Westjet 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

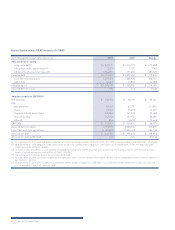

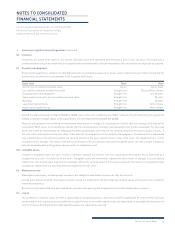

62 WestJet 2010 Annual Report

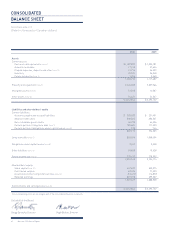

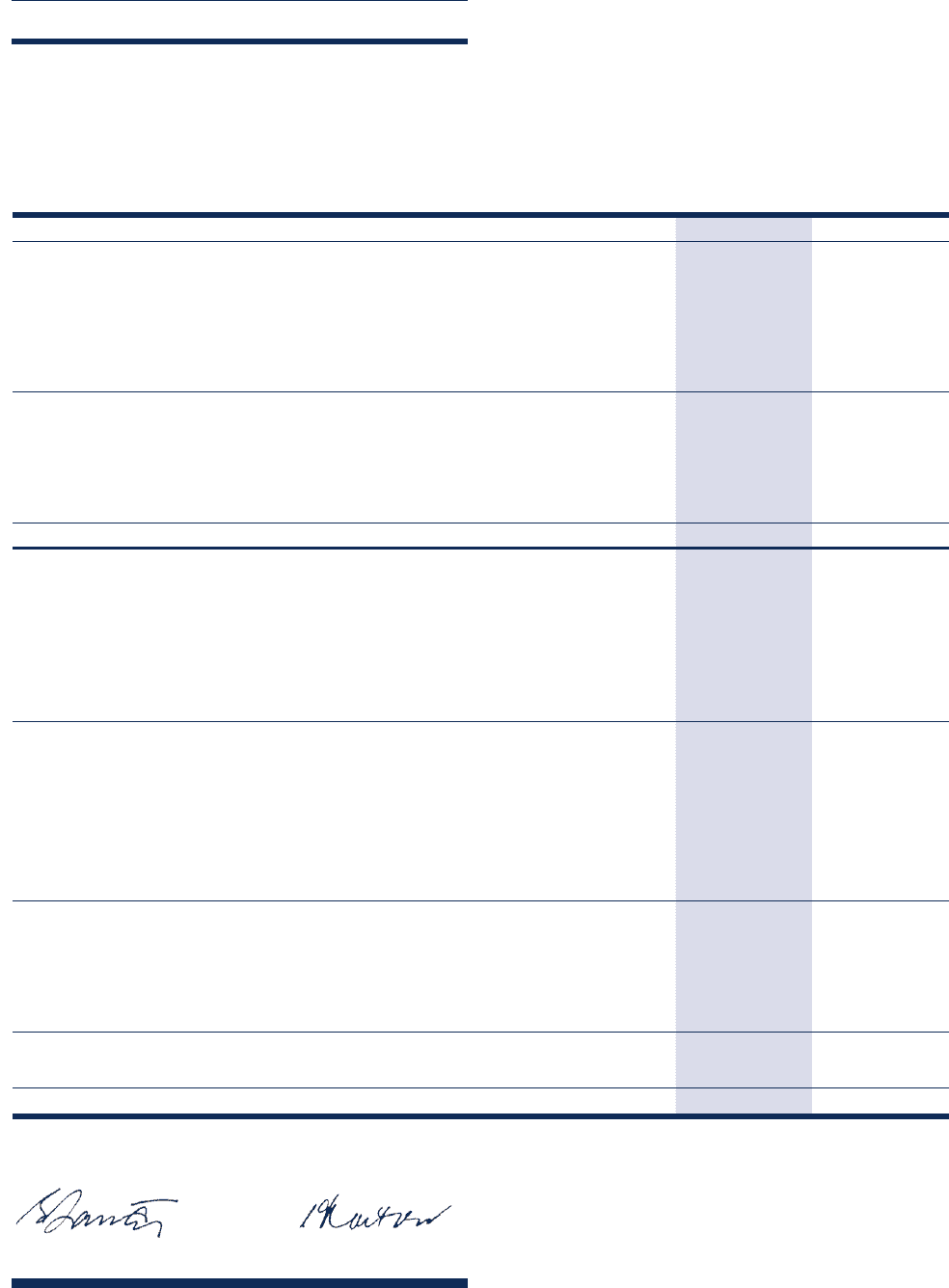

CONSOLIDATED

BALANCE SHEET

As at December 31

(Stated in thousands of Canadian dollars)

2010 2009

Assets

Current assets:

Cash and cash equivalents (note 4) $ 1,187,899 $ 1,005,181

Accounts receivable 17,518 27,654

Prepaid expenses, deposits and other (note 14) 41,716 56,239

Inventory 20,181 26,048

Future income tax (note 9) 1,396 2,560

1,268,710 1,117,682

Property and equipment (note 5) 2,226,685 2,307,566

Intangible assets (note 6) 13,018 14,087

Other assets (note 14) 54,431 54,367

$ 3,562,844 $ 3,493,702

Liabilities and shareholders’ equity

Current liabilities:

Accounts payable and accrued liabilities $ 303,583 $ 231,401

Advance ticket sales 308,022 286,361

Non-refundable guest credits 36,778 64,506

Current portion of long-term debt (note 7) 183,681 171,223

Current portion of obligations under capital leases (note 8) 108 744

832,172 754,235

Long-term debt (note 7) 863,496 1,048,554

Obligations under capital leases (note 8) 3,249 3,358

Other liabilities (note 14) 18,838 19,628

Future income tax (note 9) 337,410 278,999

2,055,165 2,104,774

Shareholders’ equity:

Share capital

(note 10) 647,637 633,075

Contributed surplus 62,534 71,503

Accumulated other comprehensive loss (note 14) (10,470) (14,852)

Retained earnings 807,978 699,202

1,507,679 1,388,928

Commitments and contingencies (note 12)

$ 3,562,844 $ 3,493,702

The accompanying notes are an integral part of the consolidated fi nancial statements.

On behalf of the Board:

Gregg Saretsky, Director Hugh Bolton, Director

On

behalf

of

the

Board:

Gre

gg

Saretsky Di

rec

tor