2K Sports 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

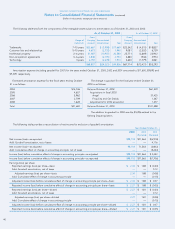

As As

Reported Restatement Reclassifications(1) Restated

Quarter ended January 31, 2002:

Net sales $282,926 $ 3,425 $ 594 $286,945

Gross profit 103,103 3,139 — 106,242

Net income $ 34,829 $ 1,923 — $ 36,752

Per share data:

Basic—EPS $ 0.95 $ 0.05 — $ 1.00

Diluted—EPS $ 0.92 $ 0.05 — $ 0.97

Quarter ended April 30, 2002:

Net sales $170,330 $(3,218) $ 174 $167,286

Gross profit 63,297 (2,655) — 60,642

Net income $ 9,637 $(1,627) — $ 8,010

Per share data:

Basic—EPS $ 0.26 $ (0.04) — $ 0.22

Diluted—EPS $ 0.25 $ (0.04) — $ 0.21

Quarter ended July 31, 2002:

Net sales $122,461 $ 537 $ 119 $123,117

Gross profit 45,524 473 — 45,997

Net income $ 4,766 $ 283 — $ 5,049

Per share data:

Basic—EPS $ 0.12 $ 0.01 — $ 0.13

Diluted—EPS $ 0.12 $ 0.01 — $ 0.13

Quarter ended October 31, 2002:

Net sales $218,259 $(1,086) $ 155 $217,328

Gross profit 83,036 (967) (358) 81,711

Net income $ 22,333 $ (581) — $ 21,752

Per share data:

Basic—EPS $ 0.56 $ (0.01) — $ 0.55

Diluted—EPS $ 0.54 $ (0.01) — $ 0.53

(1) The net sales reclassification represents freight income previously recorded as a reduction to product costs.

The quarter ended October 31, 2002 also reflects a reclassification of $358 from depreciation and amortization to product costs.

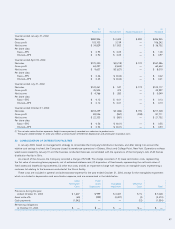

20. CONSOLIDATION OF DISTRIBUTION FACILITIES

In January 2003, based on management’s strategy to consolidate the Company’s distribution business, and after taking into account the

relative cost savings involved, the Company closed its warehouse operations in Ottawa, Illinois and College Point, New York. Operations at these

warehouses ceased by January 31 and the business conducted there was consolidated with the operations of the Company’s Jack of All Games

distribution facility in Ohio.

As a result of the closures, the Company recorded a charge of $7,028. The charge consisted of: (1) lease termination costs, representing

the fair value of remaining lease payments, net of estimated sublease rent; (2) disposition of fixed assets, representing the net book value of

fixed assets and leasehold improvements; (3) other exit costs; and (4) an impairment charge with respect to an intangible asset, representing a

customer list relating to the business conducted at the Illinois facility.

These costs are included in general and administrative expense for the year ended October 31, 2003, except for the intangibles impairment

which is included in depreciation and amortization expense, and are summarized in the table below:

Lease Fixed

Termination Asset Intangibles Other Exit

Costs Dispositions Impairment Costs Total

Provisions during the year

ended October 31, 2003 $ 1,607 $ 999 $ 4,407 $ 15 $ 7,028

Asset write-offs (65) (999) (4,407) (3) (5,474)

Cash payments (1,542) — — (12) (1,554)

Remaining obligations

at October 31, 2003 $ — $— $ — $ — $ —