Westjet 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 WestJet 2010 Annual Report

Upon proper qualification, we account for our fuel derivatives

as cash flow hedges. Under cash flow hedge accounting, the

effective portion of the change in the fair value of the hedging

instrument is recognized in accumulated other comprehensive

loss (AOCL), while the ineffective portion is recognized in

non-operating income (expense). Upon maturity of the derivative

instrument, the effective gains and losses previously recognized

in AOCL are recorded in net earnings as a component of aircraft

fuel expense.

Our policy for fuel derivatives is to measure effectiveness based

on the change in the intrinsic value of the fuel derivatives versus

the change in the intrinsic value of the anticipated jet fuel

purchase. We elect to exclude time value from the measurement

of effectiveness; accordingly, changes in time value are recognized

in non-operating income (expense) during the period the change

occurs. As a result, a significant portion of the change in fair

value of our options may be recorded as ineffective.

Ineffectiveness is inherent in hedging jet fuel with derivative

instruments in other commodities, such as crude oil, particularly

given the significant volatility observed in the market on crude

oil and related products. Because of this volatility, we are unable

to predict the amount of ineffectiveness for each period. This

may result in increased volatility in our results.

If the hedging relationship ceases to qualify for cash flow hedge

accounting, any change in fair value of the instrument from the

point it ceases to qualify is recorded in non-operating income

(expense). Amounts previously recorded in AOCL will remain in

AOCL until the anticipated jet fuel purchase occurs, at which time,

the amount is recorded in net earnings under aircraft fuel expense

.

If the transaction is no longer expected to occur, amounts

previously recorded in AOCL will be reclassified to non-operating

income (expense). For the years ended December 31, 2010

and 2009, there were no amounts reclassified as a result of

transactions no longer expected to occur.

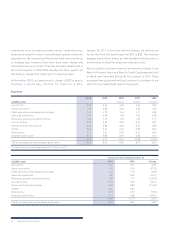

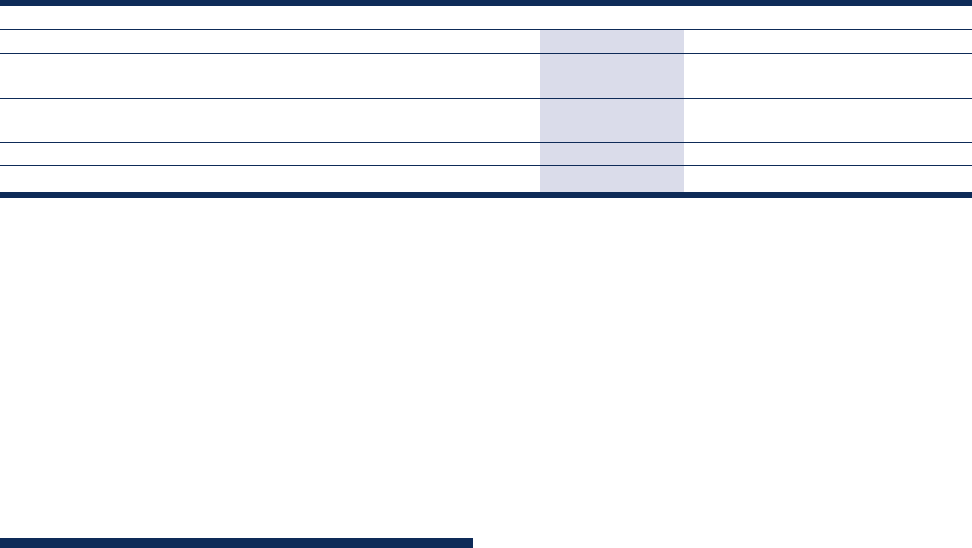

The following table displays our fuel costs per litre, including and

excluding fuel hedging, for the years ended December 31, 2010

and 2009. Please refer to page 52 of this MD&A for a discussion

on the use of non-GAAP measures, including aircraft fuel

expense, excluding hedging, which is reconciled to GAAP in the

table below.

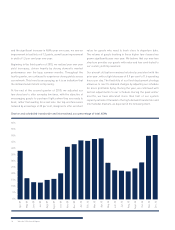

On an ASM basis, aircraft fuel expense increased by 6.5 per cent

to 3.45 cents from 3.24 cents in the prior year. Our fuel costs per

litre, including fuel hedging, increased to $0.71 per litre during

2010, representing an increase of 7.6 per cent from $0.66 per

litre in 2009. Excluding the effects of the realized loss on fuel

derivatives designated in an effective hedging relationship, our

fuel costs per litre were $0.70 for 2010, an increase of 11.1 per cent

from 2009.

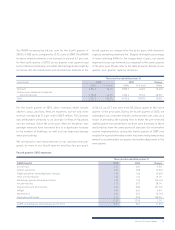

The following table presents the financial impact and statement

presentation of our fuel derivatives on the consolidated balance

sheet as at December 31, 2010 and 2009.

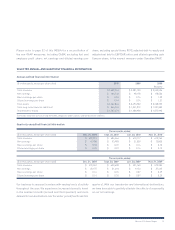

Twelve months ended December 31

($ in thousands, except per litre data) 2010 2009 Change

Aircraft fuel expense – GAAP $ 674,608 $ 570,569 18.2%

Realized loss on designated fuel derivatives – effective portion (9,172) (28,411) (67.7%)

Aircraft fuel expense, excluding hedging – Non-GAAP $ 665,436 $ 542,158 22.7%

Fuel consumption (thousands of litres) 950,341 859,116 10.6%

Fuel costs per litre (dollars) – including fuel hedging 0.71 0.66 7.6%

Fuel costs per litre (dollars) – excluding fuel hedging 0.70 0.63 11.1%