Westjet 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2010 Annual Report 93

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2010 and 2009

(Stated in thousands of Canadian dollars,

except share and per share amounts)

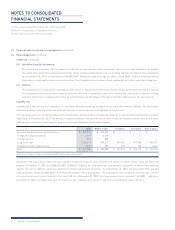

(i) Short-term deposits include deposits relating to aircraft fuel, airport operations and other operating costs.

(ii) Aircraft-related deposits include long-term deposits with lessors for the lease of aircraft and long-term US-dollar deposits, which relate to

purchased aircraft.

(iii) Deferred gains from the sale and leaseback of aircraft, net of amortization, which are being deferred and amortized over the lease terms

with the amortization included in aircraft leasing expense.

(iv) Included in other liabilities is an estimate pertaining to asset retirement obligations on its aircraft under operating leases. During the year

ended December 31, 2010, the Corporation increased the liability by $701 (2009 – $1,217) due to the addition of further leased aircraft with

$nil (2009 – $nil) incurred on the settlement of these obligations.

(v) Incentives received by the Corporation for entering into various leasing and maintenance contracts. Amounts are deferred and recognized

in net earnings on a straight-line basis over the term of the contract.

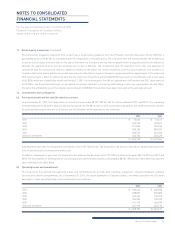

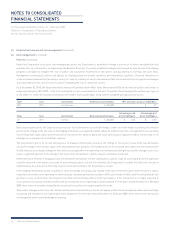

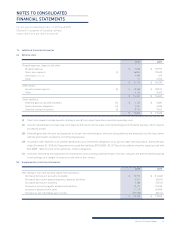

(b) Supplementary cash fl ow information

2010 2009

Net change in non-cash working capital from operations:

(Increase) decrease in accounts receivable $ 10,378 $ (11,365)

(Increase) decrease in prepaid expenses, deposits and other 8,531 (2,691)

(Increase) decrease in inventory 5,788 (9,014)

Increase in accounts payable and accrued liabilities 79,474 15,926

Increase in advance ticket sales 21,779 35,008

Decrease in non-refundable guest credits (27,728) (8,514)

$ 98,222 $ 19,350

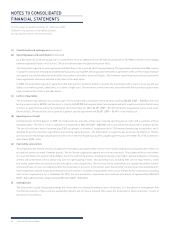

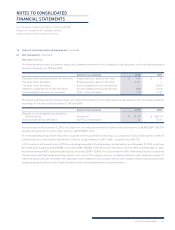

2010 2009

Prepaid expenses, deposits and other:

Prepaid expenses $ 9,082 $ 29,797

Short-term deposits (i) 26,854 23,439

Derivatives

(note 13) 5,689 277

Other 91 2,726

$ 41,716 $ 56,239

Other assets:

Aircraft-related deposits (ii) $ 45,268 $ 50,975

Other 9,163 3,392

$ 54,431 $ 54,367

Other liabilities:

Deferred gain on sale and leaseback (iii) $ 4,143 $ 5,281

Asset retirement obligations (iv) 5,901 4,926

Deferred contract incentives (v) 8,794 9,421

$ 18,838 $ 19,628

14. Additional fi nancial information

(a) Balance sheet