2K Sports 2003 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

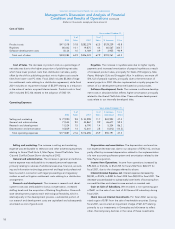

Our consolidated financial information should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and

Results of Operations and Consolidated Financial Statements (including the notes thereto) contained elsewhere in this report.

We restated our previously issued financial statements for the fiscal years ended October 31, 1999, 2000, 2001 and 2002, the interim quarters

of 2002 and the first three quarters of 2003 to reflect our revised revenue recognition policy. Under this policy, we recognize as a reduction of net

sales a reserve for estimated future price concessions in the period in which the sale is recorded. Measurement of the reserve is based on,

among other factors, an historical analysis of price concessions, an assessment of field inventory levels and sell-through for each product, current

industry conditions and other factors affecting the estimated timing and amount of concessions management believes will be granted. We previ-

ously recognized price concession reserves in the period in which we communicated the price concessions to our customers. We also restated

our financial statements for the fiscal years ended October 31, 2000 and 2001 to increase our provision for returns at October 31, 2000 by

approximately $4.9 million for certain sales transactions primarily to retail customers in fiscal 2000, and to reflect the fiscal 2001 returns as a

reduction of the revised October 31, 2000 reserve for returns rather than the previously reported reduction of sales in fiscal 2001. Additionally,

fiscal 2000 and 2001 revenues were restated for approximately $0.2 million to adjust for sales cut-off transactions at the end of fiscal 2000. See

Notes 2 and 19 to Consolidated Financial Statements for details relating to the restatement.

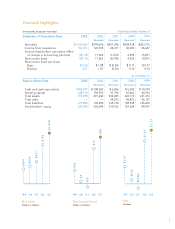

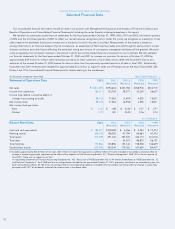

(In thousands, except per share data) Years Ended October 31

Statement of Operations Data: 2003 2002 2001(1) 2000 1999

(Restated) (Restated) (Restated) (Restated)

Net sales $1,033,693 $794,676 $451,396 $358,918 $303,715

Income from operations 163,011 122,705 28,377 30,250 26,627

Income (loss) before cumulative effect of

change in accounting principle 98,118 71,563 (1,674) 4,555 15,871

Net income (loss) 98,118 71,563 (6,918) 4,555 15,871

Net income (loss) per share

Basic $ 2.34 $ 1.88 $ (0.20) $ 0.17 $ 0.77

Diluted 2.27 1.81 (0.20) 0.16 0.74

As of October 31

Balance Sheet Data: 2003 2002 2001 2000 1999

(Restated) (Restated) (Restated) (Restated)

Cash and cash equivalents $ 183,477 $108,369 $ 6,056 $ 5,245 $ 10,374

Working capital 348,155 196,555 91,794 65,663 40,743

Total assets 707,298 491,440 354,305 326,173 231,016

Total debt —— 54,073 96,873 56,137

Total liabilities 173,806 135,896 135,140 158,538 146,609

Stockholders’ equity 533,492 355,544 219,165 167,634 84,407

(1) Includes approximately $23.8 million of net sales, $8.7 million of income from operations and $5.2 million of income included in loss before cumulative effect of

change in accounting principle, representing the effect of the adoption of Staff Accounting Bulletin 101, “Revenue Recognition” (SAB 101) in the first quarter of

fiscal 2001. There was no impact on net loss.

As required by Statement of Financial Accounting Standards No. 145, “Rescission of FASB Statements No. 4, 44 and 64, Amendment to FASB Statement No. 13,

and Technical Corrections,” the $1,948 net loss on extinguishment of debt for the year ended October 31, 2001, previously classified as an extraordinary item, has

been reclassified as follows: $3,165 of loss on extinguishment to non-operating expenses (included within loss before cumulative effect of change in accounting

principle) and $1,217 of tax benefit to benefit for income taxes in the above table.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Selected Financial Data

10