2K Sports 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

7. INVESTMENTS

Investments are comprised of marketable equity securities and are

classified as current and non-current assets. The investments are

accounted for under the cost method as “available-for-sale” in accor-

dance with Statement of Financial Standards No. 115 “Accounting for

Certain Investments in Debt and Equity Securities.” The investments

are stated at fair value, with unrealized appreciation (loss) reported as

a separate component of accumulated other comprehensive income

(loss) in stockholders’ equity.

For the fiscal years ended October 31, 2003 and 2002, the gross

proceeds from the sale of investments were $114 and $6,170, respec-

tively. The gross realized gain from these sales totaled $39 and $181,

respectively. The gain/loss on sale of securities is based on the aver-

age cost of the individual securities sold.

During 2001, the Company recorded an impairment charge of

$21,477, consisting of approximately $19,171 relating to its invest-

ment in Gameplay, $2,000 relating to its investment in eUniverse, Inc.

based on the quoted market prices and $306 relating to its invest-

ment in a privately held company, which is included in other non-

current assets. All of these investments were deemed to be other

than temporarily impaired.

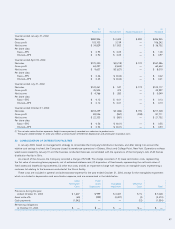

8. INVENTORIES

As of October 31, 2003 and 2002, inventories consist of:

