Westjet 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 WestJet 2010 Annual Report

and the significant increase in ASMs year over year, we saw an

improvement in load factor of 1.2 points, as well as an improvement

in yield of 1.3 per cent year over year.

Beginning in the third quarter of 2010, we realized year over year

yield increases, driven heavily by strong domestic market

performance over the busy summer months. Throughout the

fourth quarter, we continued to experience strong yields across

our network. This trend is encouraging, as it is an indication that

the demand environment is improving.

At the end of the second quarter of 2010, we adjusted our

fare structure to offer everyday low fares, with the objective of

encouraging guests to purchase flights when they are ready to

book, rather than waiting for a seat sale. Our top-end fares were

reduced by an average of 25 per cent, designed to offer excellent

value for guests who need to book close to departure date.

The volume of guests booking in these higher fare classes has

grown significantly year over year. We believe that our new fare

structure provides our guests with value and has contributed to

our overall yield improvement.

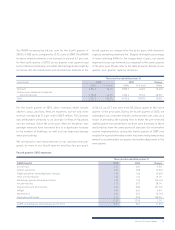

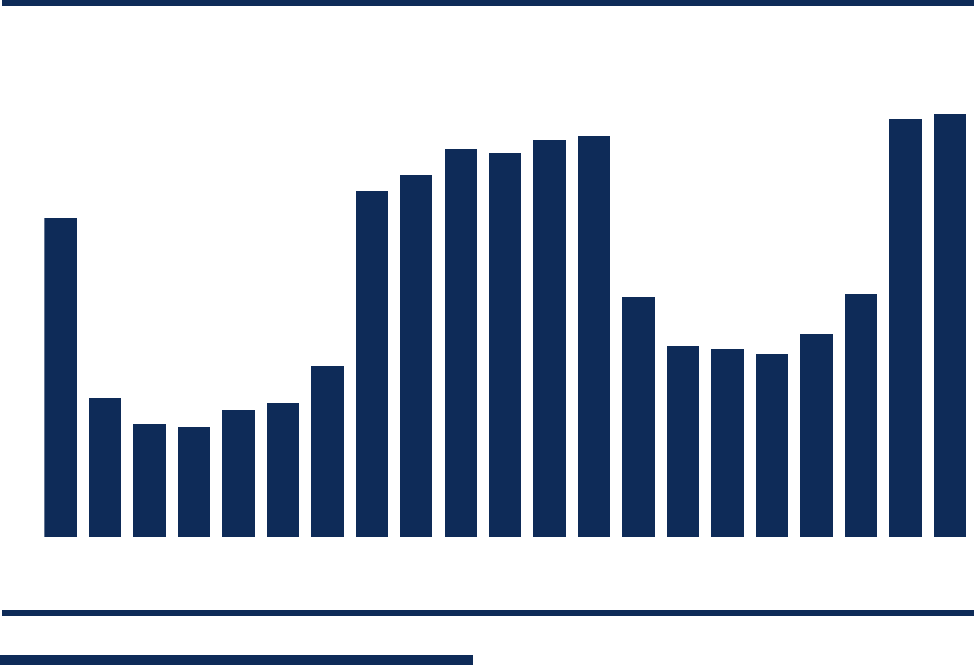

Our aircraft utilization remained relatively consistent with the

prior year, with a slight decrease of 0.9 per cent to 11.6 operating

hours per day. The flexibility of our fleet deployment strategy

allows us to react to demand changes by adjusting our schedule

for more profitable flying. During the year, we continued with

tactical adjustments to our schedule. During the peak winter

months, we have allocated more than half of our system

capacity outside of Canada to the high-demand transborder and

international markets, as depicted in the following chart.

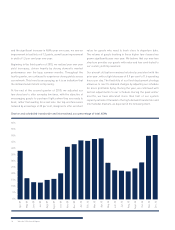

Charter and scheduled transborder and international as a percentage of total ASMs

Apr. 09

May 09

Jun. 09

Jul. 09

Aug. 09

Sept. 09

Oct. 09

Nov. 09

Dec. 09

Jan. 10

Feb. 10

Mar. 10

Apr. 10

May 10

Jun. 10

Jul. 10

Aug. 10

Sept. 10

Oct. 10

Nov. 10

Dec. 10

60%

55%

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%