2K Sports 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1. DESCRIPTION OF THE BUSINESS

Take-Two Interactive Software, Inc. (the “Company”) was incorpo-

rated in the State of Delaware in September 1993. The Company

develops interactive software games designed for PCs, video game

consoles and handheld platforms and publishes games developed

internally and by third parties. The Company also distributes games

for video game consoles and handheld platforms published internally

and by third parties, as well as hardware and accessories manufac-

tured by third parties.

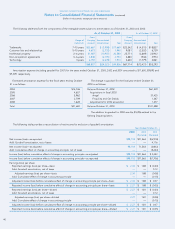

2. RESTATEMENT OF FINANCIAL STATEMENTS

The Company restated its previously issued financial statements

for the fiscal years ended October 31, 2000 (not presented herein),

2001 and 2002 to reflect its revised revenue recognition policy. Under

this policy, the Company recognizes as a reduction of net sales a

reserve for estimated future price concessions in the period in which

the sale is recorded. Measurement of the reserve is based on, among

other factors, an historical analysis of price concessions, an assess-

ment of field inventory levels and sell-through for each product,

current industry conditions and other factors affecting the estimated

timing and amount of concessions management believes will be

granted. The Company previously recognized price concession

reserves in the period in which it communicated the price concessions

to its customers. The Company also restated its financial statements

for the years ended October 31, 2000 and 2001 to increase its provi-

sion for returns at October 31, 2000 by approximately $4.9 million for

certain sales transactions primarily to retail customers in fiscal 2000,

and to reflect the fiscal 2001 returns as a reduction of the revised

October 31, 2000 reserve for returns rather than the previously

reported reduction of sales in fiscal 2001. Additionally, fiscal 2000 and

2001 revenues were restated for approximately $0.2 million to adjust

for sales cut-off transactions at the end of fiscal 2000. The impact of

these changes on opening retained earnings as of November 1, 2000

was $2.6 million. See Note 19.

The Company’s 2002 financial statements have been restated

as follows:

Year Ended October 31, 2002

Statement of Operations Data: As Reported As Restated

Net sales $793,976 $794,676

Product costs $410,118 $411,518

Royalties $ 80,774 $ 80,442

Cost of sales $499,016 $500,084

Gross profit $294,960 $294,592

Depreciation and amortization $ 11,187 $ 10,829

Income from operations $122,715 $122,705

Income before provision for income taxes $120,948 $120,938

Provision for income taxes $ 49,383 $ 49,375

Net income $ 71,565 $ 71,563

Basic net income per share $ 1.88 $ 1.88

Diluted net income per share $ 1.81 $ 1.81

As of October 31, 2002

Balance Sheet Data: As Reported As Restated

Accounts receivable, net* $107,188 $105,576

Prepaid royalties, current $ 13,723 $ 14,215

Deferred tax asset $ 5,392 $ 6,245

Total current assets $328,632 $328,365

Total assets $491,707 $491,440

Accrued expenses and other current liabilities* $ 49,821 $ 50,698

Income taxes payable $ 1,603 $ 1,357

Total current liabilities $131,179 $131,810

Retained earnings $ 87,804 $ 86,906

Total liabilities and stockholders’ equity $491,707 $491,440

* Restated amounts reflect a reclassification relating to the presentation of

allowances.

The Company’s Consolidated Statement of Operations for the

year ended October 31, 2001 has been restated as follows:

Year Ended October 31, 2001

Statement of Operations Data: As Reported As Restated

Net sales $448,801 $451,396

Product costs $283,522 $282,279

Royalties $ 18,573 $ 19,875

Cost of sales $306,264 $306,323

Gross profit $142,537 $145,073

Income from operations $ 25,841 $ 28,377

Loss before benefit for income taxes and

cumulative change in accounting principle* $ (6,660) $ (4,124)

Benefit for income taxes* $ (3,417) $ (2,450)

Net loss before cumulative change

in accounting principle $ (3,243) $ (1,674)

Cumulative change in accounting principle $ (5,337) $ (5,244)

Net loss $ (8,580) $ (6,918)

Basic net loss per share $ (0.25) $ (0.20)

Diluted net loss per share $ (0.25) $ (0.20)

* As required by Statement of Financial Accounting Standards No. 145, “Rescis-

sion of FASB Statements No. 4, 44 and 64, Amendment to FASB Statement No.

13, and Technical Corrections”, the $1,948 net loss on extinguishment of debt

for the year ended October 31, 2001, previously classified as an extraordinary

item, has been reclassified in the As Reported column in the above table as

follows: $3,165 of loss on extinguishment to non-operating expenses and

$1,217 of tax benefit to benefit for income taxes.

All applicable amounts relating to the aforementioned restate-

ments have been reflected in these consolidated financial statements

and notes thereto.

3. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements include the financial state-

ments of the Company and its wholly owned subsidiaries and for enti-

ties for which the Company is deemed to be the primary beneficiary

as defined in FASB Interpretation No. 46, “Consolidation of Variable

Interest Entities.” All material intercompany balances and transactions

have been eliminated in consolidation.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Dollars in thousands, except per share amounts)

32