2K Sports 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

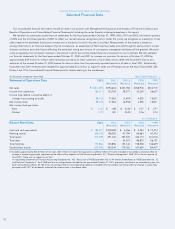

Operating Expenses

Years ended October 31,

% of % of $ Increase % Inc

2002 Sales 2001 Sales (Decrease) (Dec)

Selling and marketing $ 77,990 9.8 $ 52,998 11.7 $24,992 47.2

General and administrative 71,544 9.0 44,867 9.9 26,677 59.5

Research and development 11,524 1.5 6,190 1.4 5,334 86.2

Depreciation and amortization 10,829 1.4 12,641 2.8 (1,812) (14.3)

Total operating expenses $171,887 21.6 $116,696 25.9 $55,191 47.3

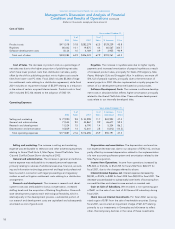

Cost of Sales

Years ended October 31,

% of % of

2002 Sales 2001 Sales % Increase % Inc

Product costs $411,518 51.8 $282,279 62.5 $129,239 45.8

Royalties 80,442 10.1 19,875 4.4 60,567 304.7

Software development costs 8,124 1.0 4,169 0.9 3,955 94.9

Total cost of sales $500,084 62.9 $306,323 67.9 $193,761 63.3

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (continued)

(Dollars in thousands, except per share amounts)

18

Selling and marketing. The increase in selling and marketing

expense was attributable to television and other advertising expenses

relating to Grand Theft Auto 3, Max Payne, Grand Theft Auto: Vice

City and Conflict Desert Storm during fiscal 2002.

General and administrative. The increase in general and adminis-

trative expense was attributable to increased personnel expenses

primarily relating to salaries of additional executive, financial, account-

ing and information technology personnel and legal and professional

fees incurred in connection with legal proceedings and regulatory

matters as well as litigation settlement costs relating to a distribution

arrangement.

Research and development. The increase in research and devel-

opment costs was attributable to bonus compensation, increased

staffing levels and the acquisition of Barking Dog Studios. Once soft-

ware development projects reach technological feasibility, which is

relatively early in the development process, a substantial portion of

our research and development costs are capitalized and subsequently

amortized as cost of goods sold.

Depreciation and amortization. The depreciation and amortiza-

tion expense decrease was due to our adoption of SFAS 142, and was

partly offset by increased depreciation related to the implementation

of a new accounting software system and amortization related to the

Max Payne acquisition.

Income from Operations. Income from operations increased by

$94,328, or 332.4%, to $122,705 for fiscal 2002 from $28,377 for

fiscal 2001, due to the changes referred to above.

Interest (Income) Expense, net. Interest expense decreased by

$8,030, or 94.4%, to $480 for fiscal 2002 from $8,510 for fiscal 2001. The

decrease was attributable to substantially lower levels of borrowing from

our credit facilities and interest income earned on invested cash.

Gain on Sale of Subsidiary. We recorded a non-operating gain

of $651 on the sale of our Jack of All Games UK subsidiary during

fiscal 2001.

(Gain) Loss on Internet Investments. For fiscal 2002, we recog-

nized a gain of $181 from the sale of marketable securities. During

fiscal 2001, we incurred an impairment charge of $21,477 relating

primarily to our investments in Gameplay and eUniverse to reflect

other- than-temporary declines in the value of these investments.

Cost of Sales. The decrease in product costs as a percentage of

net sales was due to the higher proportion of publishing net sales

which have lower product costs than distribution net sales, partly

offset by the shift in publishing product mix to higher cost console

titles from lower- cost PC titles. Fiscal 2002 includes $3,064 of litiga-

tion settlement costs relating to a distribution agreement, while fiscal

2001 includes an impairment charge of $3,397 relating to a reduction

in the value of certain acquired Internet assets. Product costs in fiscal

2001 included $15,106 related to the adoption of SAB 101.

Royalties. The increase in royalties were due to higher royalty

payments and increased amortization of prepaid royalties as a result

of increased product sales, principally for State of Emergency, Max

Payne, Midnight Club and Smuggler’s Run. In addition, we wrote off

$14,122 of prepaid royalties, principally due to the termination of

several projects in 2002. We also implemented a royalty program for

certain of our development personnel based on product sales.

Software Development Costs. The increase in software develop-

ment costs in absolute dollars reflects higher amortization principally

related to the Grand Theft Auto titles. These software development

costs relate to our internally developed titles.