2K Sports 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

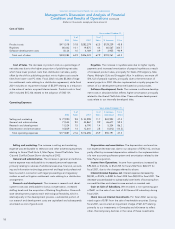

Our principal sources of revenue are derived from publishing and

distribution operations. Publishing revenues are derived from the sale

of internally developed software titles or software titles licensed from

third parties. Operating margins in our publishing business are

dependent upon our ability to continually release new, commercially

successful products. We develop most of our front-line products inter-

nally, and we own all of our major intellectual properties, which we

believe permits us to maximize profitability.

Our distribution revenues are derived from the sale of third-party

software titles, accessories and hardware. Operating margins in our

distribution business are dependent on the mix of software and hard-

ware sales, with software generating higher margins than hardware.

Publishing activities generate significantly higher margins than distribu-

tion activities, with sales of PC software titles resulting in higher margins

than sales of products designed for video game consoles.

We have pursued a growth strategy by capitalizing on the wide-

spread market acceptance of video game consoles and the growing

popularity of innovative gaming experiences that appeal to more

mature audiences. We have established a portfolio of successful pro-

prietary software content, including our premier brands: Grand Theft

Auto, Max Payne and Midnight Club, for the major hardware plat-

forms. We expect to continue to be the leader in the mature, action

product category by leveraging our existing franchises and develop-

ing new brands, such as Manhunt.

We currently anticipate that the release of new brands in fiscal

2004, including The Warriors and Red Dead Revolver, along with the

launch of the next installment of Grand Theft Auto, will generate sig-

nificant cash flow from our publishing business. We also believe that

we will be able to continue to grow our distribution business through

a combination of our retail relationships and our value product offer-

ings.

Historically, each generation of video game consoles and hand-

held platforms experiences a gradual decrease in retail pricing over

the life of the system, with retail pricing for software titles following

a similar trend. The PlayStation 2 and Xbox were introduced several

years ago, and have been reduced in price since their launch, with

additional price reductions anticipated to occur in 2004. Reduced

pricing for our titles could result in lower margins for our published

products and reduced growth rates in our publishing business.

However, as retail prices for interactive entertainment hardware and

software decline, our distribution business benefits from the wider

availability of higher margin, value priced software titles.

Estimates

The preparation of financial statements in conformity with general-

ly accepted accounting principles requires management to make esti-

mates and assumptions that affect the reported amounts of assets

and liabilities and the disclosure of contingent assets and liabilities at

the dates of the financial statements and the reported amounts of net

sales and expenses during the reporting periods. The most significant

estimates and assumptions relate to the recoverability of prepaid roy-

alties, capitalized software development costs and other intangibles,

inventories, realization of deferred income taxes and the adequacy

of allowances for returns, price concessions and doubtful accounts.

Actual amounts could differ significantly from these estimates.

Revenue Recognition

We recognize revenue upon the transfer of title and risk of loss to

our customers. We apply the provisions of Statement of Position 97-2,

“Software Revenue Recognition” in conjunction with the applicable

provisions of Staff Accounting Bulletin No. 101, “Revenue Recogni-

tion.” Accordingly, we recognize revenue for software when (1) there

is persuasive evidence that an arrangement with our customer exists,

which is generally a customer purchase order, (2) the software is deliv-

ered, (3) the selling price is fixed or determinable and (4) collection of

the customer receivable is deemed probable. Our payment arrange-

ments with customers typically provide net 30- and 60-day terms.

Revenue is recognized after deducting estimated reserves for

returns and price concessions. In specific circumstances when we do

not have a reliable basis to estimate returns and price concessions or

are unable to determine that collection of receivables is probable, we

defer the sale until such time as we can reliably estimate any related

returns and allowances and determine that collection of the receiv-

ables is probable.

Allowances for Returns and Price Concessions

We accept returns and grant price concessions in connection with

our publishing arrangements. Following reductions in the price of

our products, we grant price concessions to permit customers to take

credits against amounts they owe us with respect to merchandise

unsold by them. Our customers must satisfy certain conditions to

entitle them to return products or receive price concessions, including

compliance with applicable payment terms and confirmation of field

inventory levels.

Our distribution arrangements with customers do not give them

the right to return titles or to cancel firm orders. However, we some-

times accept returns from our distribution customers for stock balanc-

ing and make accommodations to customers, which include credits

and returns, when demand for specific titles falls below expectations.

We make estimates of future product returns and price conces-

sions related to current period product revenue. We estimate the

amount of future returns and price concessions for published titles

based upon, among other factors, historical experience, customer

inventory levels, analysis of sell-through rates and changes in demand

and acceptance of our products by consumers.

Significant management judgments and estimates must be made

and used in connection with establishing the allowance for returns

and price concessions in any accounting period. We believe we can

make reliable estimates of returns and price concessions. However,

actual results may differ from initial estimates as a result of changes in

circumstances, market conditions and assumptions. Adjustments to

estimates are recorded in the period in which they become known.

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of Financial

Condition and Results of Operations (continued)

(Dollars in thousands, except per share amounts)

12