,

2001, the Company adopted the provisions of Statement of Financial

Accounting Standards No. 141, “Business Combinations” (“SFAS

141”) in its entirety and Statement of Financial Accounting Standards

No. 142, “Goodwill and Other Intangible Assets” (“SFAS 142”). SFAS

141 requires all business combinations be accounted for using the

purchase method of accounting and that certain intangible assets

acquired in a business combination shall be recognized as assets

apart from goodwill. SFAS 142 addresses the recognition and meas-

urement of goodwill and other intangible assets subsequent to their

acquisition. SFAS 142 provides that intangible assets with finite useful

lives be amortized and that intangible assets with indefinite lives and

goodwill not be amortized. The Company discontinued the amortiza-

tion of goodwill as of November 1, 2001. Identifiable intangibles are

amortized under the straight-line method over the period of expected

benefit ranging from three to ten years, except for intellectual proper-

ty, which is amortized based on the shorter of the useful life or

expected revenue stream. Prior to November 1, 2001, intangible

assets were amortized under the straight-line method over the period

of expected benefit of seven years for the acquisition of development

studios and ten years for the acquisition of distribution operations.

Upon completion of the transitional impairment test, the fair value for

each of our reporting units exceeded the reporting unit’s carrying

amount and no impairment was indicated.

SFAS 142 requires an annual test for impairment of goodwill, and

between annual tests if events occur or circumstances change that

would more likely than not reduce the fair value of a reporting unit

below its carrying amount. In assessing potential impairment of good-

will, the Company determines the implied fair value of each reporting

unit using discounted cash flow analysis and compares such values to

the respective reporting unit’s carrying amount. The Company per-

forms its annual test for indication of goodwill impairment in the

fourth quarter of each fiscal year. At October 31, 2003 and 2002, the

fair value of the Company’s reporting units exceeded the carrying

amounts and no impairment was indicated.

Impairment of Long-Lived Assets

The Company accounts for long-lived assets in accordance with

the provisions of Statement of Financial Accounting Standards No.

144, “Accounting for the Impairment or Disposal of Long-Lived

Assets” (“SFAS 144”), which was adopted in the first quarter of fiscal

2003 with no material effect on the Company’s financial condition and

results of operations. SFAS 144 requires that long-lived assets be

reviewed for impairment whenever events or changes in circum-

stances indicate that the carrying amount of an asset may not be

recoverable, including assets to be disposed of by sale, whether pre-

viously held and used or newly acquired. The Company compares the

carrying amount of the asset to the estimated undiscounted future

cash flows expected to result from the use of the asset. If the carrying

amount of the asset exceeds estimated expected undiscounted future

cash flows, the Company records an impairment charge for the differ-

ence between the carrying amount of the asset and its fair value. The

estimation of fair value is generally measured by discounting expect-

ed future cash flows at the Company’s incremental borrowing rate or

fair value if available.

Stock-Based Compensation

The Company accounts for its employee stock option plans in

accordance with Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees” (“APB 25”). Under APB

25, generally no compensation expense is recorded when the terms

of the award are fixed and the exercise price of the employee stock

option equals or exceeds the fair value of the underlying stock on the

date of grant. The Company adopted the disclosure-only provisions

of Statement of Financial Accounting Standards No. 123, “Accounting

for Stock-Based Compensation” (“SFAS 123”).

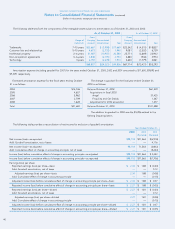

Had compensation cost for the Company’s stock option plans

been determined based on the fair value at the grant date for awards

consistent with the provisions of SFAS 123, the Company’s net

income and the net income per share would have been reduced to

the pro forma amounts indicated below.

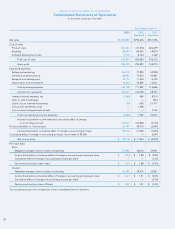

Years ended October 31,

2003 2002 2001

(Restated) (Restated)

Net income (loss), as reported $ 98,118 $ 71,563 $ (6,918)

Add: Stock-based employee

compensation expense included

in reported net income, net of

related tax effects 2,133 1,878 3

Deduct: Total stock-based

employee compensation

expense determined under fair

value based method for all

awards, net of related tax effects (18,194) (16,415) (11,713)

Pro forma net income (loss) $ 82,057 $ 57,026 $(18,628)

Earnings (loss) per share:

Basic—as reported $ 2.34 $ 1.88 $ (0.20)

Basic—pro forma $ 1.96 $ 1.50 $ (0.55)

Diluted—as reported $ 2.27 $ 1.81 $ (0.20)

Diluted—pro forma $ 1.90 $ 1.44 $ (0.55)

The pro forma disclosures shown are not representative of the

effects on net income and the net income per share in future periods.

Pro forma net income (loss) and net income (loss) per share for the

years ended October 31, 2002 and 2001 also differ from amounts

previously reported as a result of adjustments made to correct com-

putational errors.

The fair value of the Company’s stock options used to compute

pro forma net income and the net income per share disclosures is the

estimated present value at the grant date using the Black-Scholes

option-pricing model. The weighted average fair values of options

granted were $15.05, $9.13 and $5.76 for the years ended October

31, 2003, 2002 and 2001, respectively. The following weighted aver-

age assumptions for 2003 were used to value grants: expected

volatility of 78%; a risk-free interest rate of 2.60%; and an expected

35