2K Sports 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

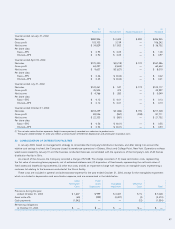

Additionally, in connection with the Company’s acquisition of the

publishing rights to the franchise of Duke Nukem PC and video

games in December 2000, the Company is contingently obligated to

pay $6,000 in cash upon delivery of the final version of Duke Nukem

Forever for the PC. In May 2003, the Company agreed to make pay-

ments of up to $6,000 in cash upon the achievement of certain sales

targets for Max Payne 2. The Company also agreed to make addition-

al payments of up to $2,500 to the former owners of Cat Daddy

based on a percentage of Cat Daddy’s future profits for the first three

years after acquisition. See Note 4. The payables will be recorded

when the conditions requiring their payment are met.

14. EMPLOYEE SAVINGS PLAN

The Company maintains a 401(k) retirement savings plan and trust

(the “401(k) Plan”). The 401(k) Plan is offered to all eligible employees

and participants may make voluntary contributions. The Company did

not match employee contributions during the year ended October

31, 2001. The Company began matching contributions in July 2002.

The matching contribution expense incurred by the Company during

the years ended October 31, 2003 and 2002 was $384 and $95,

respectively.

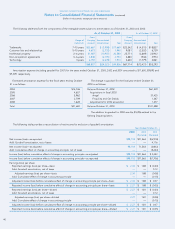

15. INCOME TAXES

The Company is subject to foreign income taxes in certain coun-

tries where it does business. Domestic and foreign income (loss)

before income taxes and cumulative effect of change in accounting

principle is as follows:

Years Ended October 31,

2003 2002 2001

(Restated) (Restated)

Domestic $134,746 $115,142 $(29,594)

Foreign 30,569 5,796 25,470

Total $165,315 $120,938 $ (4,124)

Income tax expense (benefit) is as follows:

Years Ended October 31,

2003 2002 2001

(Restated) (Restated)

Current:

Federal $33,167 $35,275 $ —

State and local 6,287 4,381 500

Foreign 14,703 2,993 5,450

Deferred 13,040 6,726 (8,400)

Total $67,197 $49,375 $(2,450)

The differences between the provision for income taxes and the

income tax computed using the U.S. statutory federal income tax rate

to pretax income are as follows:

Years ended October 31,

2003 2002 2001

(Restated) (Restated)

Statutory federal tax

expense (benefit) $57,860 $42,324 $(1,442)

Changes in expenses resulting from:

State taxes, net of federal benefit 4,035 2,995 (1,729)

Foreign tax expense differential 2,191 568 (3,355)

Goodwill and intangible

amortization 363 513 1,656

Other permanent items 1,482 1,874 123

Foreign income exclusion (9,163) ——

Valuation allowances 10,429 1,101 968

Impairment of intangibles —— 1,329

Income tax expense (benefit) $67,197 $49,375 $(2,450)

The components of the net deferred tax asset as of October 31,

2003 and 2002 consist of the following:

2003 2002

(Restated)

Current:

Deferred tax assets:

Sales and related allowances $ 8,173 $ 5,861

Depreciation and amortization 160 384

Total current deferred tax assets 8,333 6,245

Non-current deferred tax assets:

Foreign net operating losses 3,240 2,016

State net operating losses 3,311 2,069

Capital loss carryforward 7,963 7,983

14,514 12,068

Less: Valuation allowances (14,514) (4,085)

Total non-current deferred tax assets —7,983

Non-current deferred tax liability:

Capitalized software (8,486) (3,885)

Net deferred tax (liability) asset $ (153) $10,343

At October 31, 2003 and October 31, 2002, the Company had

capital loss carryforwards totaling approximately $21,000. The capital

loss carryforwards will expire in the periods fiscal 2006 through fiscal

2008. Failure to achieve sufficient levels of taxable income from capi-

tal transactions will affect the ultimate realization of the capital loss

carryforwards. At October 31, 2002 management had a strategy of

43