2K Sports 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interest (Income) Expense, net. Interest income of $2,265 for

fiscal 2003 was attributable to interest earned on the invested cash.

Interest expense of $480 for fiscal 2002 reflected borrowings from our

credit facilities, which were repaid in early fiscal 2002.

Class Action Settlement Costs. During fiscal 2002, we recorded

$1,468 of class action settlement costs, which represents a settlement

of $7,500 and related legal fees, net of $6,145 of insurance proceeds.

Provision for Income Taxes. Income tax expense was $67,197 for

fiscal 2003 as compared to $49,375 for fiscal 2002. The increase was

primarily attributable to increased taxable income. The effective tax

rate was 40.6% for fiscal 2003, as compared to an effective tax rate of

40.8% for fiscal 2002. The effective income tax rate differs from the

statutory rate primarily as a result of non-taxable foreign income, non-

deductible expenses, valuation allowances for deferred tax assets and

the mix of foreign and domestic taxes as applied to the income. The

valuation allowances relate to capital loss and state net operating loss

carryforwards.

At October 31, 2003 and October 31, 2002, we had capital loss

carryforwards totaling approximately $21,000. The capital loss carry-

forwards will expire in the periods fiscal 2006 through fiscal 2008.

Failure to achieve sufficient levels of taxable income from capital

transactions might affect the ultimate realization of the capital loss

carryforwards. At October 31, 2002, management had a strategy of

selling net appreciated assets of the company, to the extent required

to generate sufficient taxable income prior to the expiration of these

benefits. At October 31, 2003, based on management’s future plans,

this strategy was no longer viable, and accordingly a valuation

allowance has been recorded for this asset. At October 31, 2003,

we had foreign net operating losses of $9,800 expiring between

2005 and 2010, and state net operating losses of $41,700 expiring

between 2021 and 2023. Limitations on the utilization of these losses

may apply, and accordingly valuation allowances have been recorded

for these assets.

Net Income. Net income increased $26,555, or 37.1%, to $98,118

for fiscal 2003 from $71,563 for fiscal 2002, due to the changes

referred to above.

Diluted Net Income per Share. Diluted net income per share

increased $0.46, or 25.4%, to $2.27 for fiscal 2003 from $1.81 for

fiscal 2002. The increase in net income was partly offset by the higher

weighted average shares outstanding. The increase in weighted

shares outstanding resulted from the issuance of shares underlying

stock options and to the acquisitions of the Max Payne intellectual

property and the development studios.

17

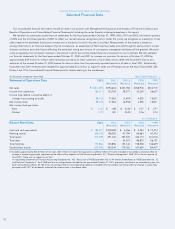

Fiscal Years Ended October 31, 2002 and 2001

Net Sales

Years ended October 31,

2002 % 2001 % $ Increase % Inc

Publishing $568,492 71.5 $244,071 54.1 $324,421 132.9

Distribution 226,184 28.5 207,325 45.9 18,859 9.1

Net sales $794,676 100.0 $451,396 100.0 $343,280 76.0

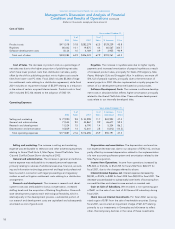

Net Sales. The increase in revenues was primarily attributable to

growth in publishing operations. Included in net sales for fiscal 2001

was $23,846 attributable to the adoption of SAB 101. See Note 3 to

Consolidated Financial Statements.

The increase in publishing revenues was primarily attributable to

the continued strong sales of Grand Theft Auto 3 for PlayStation 2

and the release of Grand Theft Auto: Vice City for the PlayStation 2,

Max Payne for the PlayStation 2 and Xbox, State of Emergency for

the PlayStation 2 and Grand Theft Auto 3 for the PC. Fiscal 2001

included $17,248 of net sales attributable to the adoption of

SAB 101.

Products designed for video game console platforms accounted

for 83.9% of fiscal 2002 publishing revenues as compared to 57.6%

for fiscal 2001. The increase was primarily attributable to continued

sales of Grand Theft Auto 3 for PlayStation 2 and the release of

Grand Theft Auto: Vice City for the PlayStation 2, Max Payne for

PlayStation 2 and Xbox and State of Emergency for PlayStation 2.

Products designed for the PC accounted for approximately 14.3%

of fiscal 2002 publishing net sales as compared to 35.6% for fiscal

2001. The decrease is a result of fewer PC titles released during

fiscal 2002.

The increase in distribution revenues was primarily attributable to

the commercial introduction of Xbox and GameCube and the contin-

ued rollout of PlayStation 2 and the sale of software for these console

platforms. Distribution revenue represented 28.5% and 45.9% of net

sales for fiscal 2002 and 2001, respectively. Fiscal 2001 included

$6,598 attributable to the adoption of SAB 101.

International operations accounted for approximately $159,245, or

20.0% of net sales for fiscal 2002 compared to $106,565, or 23.6% for

fiscal 2001. The increase in absolute dollars was primarily attributable

to expanded publishing operations in Europe, including the release

of Max Payne and State of Emergency for PlayStation 2, Grand Theft

Auto 3 for the PC and continued sales of Grand Theft Auto 3 for

PlayStation 2.