2K Sports 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

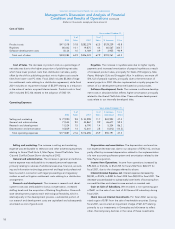

Class Action Settlement Costs. During fiscal 2002, we recorded

$1,468 of class action settlement costs, which represents a settlement of

$7,500 and related legal fees, net of $6,145 of insurance proceeds.

Loss on Early Extinguishment of Debt. During fiscal 2001, we

incurred a charge of $3,165 upon the early repayment of $15,000 of

subordinated indebtedness.

Provision for Income Taxes. We incurred income tax expense of

$49,375 for fiscal 2002 as compared to a benefit of $2,450 for fiscal

2001. The increase was primarily attributable to increased taxable

income. The difference between the statutory rate and the effective

rates of 40.8% and (59.4%) for fiscal 2002 and 2001, respectively,

primarily is the result of state and foreign tax rate differentials and

non-deductible items, such as amortization of intangibles.

Cumulative Effect of Change in Accounting Principle. In connec-

tion with the adoption of SAB 101, we recognized a cumulative effect

of $5,244, net of taxes of $3,496, in fiscal 2001.

Net Income. For fiscal 2002, we achieved net income of $71,563,

as compared to net loss of $6,918 for fiscal 2001.

Liquidity and Capital Resources

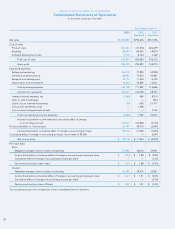

Our primary cash requirements are to fund the development and

marketing of our products. We satisfy our working capital require-

ments primarily through cash flow from operations. At October 31,

2003, we had working capital of $348,155 as compared to working

capital of $196,555 at October 31, 2002.

Our cash and cash equivalents increased $75,108 to $183,477 at

October 31, 2003, from $108,369 at October 31, 2002. The increase

is primarily attributable to $80,628 of cash provided by operating

activities and by $44,562 provided by financing activities, partly offset

by $45,881 used in investing activities.

Net cash provided by operating activities for fiscal 2003 was

$80,628 compared to $144,998 for fiscal 2002 and $27,319 for fiscal

2001. The decrease in fiscal 2003 was primarily attributable to cash

used to finance significantly increased levels of accounts receivables

and inventories, increases in prepaid expenses and software develop-

ment costs, partly offset by an increase in net income, higher non-cash

adjustments principally relating to the consolidation of our distribution

facilities and increased tax benefit from stock options. The increase in

cash provided by operating activities in fiscal 2002 was primarily attrib-

utable to increased net income and our focus on working capital man-

agement in both fiscal 2002 and 2001. The increase in cash provided

from operations for fiscal 2002 was also attributable to increases in

accounts payable and accrued expenses, partly offset by increased

levels of inventories, prepaid expenses and accounts receivable.

Net cash used in investing activities for fiscal 2003 was $45,881

as compared to $18,084 for fiscal 2002 and $13,479 for fiscal 2001.

The increase in fiscal 2003 is primarily attributable to higher expen-

ditures for the acquisition of development studios and lower pro-

ceeds from sale of investments, partly offset by fewer intangible

assets acquisitions. The increase in fiscal 2002 is primarily attributa-

ble to the acquisition of the Max Payne intangible assets and the

Barking Dog development studio and increased expenditures for

fixed assets. Net cash used in investing activities for fiscal 2001

related primarily to the purchase of fixed assets and, to a lesser

extent, acquisitions.

Net cash provided by financing activities for fiscal 2003 was

$44,562 as compared to net cash used in financing activities for fiscal

2002 of $31,988 and $11,790 for fiscal 2001. The increase in fiscal

2003 was primarily attributable to the absence of repayment of

indebtedness and higher proceeds from the exercise of stock options.

The increase in net cash used in financing activities for fiscal 2002 was

primarily attributable to the absence of private placement proceeds in

fiscal 2002 and the repayment of indebtedness. Net cash used in fis-

cal 2001 related primarily to the repayment of indebtedness offset by

proceeds from equity offerings and the exercise of stock options and

warrants.

In December 1999, we entered into a credit agreement, as

amended and restated in August 2002, with a group of lenders led by

Bank of America, N.A., as agent. The agreement provides for borrow-

ings of up to $40,000 through the expiration of the line of credit on

August 28, 2005. Generally, advances under the line of credit are

based on a borrowing formula equal to 75% of eligible accounts

receivable plus 35% of eligible inventory. Interest accrues on such

advances at the bank’s prime rate plus 0.25% to 1.25%, or at LIBOR

plus 2.25% to 2.75% depending on our consolidated leverage ratio

(as defined). We are required to pay a commitment fee to the bank

equal to 0.5% of the unused loan balance. Borrowings under the line

of credit are collateralized by our accounts receivable, inventory,

equipment, general intangibles, securities and other personal proper-

ty, including the capital stock of our domestic subsidiaries. Available

borrowings under the agreement are reduced by the amount of out-

standing letters of credit, which were $9,290 at October 31, 2003.

The loan agreement contains certain financial and other covenants,

including the maintenance of consolidated net worth, consolidated

leverage ratio and consolidated fixed charge coverage ratio. As of

October 31, 2003, we were in compliance with such covenants. The

loan agreement limits or prohibits us from declaring or paying cash

dividends, merging or consolidating with another corporation, selling

assets (other than in the ordinary course of business), creating liens

and incurring additional indebtedness. We had no outstanding bor-

rowings under the revolving line of credit as of October 31, 2003.

In February 2001, our United Kingdom subsidiary entered into a

credit facility agreement, as amended in March 2002, with Lloyds TSB

Bank plc (“Lloyds”) under which Lloyds agreed to make available bor-

rowings of up to approximately $22,200. Advances under the credit

facility bear interest at the rate of 1.25% per annum over the bank’s

base rate, and are guaranteed by us. Available borrowings under the

agreement are reduced by the amount of outstanding guarantees. The

facility expires on March 31, 2004. We had no outstanding guarantees

or borrowings under this facility as of October 31, 2003.

For fiscal 2003, 2002 and 2001, we received proceeds of $44,865,

$23,308 and $22,931, respectively, relating to the exercise of stock

options and warrants.

19