2K Sports 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

holding period of 4.2 years. The following weighted average assump-

tions for 2002 were used to value grants: expected volatility of 74%; a

risk-free interest rate of 1.77%; and an expected holding period of 4.1

years. The following weighted average assumptions for 2001 were

used to value grants: expected volatility of 85% for grants with a

holding period of 2 years, 79% for a holding period of 3 years and

75% for holding periods of 4 to 5 years; a risk-free interest rate of

generally 4.85% to 5.0%; and an expected holding period of two to

five years. Dividends were assumed to be zero for the years ended

October 31, 2003, 2002 and 2001.

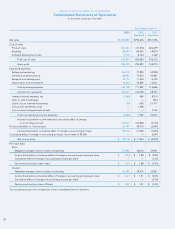

Net Income (Loss) per Share

Basic earnings per share (“EPS”) is computed by dividing the net

income (loss) applicable to common stockholders for the year by the

weighted-average number of common shares outstanding during the

year. Diluted EPS is computed by dividing the net income (loss) appli-

cable to common stockholders for the year by the weighted-average

number of common and common stock equivalents, which include

common shares issuable upon the exercise of stock options, restricted

stock (for fiscal 2003) and warrants outstanding during the year.

Common stock equivalents are excluded from the computation if

their effect is antidilutive.

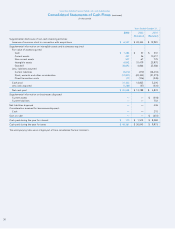

Comprehensive Income (Loss)

Comprehensive income (loss) includes net income adjusted for the

change in foreign currency translation adjustments and the change in

net unrealized gain (loss) from investments.

Income Taxes

The Company recognizes deferred taxes under the asset and lia-

bility method of accounting for income taxes. Under the asset and

liability method, deferred income taxes are recognized for differences

between the financial statement and tax bases of assets and liabilities

at currently enacted statutory tax rates for the years in which the

differences are expected to reverse. The effect on deferred taxes of

a change in tax rates is recognized in income in the period that

includes the enactment date. Valuation allowances are established

when necessary to reduce deferred tax assets to the amounts expect-

ed to be realized after considering tax planning strategies, if applica-

ble. No income taxes have been provided on the undistributed

earnings of foreign subsidiaries, as such earnings are expected to

be permanently reinvested in those companies.

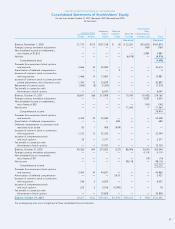

Foreign Currency Translation

The functional currency for the Company’s foreign operations is

the applicable local currency. Accounts of foreign operations are

translated into U.S. dollars using quarter or year-end exchange rates

for assets and liabilities at the balance sheet date and average pre-

vailing exchange rates for the period for revenue and expense

accounts. Adjustments resulting from translation are included in other

comprehensive income (loss). Realized and unrealized transaction

gains and losses are included in income in the period in which they

occur. Foreign exchange transaction gains (loss) included in net

income for fiscal years ended October 31, 2003, 2002 and 2001

amounted to $2,015, $840 and $(108), respectively.

Fair Value of Financial Instruments

The carrying amounts of the Company’s financial instruments,

including cash and cash equivalents, accounts receivable, accounts

payable and accrued liabilities, approximates fair value because of

their short maturities. Investments are reported at fair value. The

carrying amount of prepaid royalties approximates fair value based

upon the recoverability of these assets. The carrying amount of the

Company’s lines of credit approximates fair value because the interest

rates of the lines of credit are based on floating rates identified by

reference to market rates. The carrying amounts of the Company’s

loan payable and capital lease obligations approximate the fair value

of such instruments based upon management’s best estimate of inter-

est rates that would be available to the Company for similar debt

obligations.

Consideration Given to Customers or Resellers

In November 2001, the Financial Accounting Standards Board

(“FASB”) Emerging Issues Task Force (EITF) reached a consensus on

EITF Issue 01-09, “Accounting for Consideration Given by a Vendor

to a Customer or Reseller of the Vendor’s Products,” which is a codifi-

cation of EITF 00-14, 00-22 and 00-25. This EITF presumes considera-

tion from a vendor to a customer or reseller of the vendor’s products

to be a reduction of the selling prices of the vendor’s products and,

therefore, should be characterized as a reduction of revenue when

recognized in the vendor’s income statement and could lead to nega-

tive revenue under certain circumstances. Revenue reduction is

required unless consideration relates to a separate identifiable benefit

and the benefit’s fair value can be established. The Company has

early adopted EITF 01-09 effective November 1, 2001. The adoption

of the new standard did not have a material impact on the consolidat-

ed financial statements. The prior period financial statements have

been reclassified in accordance with this statement and as a result,

net sales and selling and marketing expenses have been reduced by

$2,255 for the year ended October 31, 2001, with no impact on

reported net loss.

Recently Adopted Accounting Pronouncements

In August 2001, the Financial Accounting Standards Board

(“FASB”) issued Statement of Financial Accounting Standards No.

143, “Accounting for Obligations Associated with the Retirement of

Long-Lived Assets” (“SFAS 143”). The objective of SFAS 143 is to

provide accounting guidance for legal obligations associated with the

retirement of long-lived assets. The provisions of SFAS 143 are effec-

tive for financial statements issued for fiscal years beginning after

June 15, 2002. The adoption of SFAS 143 in the first quarter of fiscal

2003 did not have an impact on the Company’s financial condition,

cash flows and results of operations.

In April 2002, the FASB issued Statement of Financial Accounting

Standards No. 145, “Rescission of FASB Statements No. 4, 44 and 64,

Amendment to FASB Statement No. 13, and Technical Corrections”

(“SFAS 145”). SFAS 145 eliminates the requirement (in SFAS 4) that

gains and losses from the extinguishments of debt be aggregated

and classified as extraordinary items, net of the related income tax.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements (continued)

(Dollars in thousands, except per share amounts)

36