2K Sports 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

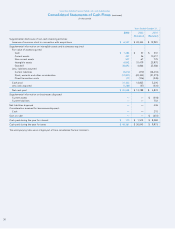

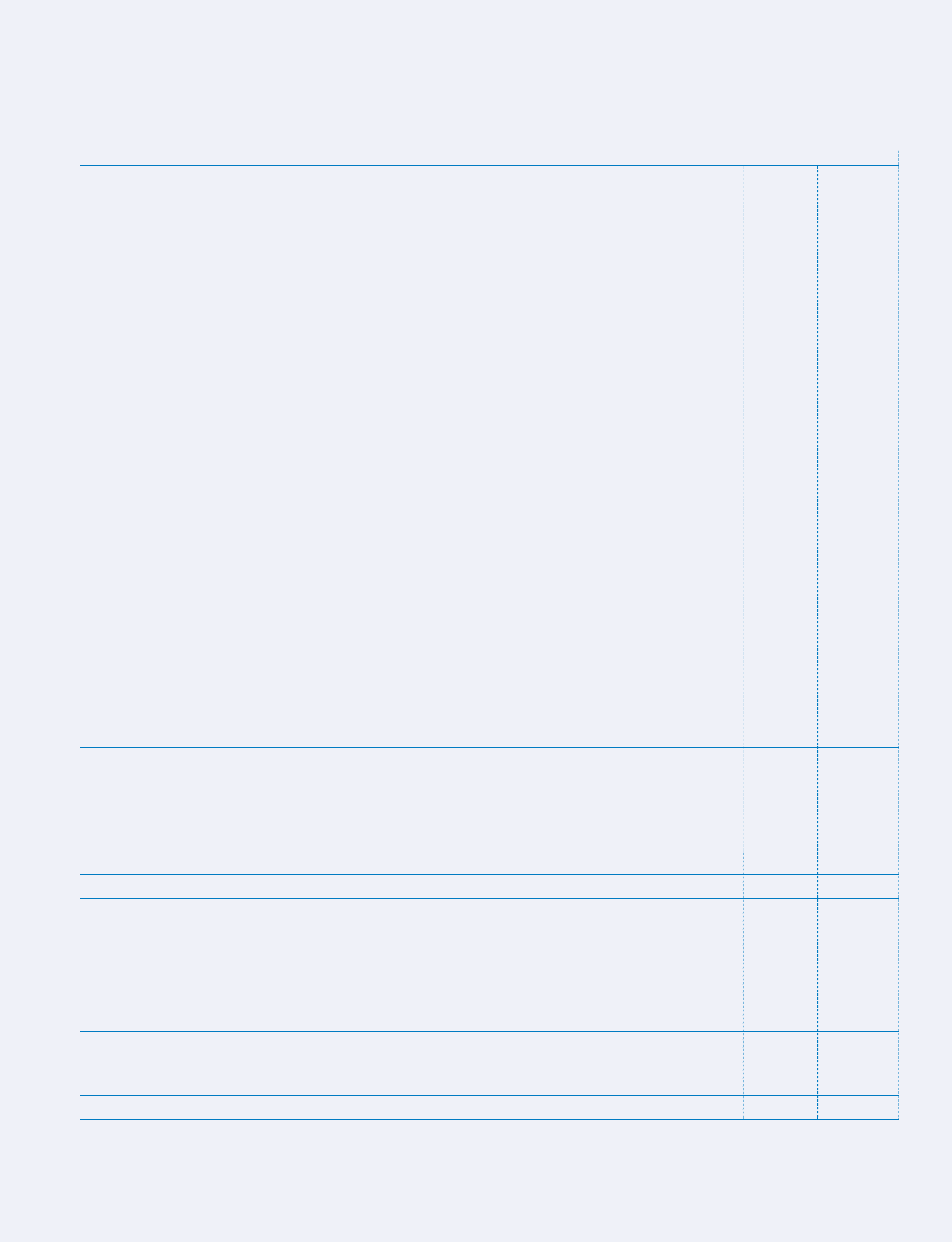

Years Ended October 31,

2003 2002 2001

(Restated) (Restated)

Cash flows from operating activities:

Net income (loss) $ 98,118 $ 71,563 $ (6,918)

Adjustment to reconcile net income (loss) to net cash provided by operating activities:

Depreciation and amortization 12,516 10,829 12,641

(Gain) loss on disposal of fixed assets (31) 126 219

Gain on sale of subsidiary —— (651)

(Gain) loss on Internet investments (39) (181) 21,477

Impairment charge on Internet assets —— 4,187

Impairment of intellectual property and technology 7,892 ——

Non-cash charges for consolidation of distribution facilities 5,474 ——

Loss on early extinguishment of debt —— 3,165

Provision (benefit) for deferred taxes 8,203 6,726 (9,422)

Provision for returns 47,342 28,350 40,543

Provision for price concessions 45,919 29,513 25,757

Provision for doubtful accounts and sales allowances 31,390 16,638 5,528

Amortization of various expenses and discounts 9,301 6,262 1,168

Write-off of prepaid royalties and capitalized software 9,588 15,616 1,585

Tax benefit from exercise of stock options 20,858 10,700 —

Compensatory stock and stock options 3,445 3,052 5

Other (2,190) (840) 108

Changes in operating assets and liabilities, net of effects of acquisitions:

Increase in accounts receivable (185,611) (87,100) (51,505)

Increase in inventories (25,146) (12,852) (2,821)

Increase in prepaid royalties (10,764) (8,157) (8,174)

Increase in prepaid expenses and other current assets (15,597) (3,034) (4,509)

Increase in capitalized software development costs (5,152) (895) (3,099)

Decrease (increase) in other non-current assets —257 (455)

Increase in accounts payable 20,148 23,019 1,511

Increase (decrease) in accrued expenses and other current liabilities 4,445 33,835 (3,021)

Increase in income taxes payable 519 1,571 —

Net cash provided by operating activities 80,628 144,998 27,319

Cash flows from investing activities:

Purchase of fixed assets (15,464) (10,466) (8,568)

Sale of investments 114 6,170 —

Acquisitions, net of cash acquired (27,973) (3,788) (1,769)

Acquisition of intangible assets (2,075) (10,000) (3,105)

Proceeds from disposal of business —— 215

Other investing activities (483) — (252)

Net cash used in investing activities (45,881) (18,084) (13,479)

Cash flows from financing activities:

Proceeds from private placements —— 20,892

Net repayments under lines of credit —(54,284) (40,545)

Repayment of loan payable —— (15,000)

Proceeds from exercise of stock options and warrants 44,865 23,308 22,931

Other financing activities (303) (1,012) (68)

Net cash provided by (used in) financing activities 44,562 (31,988) (11,790)

Effect of foreign exchange rates (4,201) 7,387 (1,239)

Net increase in cash for the period 75,108 102,313 811

Cash and cash equivalents, beginning of the period 108,369 6,056 5,245

Cash and cash equivalents, end of the period $ 183,477 $108,369 $ 6,056

The accompanying notes are an integral part of these consolidated financial statements.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(In thousands)

29