Westjet 2010 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2010 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

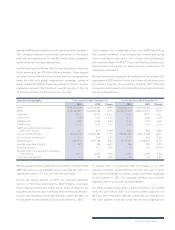

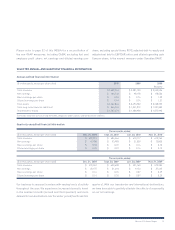

10 WestJet 2010 Annual Report

OVERVIEW

Although economic uncertainty persisted throughout 2010,

demand for air travel improved, which is reflected in our strong

financial results for the year. The increase in demand resulted

in improved yields year-over-year, particularly throughout

the second half of 2010. Our 2010 earnings before tax (EBT)

margin of 7.5 per cent was once again one of the best in the North

American airline industry. In 2010 we began to capitalize on new

reservations systems for both WestJet and WestJet Vacations,

which were implemented in the prior year. In the first quarter

of 2010, we launched our WestJet Frequent Guest and WestJet

Credit Card programs, which reward our guests and make our

airline even more attractive for frequent travellers. We continued

to increase our self-service capabilities to enhance our guest

experience, while improving efficiencies at our airports. In 2010

we launched four additional interline agreements, including our

first with a U.S. carrier, American Airlines. We were also able to

further develop one of these interline agreements into our first

code-share arrangement with Cathay Pacific Airlines. In February

2011, we announced our second interline agreement with a U.S.

carrier, Delta Airlines. We will continue to develop our partnership

strategy to enable us to meet our objective of becoming one of

the five most successful airlines in the world by 2016. The fourth

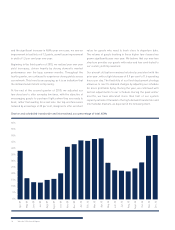

quarter of 2010 marks our 23rd consecutive quarter of profitability.

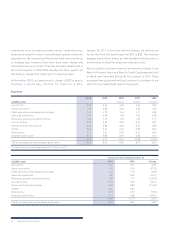

2010 highlights

• Recognized total revenues of $2.6 billion, an increase of 14.4

per cent from 2009.

•

Recorded RASM of 13.36 cents, up 3.0 per cent from 12.97 cents

in 2009.

• Increased capacity by 11.1 per cent and increased RPMs,

a measure of guest traffic, by 12.9 per cent, compared to

the prior year.

•

Realized CASM of 12.09 cents, up 2.7 per cent from 11.77 cents

in 2009.

• Realized CASM, excluding fuel and employee profit share,

of 8.52 cents for 2010, up 0.8 per cent over 2009.

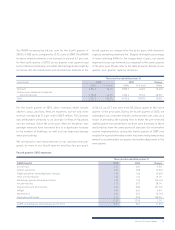

• Recorded an operating margin of 9.5 per cent, up from

9.2 per cent in 2009.

• Recorded an EBT margin of 7.5 per cent in 2010, an increase

of 1.5 points over the 2009 EBT margin of 6.0 per cent.

•

Realized net earnings of $136.7 million, an increase of

39.3 per cent from 2009.

•

Excluding special items, realized net earnings of $142.8 million,

an increase of 53.3 per cent from net earnings, excluding

special items, in 2009 of $93.1 million.

•

Reported diluted earnings per share of $0.94 for 2010,

an increase of 27.0 per cent from $0.74 in 2009.

• Excluding special items, realized diluted earnings per share

of $0.98, an increase of 38.0 per cent from $0.71 in 2009.

• Generated cash flow from operations of $443.3 million,

an increase from $318.7 million in 2009.

• Realized a trailing 12-month return on invested capital

(ROIC) of 9.2 per cent, an increase from 7.8 per cent as at

December 31, 2009.

•

Declared our first-ever quarterly dividend of $0.05 per common

voting share and variable voting share, paid on January 21, 2011,

to shareholders of record on December 15, 2010.

• Filed a notice with the TSX to make a normal course issuer

bid (NCIB) to purchase up to 7.3 million outstanding shares

on the open market and, in the fourth quarter of 2010,

repurchased 2.3 million shares for total consideration of

$31.4 million.

Our culture and people continued to shine in 2010. In February

2010, we were inducted into Canada’s Most Admired Corporate

Culture Hall of Fame by Waterstone Human Capital. We are also

proud to have been the highest ranked airline based on brand equity

in an August 2010 syndicated study conducted by Harris/Decima.

The other airlines measured in the study were Air Canada,

American Airlines, British Airways, Porter Airlines, Southwest

Airlines, United Airlines and Virgin Atlantic. In addition to being

the highest ranked airline, we also rated in the top three per cent