Westjet 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 WestJet 2010 Annual Report

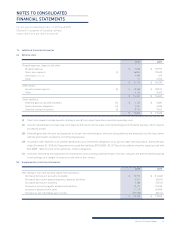

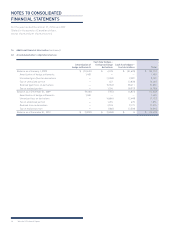

14. Additional fi nancial information (continued)

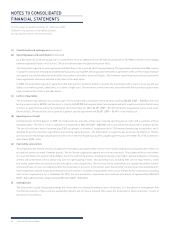

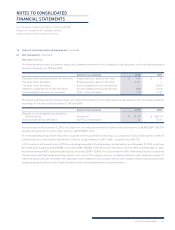

(c) Accumulated other comprehensive loss

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2010 and 2009

(Stated in thousands of Canadian dollars,

except share and per share amounts)

Amortization of

hedge settlements

Cash fl ow hedges –

foreign exchange

derivatives

Cash fl ow hedges –

fuel derivatives Total

Balance as at January 1, 2009 $ (10,620) $ 4,133 $ (31,625) $ (38,112)

Amortization of hedge settlements 1,400 — — 1,400

Unrealized gain (loss) on derivatives — (1,358) 9,587 8,229

Tax on unrealized portion — 447 (2,878) (2,431)

Realized (gain) loss on derivatives — (5,553) 28,411 22,858

Tax on realized portion — 1,576 (8,372) (6,796)

Balance as at December 31, 2009 (9,220) (755) (4,877) (14,852)

Amortization of hedge settlements 1,400 — — 1,400

Unrealized loss on derivatives — (4,684) (2,448) (7,132)

Tax on unrealized portion — 1,224 670 1,894

Realized loss on derivatives — 2,143 9,172 11,315

Tax on realized portion — (586) (2,509) (3,095)

Balance as at December 31, 2010 $ (7,820) $ (2,658) $ 8 $ (10,470)