Westjet 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2010 Annual Report 17

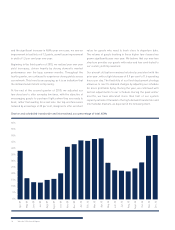

During 2010, total revenues increased by 14.4 per cent to

$2,609.3 million from $2,281.1 million in 2009. The increase in

revenues is primarily attributable to the increased capacity since

the prior year, along with positive variances in both load factor and

yield. Our traffic growth of 12.9 per cent outpaced our 11.1 per cent

capacity growth during the year. One of our key revenue

measurements is RASM, as it takes into consideration load factor

and yield. Our RASM increased by 3.0 per cent to 13.36 cents

for 2010, compared to 12.97 cents in 2009. Average stage length

growth of 4.9 per cent from 2009 placed downward pressure on

RASM. As average stage length increases, revenue per available

seat mile typically decreases. Despite the growth in stage length

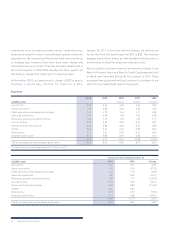

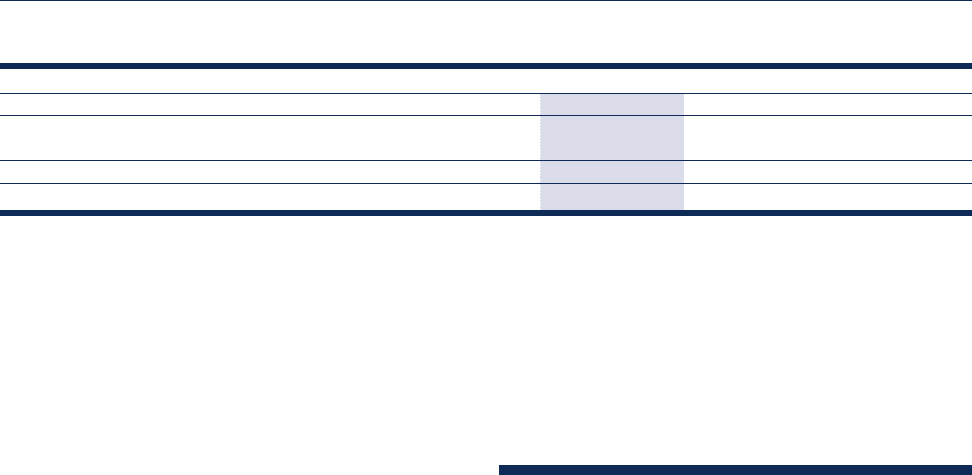

2010 RESULTS OF OPERATIONS

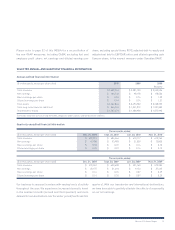

Revenue

Twelve months ended December 31

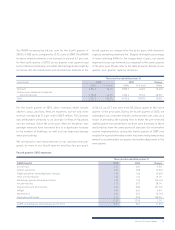

($ in thousands) 2010 2009 Change

Guest $ 2,405,281 $ 2,067,860 16.3%

Other 203,980 213,260 (4.4%)

$ 2,609,261 $ 2,281,120 14.4%

RASM (cents) 13.36 12.97 3.0%

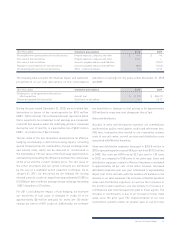

administration charge per ASM decreased by 16.1 per cent to

1.04 cents, compared to 1.24 cents in the same period of 2009.

This decrease was mainly attributable to the reclassification in

2010 of our onboard product costs from marketing expense to our

airport operations. Our advertising expenses have also decreased,

on an ASM basis, from the same quarter of the prior year.

Aircraft leasing

Our aircraft leasing costs in the fourth quarter of 2010 increased

by 28.1 per cent to 0.73 cents per ASM from 0.57 cents per ASM

in the same quarter of 2009. During the fourth quarter of 2009,

we assumed delivery of five leased aircraft and, in addition,

during 2010 an additional five leased aircraft were added to our

fleet. Leased aircraft now represent 42 per cent of our total fleet,

with a total of 38 aircraft under operating lease, as compared to

38 per cent of our fleet at the end of 2009. Our ASM growth from

the fourth quarter of the prior year is attributable to the addition

of these leased aircraft. As well, our foreign exchange forward

hedging program contributed to the decrease in costs per ASM

for the fourth quarter of 2010, as compared to the prior year,

as we had not hedged the foreign currency exposure on aircraft

leasing expenses during the fourth quarter of 2009.

Depreciation and amortization

Our depreciation and amortization charge per ASM was 0.65 cents,

a reduction of 21.7 per cent from 0.83 cents in the prior year. The

decrease in depreciation and amortization expense in the current

quarter versus the same quarter of 2009 is primarily attributable

to the change in our fleet mix, where a smaller percentage of our

total aircraft fleet was comprised of owned aircraft. As such, the

number of cycles flown by owned aircraft versus those that are

under operating lease has decreased from the prior year.

Income taxes

Our effective consolidated income tax rate for the three months

ended December 31, 2010, was 28.5 per cent, as compared to

12.4 per cent for the same period in 2009. This difference in our

effective tax rate for the three month period ended December 31,

2010, was primarily due to a corporate income tax rate reduction

enacted by the Ontario provincial government occurring in the

comparative period. The current period’s effective rate is in line

with expectations previously set for the quarter.