2K Sports 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Under this pronouncement, the $1,948 net loss on extinguishment

of debt for the year ended October 31, 2001, previously classified as

an extraordinary item, has been reclassified as follows: $3,165 of loss

on extinguishment to non-operating expenses and $1,217 of tax ben-

efit to provision for income taxes. The adoption of SFAS 145 in fiscal

2003 did not have any impact on the Company’s financial condition,

cash flows and results of operations, other than the reclassification

referred to above.

In January 2002, the FASB issued Statement of Financial Account-

ing Standards No. 146, “Accounting for Costs Associated with Exit or

Disposal Activities” (“SFAS 146”). SFAS 146 requires the recognition

of such costs when they are incurred rather than at the date of a com-

mitment to an exit or disposal plan. The provisions of SFAS 146 are to

be applied prospectively to exit or disposal activities initiated after

December 31, 2002. The adoption of SFAS 146 in the first quarter of

fiscal 2003 did not have a material impact on the Company’s financial

condition and results of operations.

In December 2002, the FASB issued Statement of Financial

Accounting Standards No. 148, “Accounting for Stock-Based Com-

pensation—Transition and Disclosure” (“SFAS 148”). SFAS 148

amends the transition provisions of FASB No. 123, “Accounting for

Stock-Based Compensation” (“SFAS 123”), for entities that voluntarily

change to the fair value method of accounting for stock-based

employee compensation. The Company does not currently intend

to change its accounting to the fair value method. SFAS 148 also

amends the disclosure provisions of SFAS 123 to require prominent

disclosure about the effects on reported net income of an entity’s

accounting policy decisions with respect to stock-based employee

compensation, and amends APB Opinion No. 28, “Interim Financial

Reporting” to require disclosures about such effects in interim

financial information. The disclosure provisions of the amendments

to FASB 123 were adopted by the Company in the second quarter

of fiscal 2003.

In November 2002, the FASB issued Interpretation No. 45,

“Guarantor’s Accounting and Disclosure Requirements for Guaran-

tees, Including Indirect Guarantees of Indebtedness of Others” (“FIN

45”). FIN 45 expands previously issued accounting guidance and dis-

closure requirements for certain guarantees and requires recognition

of an initial liability for the fair value of an obligation assumed by issu-

ing a guarantee. The provision for initial recognition and measure-

ment of liability will be applied on a prospective basis to guarantees

issued or modified after December 31, 2002. The adoption of FIN 45

in the first quarter of fiscal 2003 did not have any impact on the Com-

pany’s financial condition or results of operations.

In January 2003, the FASB issued Interpretation No. 46, “Consoli-

dation of Variable Interest Entities” (“FIN 46”). FIN 46 requires a vari-

able interest entity to be consolidated by a company if that company

is subject to a majority of the risk of loss from the variable interest

entity’s activities or is entitled to receive a majority of the entity’s

residual return or both. FIN 46 also provides criteria for determining

whether an entity is a variable interest entity subject to consolidation.

FIN 46 requires immediate consolidation of variable interest entities

created after January 31, 2003. For variable interest entities created

prior to February 1, 2003, consolidation is required on July 1, 2003.

The adoption of FIN 46 in the third quarter of fiscal 2003 did not

have a material impact on the Company’s financial condition or results

of operations (see Note 4).

In April 2003, the FASB issued SFAS No. 149, “Amendment of

Statement 133 on Derivative Instruments and Hedging Activities”

(“SFAS 149”). SFAS 149 amends and clarifies financial accounting and

reporting for derivative instruments, including certain derivative

instruments embedded in other contracts and for hedging activities

under SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities.” In general, SFAS 149 is effective for contracts

entered into or modified after June 30, 2003 and for hedging rela-

tionships designated after June 30, 2003. The adoption of SFAS 149

did not have any impact on the Company’s financial condition or

results of operations.

In May 2003, the FASB issued SFAS No. 150, “Accounting for

Certain Financial Instruments with Characteristics of both Liabilities

and Equity” (“SFAS 150”). SFAS 150 establishes standards for how

an issuer classifies and measures in its statement of financial position

certain financial instruments with characteristics of both liabilities

and equity. In accordance with SFAS 150, financial instruments that

embody obligations for the issuer are required to be classified as lia-

bilities. SFAS 150 is effective for financial instruments entered into or

modified after May 31, 2003, and otherwise shall be effective at the

beginning of the first interim period beginning after June 15, 2003,

except for the provisions relating to mandatorily redeemable financial

instruments which have been deferred indefinitely. The adoption of

SFAS 150 in the fourth quarter of fiscal 2003 did not have any impact

on the Company’s financial condition.

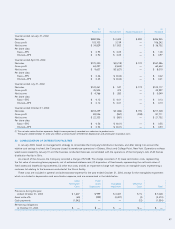

4. BUSINESS ACQUISITIONS AND CONSOLIDATION

The Company acquired seven companies that develop, publish or

distribute interactive software games during the three-year period

ended October 31, 2003. The aggregate purchase price, including

cash payments and issuance of its common stock, was $42,075,

$7,626 and $28,143 in 2003, 2002 and 2001, respectively. The value

of the Company’s common stock issued in connection with these

acquisitions has been based on the market price of the Company’s

common stock at the time such proposed transactions were agreed

and announced.

The acquisitions described below have been accounted for as

purchase transactions in accordance with APB No. 16 and SFAS 141

(for transactions after July 1, 2001) and, accordingly, the results of

operations and financial position of the acquired businesses are

included in the Company’s consolidated financial statements from

the respective dates of acquisition.

2003 Transactions

During the quarter ended July 31, 2003, the Company acquired

the assets of Frog City, Inc. (“Frog City”), the developer of Tropico 2:

Pirate Cove, and the outstanding membership interests of Cat Daddy

Games LLC (“Cat Daddy”), another development studio. The total

purchase price for both studios consisted of $757 in cash and $319 of

prepaid royalties previously advanced to Frog City. The Company also

37