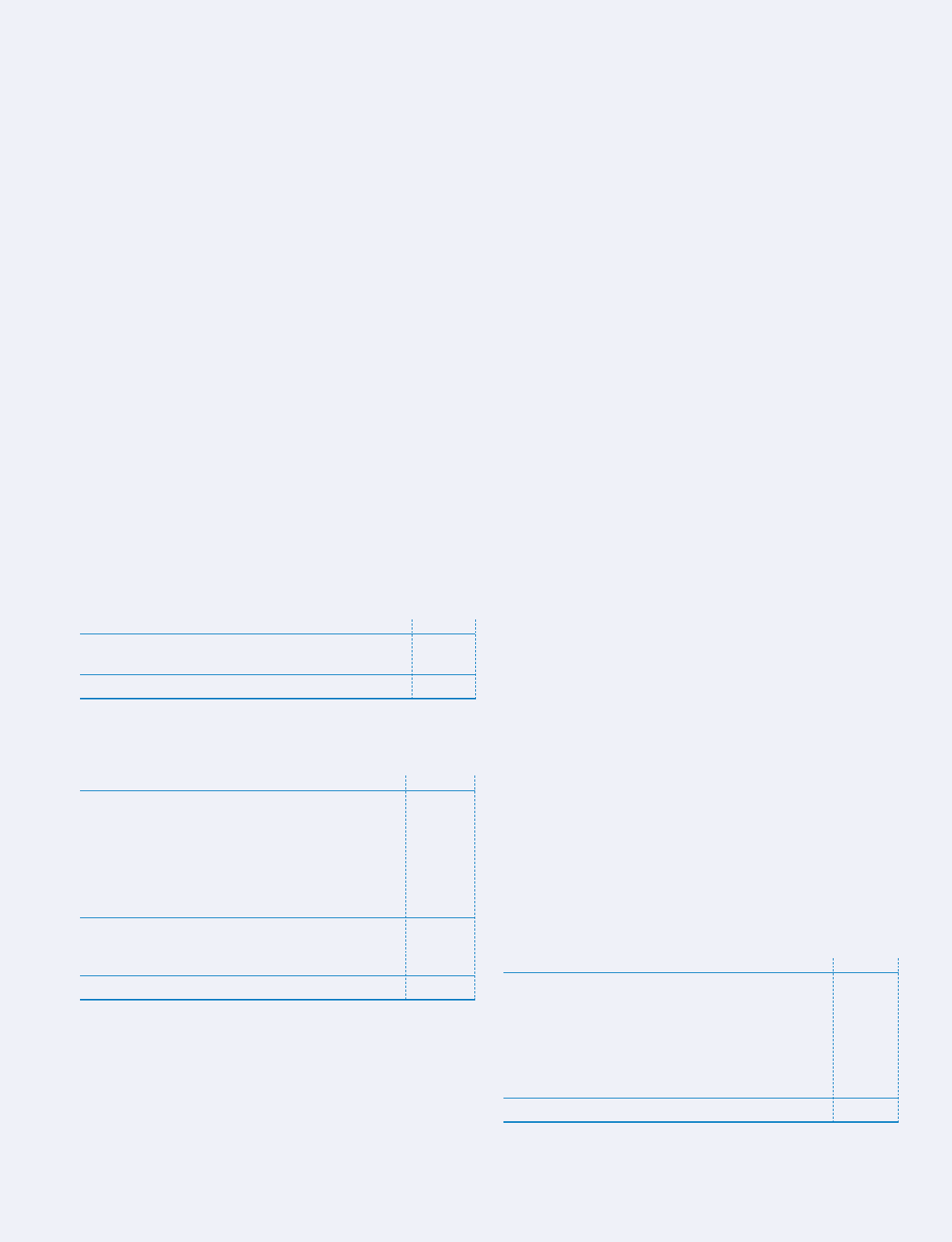

2003 2002

Parts and supplies $ 4,793 $ 3,221

Finished products 96,955 71,170

$101,748 $74,391

9. FIXED ASSETS

As of October 31, 2003 and 2002, fixed assets consist of:

2003 2002

Computer equipment $12,963 $ 8,004

Office equipment 5,096 3,811

Computer software 11,529 8,981

Furniture and fixtures 3,157 1,850

Automobiles —219

Leasehold improvements 6,047 3,265

Capital leases 398 398

39,190 26,528

Less: accumulated depreciation

and amortization 16,930 11,209

$22,260 $15,319

In 2003 and 2002, the Company capitalized costs of approximately

$2,923 and $4,113, respectively, associated with software and hard-

ware upgrades to its accounting systems.

Depreciation expense for the years ended October 31, 2003,

2002, and 2001 amounted to $9,510, $6,457 and $3,731,

respectively.

10. LINES OF CREDIT

In December 1999, the Company entered into a credit agreement,

as amended and restated in August 2002, with a group of lenders led

by Bank of America, N.A., as agent. The agreement provides for bor-

rowings of up to $40,000 through the expiration of the line of credit

on August 28, 2005. Generally, advances under the line of credit are

based on a borrowing formula equal to 75% of eligible accounts

receivable plus 35% of eligible inventory. Interest accrues on such

advances at the bank’s prime rate plus 0.25% to 1.25%, or at LIBOR

plus 2.25% to 2.75% depending on the Company’s consolidated

leverage ratio (as defined). The Company is required to pay a com-

mitment fee to the bank equal to 0.5% of the unused loan balance.

Borrowings under the line of credit are collateralized by the Compa-

ny’s accounts receivable, inventory, equipment, general intangibles,

securities and other personal property, including the capital stock of

the Company’s domestic subsidiaries. Available borrowings under the

agreement are reduced by the amount of outstanding letters of cred-

it, which was $9,290 at October 31, 2003. The loan agreement con-

tains certain financial and other covenants, including the maintenance

of consolidated net worth, consolidated leverage ratio and consoli-

dated fixed charge coverage ratio. As of October 31, 2003, the Com-

pany was in compliance with such covenants. The loan agreement

limits or prohibits the Company from declaring or paying cash divi-

dends, merging or consolidating with another corporation, selling

assets (other than in the ordinary course of business), creating liens

and incurring additional indebtedness. The Company had no out-

standing borrowings under the revolving line of credit as of October

31, 2003 and 2002.

In February 2001, the Company’s United Kingdom subsidiary

entered into a credit facility agreement, as amended in March 2002,

with Lloyds TSB Bank plc (“Lloyds”) under which Lloyds agreed to

make available borrowings of up to approximately $22,200. Advances

under the credit facility bear interest at the rate of 1.25% per annum

over the bank’s base rate, and are guaranteed by the Company. Avail-

able borrowings under the agreement are reduced by the amount of

outstanding guarantees. The facility expires on March 31, 2004. The

Company had no outstanding guarantees or borrowings under this

facility as of October 31, 2003 and 2002.

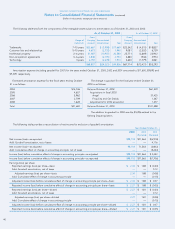

11. ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses and other current liabilities as of October 31,

2003 and 2002 consist of:

2003 2002

(Restated)

Accrued co-op advertising and product rebates $ 3,985 $ 3,318

Accrued VAT and payroll taxes 11,593 10,249

Royalties payable 8,521 14,784

Deferred revenue 2,358 10,596

Sales commissions 10,381 6,248

Other 19,869 5,503

Total $56,707 $50,698