Westjet 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 WestJet 2010 Annual Report

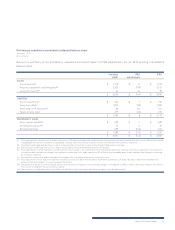

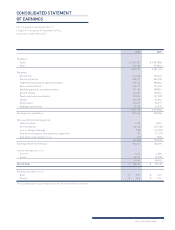

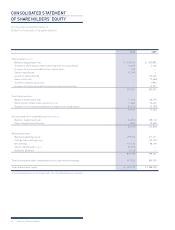

($ in thousands, except percentage amounts) 2010 2009 Change

Return on invested capital

Earnings before income taxes $ 196,667 $ 136,796 $ 59,871

Add:

Special items before tax(i) 5,368 — 5,368

Interest expense 60,164 67,706 (7,542)

Implicit interest in operating leases(ii) 74,677 54,576 20,101

$ 336,876 $ 259,078 $ 77,798

Invested capital:

Average long-term debt(iii) $ 1,133,477 $ 1,285,840 $ (152,363)

Average obligations under capital leases(iv) 3,730 2,605 1,125

Average shareholders' equity 1,448,304 1,232,459 215,845

Off balance-sheet operating leases(v) 1,066,815 779,655 287,160

$ 3,652,326 $ 3,300,559 $ 351,767

Return on invested capital 9.2% 7.8% 1.4 pts.

(i) For the year ended December 31, 2010 special items before tax includes $4,136 for CEO departure and $1,232 for revisions to the calculation of capital taxes.

(ii) Interest implicit in operating leases is equal to 7.0 per cent of 7.5 times the trailing 12 months of aircraft lease expense. 7.5 is a proxy and does not necessarily

represent actual for any given period.

(iii) Average long-term debt includes the current portion and long-term portion.

(iv) Average capital lease obligations includes the current portion and long-term portion.

(v) Off-balance-sheet aircraft leases is calculated by multiplying the trailing 12 months of aircraft leasing expense by 7.5. As at December 31, 2010, the trailing 12 months of

aircraft leasing costs totalled $142,242 (2009 – $103,954).

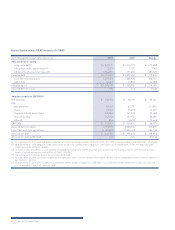

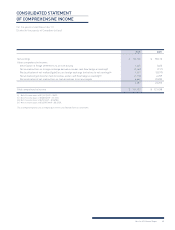

($ in thousands, except per share data) 2010 2009 Change

Free cash fl ow

Cash fl ow from operating activities $ 443,283 $ 318,661 $ 124,622

Adjusted for capital expenditures:

Aircraft additions (29,884) (118,659) 88,775

Other property and equipment and intangible additions (18,675) (48,021) 29,346

Free cash fl ow $ 394,724 $ 151,981 $ 242,743

Diluted free cash fl ow per share $ 2.72 $ 1.15 136.5%