2K Sports 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

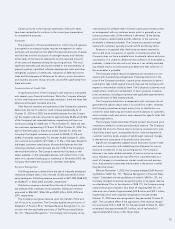

agreed to make additional payments of up to $2,500 to the former

owners of Cat Daddy, based on a percentage of Cat Daddy’s profits

for the first three years after acquisition, which will be recorded as

compensation expense if the targets are met. In connection with the

acquisitions, the Company recorded goodwill of $1,267 and net

liabilities of $191.

In November 2002, the Company acquired all of the outstanding

capital stock of Angel Studios, Inc. (“Angel”), the developer of the

Midnight Club and Smuggler’s Run franchises. The purchase price

consisted of 235,679 shares of restricted common stock (valued at

$6,557), $28,512 in cash and $5,931 (net of $801 of royalties payable

to Angel) of prepaid royalties previously advanced to Angel. In con-

nection with the acquisition, the Company recorded identifiable intan-

gibles of $4,720 (comprised of intellectual property of $2,810, tech-

nology of $1,600 and non-competition agreements of $310), goodwill

of $37,425 and net liabilities of $1,145.

In April 2003, the Company entered into an agreement with Desti-

neer Publishing Corp. (“Destineer”), a publisher of PC games, under

which Destineer granted the Company exclusive distribution rights to

eight PC games and two console ports to be published by Destineer.

The Company agreed to make recoupable advances to Destineer of

approximately $6,700 and to pay Destineer with respect to product

sales under the distribution agreement. In addition, the Company

agreed to make a loan to Destineer of $1,000. Destineer granted the

Company an immediately exercisable option to purchase a 19.9%

interest in Destineer and a second option to purchase the remaining

interest for a price equal to a multiple of Destineer’s EBIT, exercisable

during a period following April 2005. The fair value of these options

was not significant. Pursuant to the requirements of FIN 46, since

Destineer is a variable interest entity and the Company is considered

to be the primary beneficiary (as defined in FIN 46), the results of

Destineer’s operations have been consolidated in the accompanying

financial statements.

The 2003 acquisitions did not have a material effect on the

Company’s fiscal 2003 results of operations.

2002 Transaction

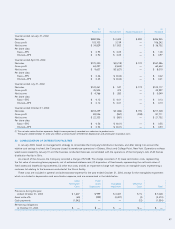

In August 2002, the Company acquired all of the outstanding capital

stock of Barking Dog Studios Ltd. (“Barking Dog”), a Canadian-based

development studio. The purchase price consisted of 242,450 shares

of restricted common stock (valued at $3,801), $3,000 in cash, $825

of prepaid royalties previously advanced to Barking Dog and assumed

net liabilities of $70. In connection with the acquisition, the Company

recorded identifiable intangibles of $1,800, comprised of non-competi-

tion agreements of $1,600 and intellectual property of $200, and good-

will of $6,772. The acquisition of Barking Dog did not have a significant

effect on the Company’s fiscal 2002 results of operations.

2001 Transactions

In July 2001, the Company acquired all of the outstanding capital

stock of Techcorp Limited (“Techcorp”), a Hong Kong-based design

and engineering firm specializing in video game accessories. In con-

sideration, the Company issued 30,000 shares of the Company’s

restricted common stock (valued at $572), paid $100 in cash and

assumed net liabilities of approximately $2,856. In connection with

the acquisition, the Company recorded goodwill of $3,558.

In November 2000, the Company acquired all of the outstanding

capital stock of VLM Entertainment Group, Inc. (“VLM”), a company

engaged in the distribution of third-party software products. In

connection with this transaction, the Company paid the former stock-

holders of VLM $2,000 in cash and issued 875,000 shares of the

Company’s common stock (valued at $8,039) and assumed net liabili-

ties of approximately $10,627. In connection with this transaction,

the Company recorded intangible assets of approximately $20,693.

In connection with the sale of a subsidiary to Gameplay.com plc

(“Gameplay”) in October 2000, the Company agreed to acquire

Gameplay’s game software development and publishing business,

Neo Software Produktions GMBH (“Neo”). Such acquisition was

completed in January of 2001 and the Company assumed net liabili-

ties of $808, in addition to the prepaid purchase price of $17,266. In

connection with the acquisition, the Company recorded goodwill and

intangibles of $18,183.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements (continued)

(Dollars in thousands, except per share amounts)

38

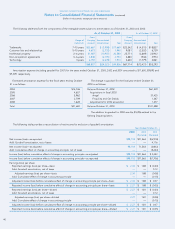

The following table sets forth the components of the purchase price of the 2001 acquisitions:

Neo VLM Techcorp Total

Cost of the acquisition:

Value of business sold (Prepaid purchase price—Neo) or stock issued $17,266 $ 8,039 $ 572 $ 25,877

Cash — 2,000 100 2,100

Transaction costs 109 27 30 166

Total $17,375 $ 10,066 $ 702 $ 28,143

Allocation of purchase price:

Current assets $ 2 $ 9,852 $ 894 $ 10,748

Non-current assets 71 201 498 770

Liabilities (881) (20,680) (4,248) (25,809)

Goodwill 8,207 12,416 3,558 24,181

Customer lists — 8,277 — 8,277

Technology 8,037 — — 8,037

Trademarks 1,939 — — 1,939

Total $17,375 $ 10,066 $ 702 $ 28,143